El excepcionalismo estadounidense sigue siendo un argumento de inversión convincente, impulsado por la productividad, la innovación y el impulso de las ganancias, según BNY Investments. Sin embargo, la elevada volatilidad subraya la importancia de la diversificación. Así, en la firma ven oportunidades para ampliar selectivamente las inversiones en los mercados internacionales con el fin de fortalecer las carteras en el entorno actual, según recogen en su informe Shifting Gears: at the table with BNY Experts.

Poder de permanencia

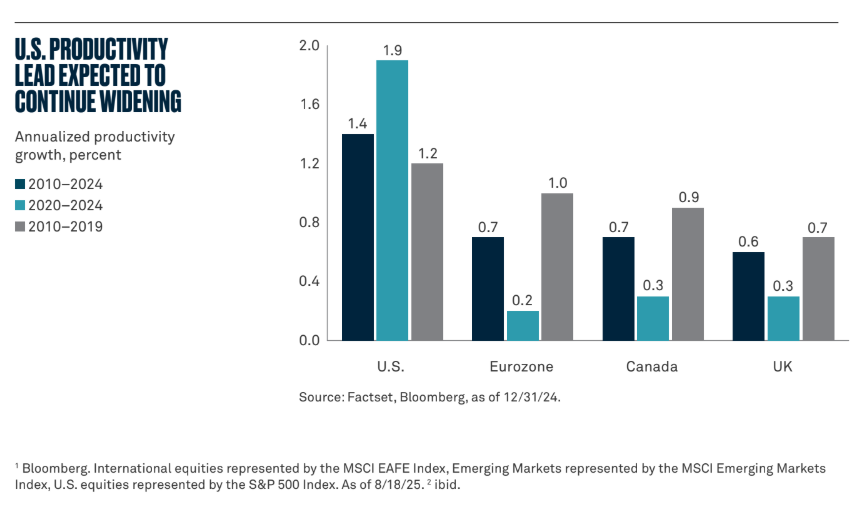

Las acciones globales han avanzado con ganancias generalizadas. Las acciones internacionales y los mercados emergentes han subido alrededor de un 20 %, mientras que Estados Unidos ha ganado casi un 10 %. Aunque las acciones estadounidenses han tenido un rendimiento inferior al del resto del mundo, la diferencia de rendimiento se ha reducido de alrededor del -17 % en abril al -10 % a mediados de agosto. Los expertos de BNY creen que esta diferencia seguirá reduciéndose a medida que Estados Unidos se beneficie de los vientos favorables del crecimiento: «Las ventajas estructurales en los mercados laborales, la productividad, la innovación y el liderazgo en inteligencia artificial se han traducido en mercados bursátiles alcistas y un fuerte crecimiento del PIB», afirman. También añaden que, desde 2010, la productividad de Estados Unidos ha crecido dos veces más rápido que la de Europa, y la disparidad se ha ampliado desde la llegada de la COVID-19.

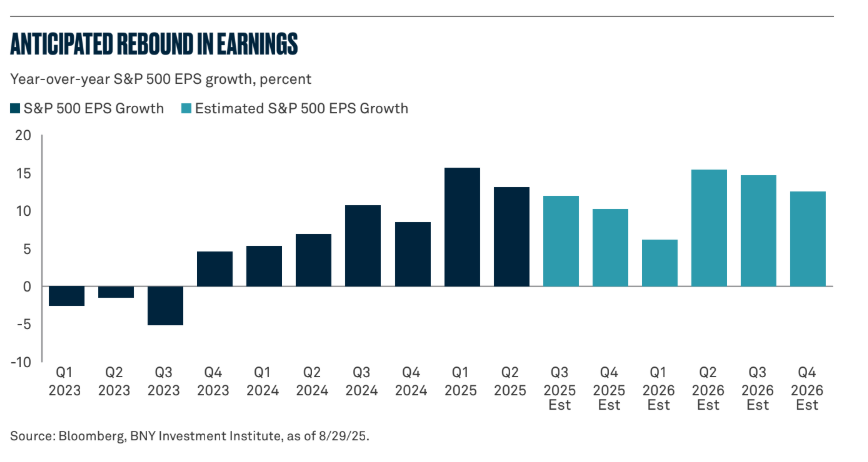

Las expectativas de beneficios también refuerzan la opinión de los expertos de BNY: «Las empresas del S&P 500 registraron unos beneficios superiores a lo esperado en la primera mitad del año y deberían seguir mejorando, respaldadas por políticas favorables y unos fundamentos sólidos», indican desde la gestora. Observan asimismo que la adopción de la IA «está impulsando la demanda de semiconductores y el gasto de capital», y que la One Big Beautiful Bill (OBBB) «ofrece incentivos para que la producción nacional de chips amplíe su capacidad y refuerce las cadenas de suministro».

En este contexto de políticas favorables y el impulso de la IA, en la gestora observan un entorno favorable para determinados sectores:

- El sector financiero está en condiciones de beneficiarse de los recortes de tipos de la Reserva Federal, una curva de rendimiento más pronunciada que mejora la actividad de los mercados crediticios y de capitales, y la relajación de las presiones regulatorias.

- Los servicios de comunicación se están beneficiando del aumento de los ingresos por publicidad digital, gracias a que la IA aumenta la participación y los precios.

- Las industrias cíclicas, incluidas las industriales, la energía y los materiales, se ven respaldadas por el gasto en infraestructuras, la relocalización y el aumento de la demanda de electricidad de los centros de datos, mientras que los créditos fiscales OBBB y las deducciones fiscales inmediatas para investigación y desarrollo reducen los costes de fabricación.

Oportunidades en mercados internacionales y emergentes

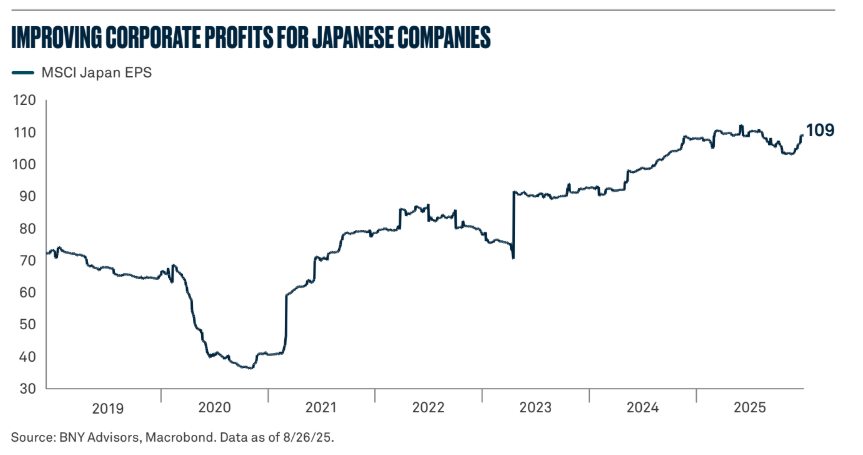

Aunque desde BNY creen que el excepcionalismo estadounidense continuará, también ven oportunidades atractivas en determinados mercados internacionales y mercados emergentes (ME) fuera de China. En Europa, existe un potencial alcista en el sector industrial, en particular en el aeroespacial y de defensa, impulsado por el aumento del gasto público en defensa, infraestructuras y energía. En Japón, el renovado impulso hacia las reformas de gobierno corporativo y el crecimiento económico continuado han llevado a máximos históricos en su mercado de valores. «La reducción de la incertidumbre comercial, la mejora, la rentabilidad empresarial y una posible recuperación de los salarios y el consumo son factores positivos a largo plazo para las acciones japonesas».

También se declaran optimistas con respecto a los mercados emergentes, excepto China, ya que la flexibilización de la Fed suele conducir a unas condiciones financieras globales más acomodaticias, lo que generalmente favorece a las acciones de los mercados emergentes.

Mirando hacia el futuro

Aunque las acciones están registrando ganancias en lo que va de año, los datos económicos parecen haber entrado en una fase de desaceleración. El sentimiento de riesgo en los mercados, especialmente en torno a la inteligencia artificial, está impulsando el rendimiento del mercado. Esperamos que el crecimiento de EE. UU. continúe, ya que las estimaciones consensuadas han comenzado a mejorar. Las expectativas de gasto de capital y la confianza empresarial han repuntado, y las estimaciones de beneficios están al alza.

Sin embargo, en el frente económico, el mercado laboral está mostrando posibles signos de tensión, lo que podría conducir a una ralentización del crecimiento. Aunque los precios al consumo están subiendo, el gasto se ha mantenido hasta ahora. El gasto podría ralentizarse, dependiendo del impacto de los aranceles y la política de inmigración en el mercado laboral.

Los riesgos geopolíticos también persisten y podrían alterar las cadenas de suministro. La continuidad de datos económicos mixtos podría afectar la confianza de los inversores, que ha mejorado desde abril.

Con estos factores sobre la mesa y de cara a los próximos 6 a 12 meses, en BNY mantienen su convicción de que «la renta variable, y en particular el mercado estadounidense, seguirá generando ganancias». Sin embargo, matizan, en un contexto de tendencias cambiantes, «añadir diversificación geográfica, como la exposición a Japón y a determinados mercados emergentes, puede ayudar a mitigar el riesgo y ampliar la exposición al crecimiento».

Conozca más sobre el informe Shifting Gears: at the table with BNY Experts.

IN THE UNITED STATES: FOR GENERAL PUBLIC USE.

IN ALL OTHER JURISDICTIONS: FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS. This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY is not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Charts are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY product. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY believed to be reliable, but BNY makes no representation to its accuracy and completeness. BNY accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only.

- Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue Eugène Ruppert L-2453 Luxembourg. Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland.

Any views and opinions contained in this document are those of Investment Manager as at the date of issue; are subject to change and should not be taken as investment advice. BNY is not responsible for any subsequent investment advice given based on the information supplied.

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation.

This document is not intended as investment advice. Investment involves risk. Past performance is not indicative of future performance. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested. No warranty is given as to the accuracy or completeness of this information and no liability is accepted for errors or omissions in such information. BNY accepts no liability for loss arising from use of this material.

The investment program contained in this presentation may not meet the objectives or suitability requirements of any specific investor. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. You are advised to exercise caution when reading this document. If you are in any doubt about the contents of this document, you should obtain independent professional advice.

The information contained in this document should not be construed as a recommendation to buy or sell any security. It should not be assumed that a security has been or will be profitable. There is no assurance that a security will remain in the portfolio. Tax treatment will depend on the individual circumstances of clients and may be subject to change in the future.

If there is any inconsistency between this warning statement and the disclosure stated under this document, this warning statement shall prevail to the extent of the inconsistency.

BNY COMPANY INFORMATION

BNY Investments is the brand name for the investment management business of BNY and its investment firm affiliates worldwide. BNY is the corporate brand of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. • Mellon Investments Corporation (MIC) is a registered investment adviser and subsidiary of The Bank of New York Mellon Corporation (BNY). MIC is composed of two divisions; BNY Investments Mellon (Mellon), which specializes in index management, and BNY Investments Dreyfus (Dreyfus), which specializes in cash management and short duration strategies. • Insight Investment – Investment advisory services in North America are provided through two different investment advisers registered with the Securities and Exchange Commission (SEC) using the brand Insight Investment: Insight North America LLC (INA) and Insight Investment International Limited (IIIL). The North American investment advisers are associated with other global investment managers that also (individually and collectively) use the corporate brand Insight. Insight is a subsidiary of The Bank of New York Mellon Corporation. • Newton Investment Management – “Newton” and/or “Newton Investment Management” is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021, NIMJ was established in March 2023. NIM and NIMNA are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of The Bank of New York Mellon Corporation. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of The Bank of New York Mellon Corporation. • Siguler Guff – The Bank of New York Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC). • BNY Mellon Advisors, Inc. (BNY Advisors) is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Advisors is a subsidiary of The Bank of New York Mellon Corporation.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-793223-2025-08-21

GU-691 – 30 June 2026

IM-ATTSHFTGGRSBRO-0925