Asset Managers’ Budgets to Obtain Alternative Data Continue to Grow

| By Marta Rodriguez | 0 Comentarios

Investment managers’ budgets for alternative data will continue to increase this year, consolidating the strong growth of the past two years, according to new research by Exabel and BattleFin, two platforms specializing in alternative data.

Around 85% of the investment managers and analysts surveyed in the global study state that their budgets will increase this year, and 33% foresee substantial growth, according to the report “Alternative Data Buy-side Insights & Trends 2025” by Exabel and BattleFin. This increase adds to the recent expansion of budgets. The study, which included fund managers in the U.S., the U.K., Hong Kong, and Singapore with a total of $820 billion in assets under management, revealed that 43% of respondents reported a budget increase of between 50% and 75%, while 36% indicated that their budgets grew between 25% and 50% during the period analyzed.

The report by Exabel, which was acquired by BattleFin in December of last year, identified that one of the key areas of budget growth is likely to be investment in third-party software systems for data analysis. Currently, 66% of the firms surveyed use third-party software as part of their solutions, compared with 51% that use internally developed systems and 51% that use systems provided by data vendors. However, the research also revealed that 59% of respondents still use basic tools and legacy systems, such as Excel and Tableau, to analyze alternative data.

This landscape appears to be changing: 85% of respondents predict that their use of third-party systems will increase over the next five years, and 15% expect a drastic increase in their adoption for data analysis. The main reason is their greater cost-effectiveness, mentioned by 87% of respondents. In addition, 62% believe that these systems offer a more consistent way of working with different types of data, while 52% consider them more effective than internal systems.

In fact, senior management at the firms surveyed supports the increase in budgets: 98% state that they are very or fairly committed to the use of alternative data for investment research. Likewise, 84% have a head of alternative data on their teams, while only 11% admit not having one.

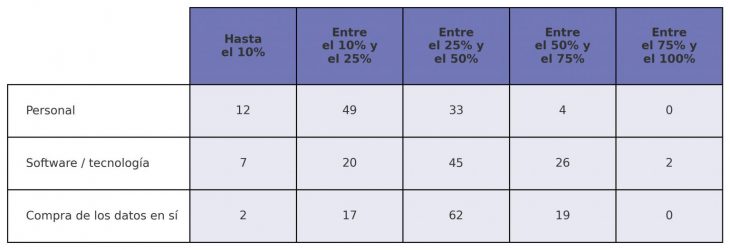

When allocating budgets for the acquisition and management of alternative data, the survey revealed that approximately 62% of firms allocate between 25% and 50% of their resources to purchasing data, while 45% indicate that their firm allocates between 25% and 50% of the budget to technology and software. And 49% indicated that their firms allocate between 10% and 25% of the budget to hiring staff to analyze and manage alternative data.

In light of these results, Tim Harrington, CEO of BattleFin & Exabel, commented: “The demand for alternative data continues to grow globally, with investment managers increasing their budgets year after year both to acquire and to manage a growing variety of datasets. The main challenges include resource allocation, data standardization across different sources, and the use of third-party analytical tools. We are committed to harnessing the power of alternative data to deliver actionable insights and generate value. In today’s dynamic market environment, accessing high-quality data is crucial to gaining a competitive advantage and unlocking alpha.”

Below is a table showing how the firms surveyed distribute their budgets for the acquisition and management of alternative data.