The Art Market Continues to Be Complex and Relatively Opaque, So Advice Helps to Gain Transparency

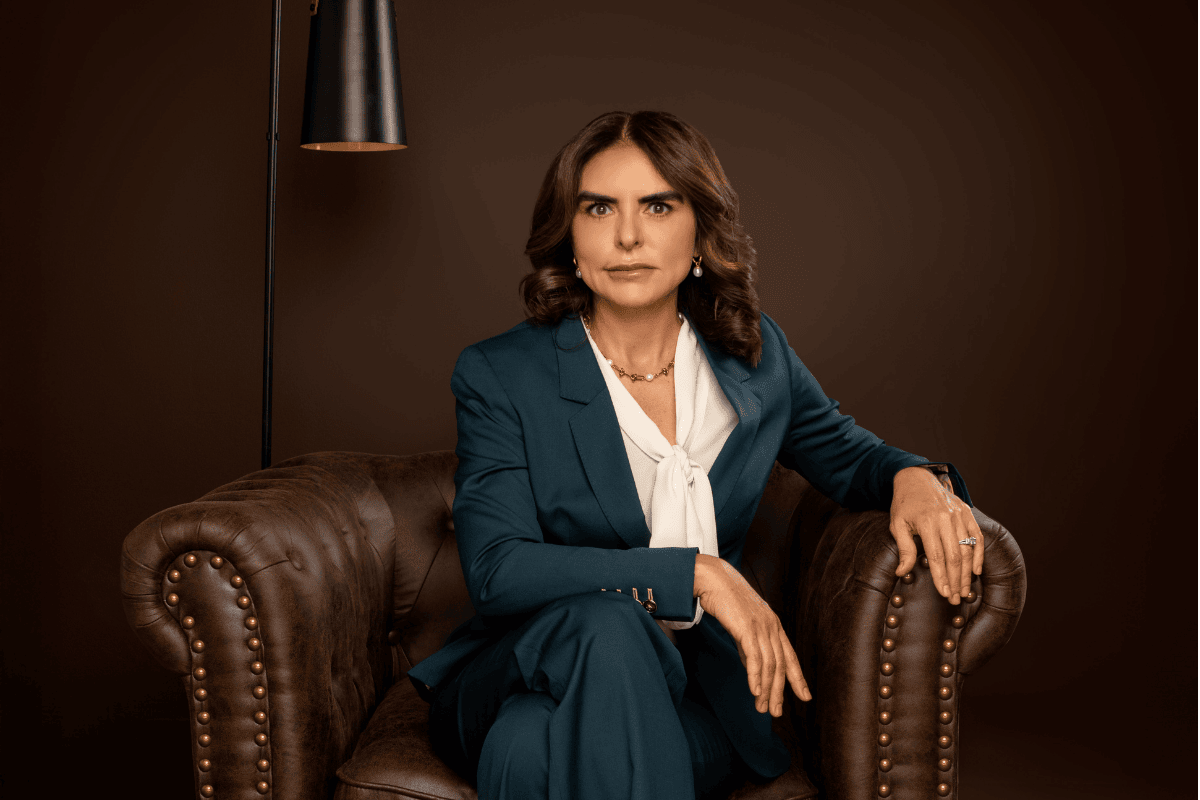

| By Marta Rodriguez | 0 Comentarios

Art is increasingly seen as an alternative asset in diversified portfolios, not only because of its potential returns but also because of its “hedonic” dimension, which means that, on average, high-net-worth individuals allocate around 15% of their wealth to it. And demand is growing. Elisa Hernando, founder and CEO of the art advisory ArteGlobaL, explains in this interview with Funds Society the importance of having expert advice, because not all artists appreciate in value, and the asset is not as transparent as others. She discusses this with us on the occasion of the opening of the ARCO fair in Madrid.

Has art gained prominence as a diversifier in investment portfolios?

Yes, it is increasingly considered an alternative asset within a diversified portfolio. But it is always worth remembering something important: not all works or all artists increase in value, so having information and expert guidance is essential.

Art also has something that other assets do not: a hedonic dimension. In other words, it provides enjoyment, knowledge, and cultural experience in addition to potential financial return. In fact, some studies suggest that high-net-worth individuals allocate on average around 15% of their wealth to art.

Beyond consulting firms… do financial institutions feel increasingly “compelled” to advise their clients on art?

Rather than compelled, I would say it is a growing demand from their own clients. As wealth becomes more diversified, more alternative assets appear, and art begins to form part of those conversations.

The art market remains complex and relatively opaque, so advice helps bring greater transparency and supports more informed decision-making.

How are clients evolving in their appetite for investing in art? Is there greater sophistication?

Yes, there is growing interest in understanding the market before making a purchase. Buyers ask more questions, compare options, and want information. We also see mixed motivations: some approach art out of cultural interest or a desire to learn, while others prioritize potential appreciation, although it is common for several motivations to coexist.

There are very diverse profiles, from newcomers to major investors. Do they all seek advice?

Advisory services can be useful for both profiles, although for different reasons. For those starting out, because the market can be overwhelming and they need guidance to filter options and understand pricing. For more experienced collectors or high-net-worth individuals, because they seek coherence in their collection and want to evaluate opportunities.

In a highly volatile environment, can art serve as a safe-haven asset like gold?

Art can preserve value in certain segments and over long time horizons, but it is less liquid than other assets. That is why I always stress that the selection of the work, knowledge of the artist, and expert guidance are key.

Tokenization is beginning to reach the art world. Do you think it will be adopted on a large scale?

Technology can help improve accessibility or transparency, but we are still at very early stages. In fact, the share of NFTs in auctions was only 0.1% in 2023, far from the speculative peak of 2021. We will probably see further developments, but value in the art market remains closely tied to the work, the artist, and the cultural context, not only to the technological format.

You are an advisor to the First Collector program of Fundación Santander, which marks its 15th anniversary at ARCO. What assessment do you make?

The assessment is very positive. Since it was created in 2011, we have advised more than 1,000 people on purchasing art at ARCO. The objective has always been the same: to help those who want to start collecting to do so with criteria and without fear, supporting them in their first acquisitions.

Do you think art will increasingly become part of investment portfolios? What expectations are there for ARCO this year?

Interest exists and will probably continue to grow, but always with the understanding that art requires knowledge and a long-term perspective. ARCO is also a good place to buy because there is a selection process for galleries and visitors can access a great deal of information before making a decision.