The Story of How Gold “Dethroned” U.S. Bonds

| By Marta Rodriguez | 0 Comentarios

Tensions have eased for now, but the controlled disorder on the geopolitical front is here to stay, which also brings a new perspective on the role of certain financial assets. According to some experts, while gold is gaining traction among investors, U.S. Treasury bonds, another classic safe-haven asset, appear to be suffering a noticeable loss of relevance as an investment asset.

The trend analysts observe is that investors are increasingly using gold as a hedge against equity risk, displacing long-term Treasury bonds. “This shift reflects a structural collapse in the traditional relationship between equities and fixed income: since 2022, correlations have remained close to zero, which has eroded the effectiveness of bonds as a diversifier. Historically, duration exposure cushioned declines in risk assets. However, recent episodes, such as the drop after Liberation Day, where equities and long-term bonds were sold simultaneously, have undermined confidence in bonds as a reliable hedge,” notes Lale Akoner, Global Market Analyst at eToro.

Flows show that investors are allocating to equities and gold simultaneously, while reducing exposure to long-term bonds. For Akoner, this trend reflects more than just inflation hedging and a reallocation in portfolio risk management. “If the correlation between bonds and stocks remains unstable, gold’s role as a volatility buffer could solidify, redefining how portfolios hedge downside risk across the cycle,” she explains.

The Loss of the Throne

Since the mid-1990s, bonds issued by the U.S. government have become the world’s most widely used reserve asset, dethroning the one that had reigned until then: gold. As Enguerrand Artaz, strategist at La Financière de l’Échiquier, explains, paradoxically, that crown they held was largely thanks to Europe. “While U.S. debt gradually gained presence in reserve assets, gold’s share quickly declined and European central banks sold their gold reserves to prepare for the advent of the euro. Thus, the yellow metal fell from 60% of global reserves in the early 1980s to 10% in the early 2000s. In parallel, U.S. Treasury bonds rose from 10% to 30%. These levels remained generally stable for two decades. However, the situation has reversed again. In fact, after overtaking the euro in 2024, gold has once again surpassed U.S. debt in global reserves since September 2025,” says Artaz.

In his view, this shift is explained by two underlying dynamics. The first is the gradual erosion of the volume of U.S. debt held by foreign investors since the mid-2010s. And the other ongoing dynamic is the strong increase in gold purchases since 2022 amid greater geopolitical uncertainty driven by the conflict between Russia and Ukraine.

The expert believes there are good reasons for these two dynamics to continue: “The return of geopolitical conflicts and a gradual but powerful trend toward the regionalization of the world favor the use of gold as a reserve asset: gold is not directly dependent on a state and is virtually the only asset capable of absorbing the flows leaving U.S. bonds.”

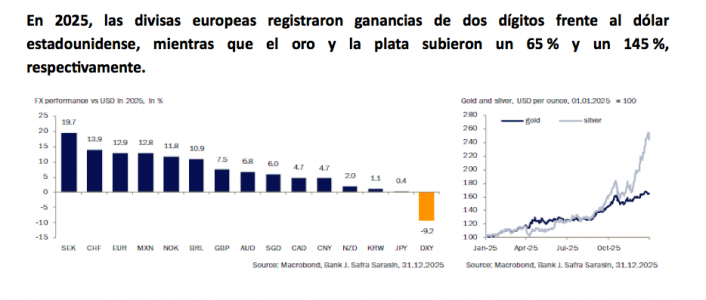

One data point that helps contextualize this reflection is that the gold and U.S. debt markets are of comparable size, around 25 and 30 trillion dollars, respectively, and far larger than other asset classes. According to the analysis by the LFDE expert, “this phenomenon has accelerated in recent months in parallel with the sharp increase in the price of gold (139% since the end of 2023), but also structurally: the aggressive trade policy of the Trump Administration has heightened the propensity of central banks and investors to abandon the dollar as the preferred safe-haven asset.”

In a final reflection, Artaz points out that doubts about the “health of U.S. public finances” and increased disaffection with U.S. debt could cause the dollar to lose its status as a reserve currency. “There’s only one step left, but it would not be wise to take it. Adding all instruments together, the dollar remains the world’s primary reserve asset and, even if gold dethroned it, it would still be a reference. On the other hand, the U.S. debt market, which is 30% held by investors outside the U.S., could become a geopolitical battleground. That would allow gold to continue to shine,” he concludes.

Outside the Geopolitical Battle

Artaz’s conclusion deserves a few lines: could large holders of U.S. debt end up using their bonds as a “weapon”? For example, it caught the attention of the investment community that last week, two Danish pension funds and one Swedish fund announced they were actively selling U.S. bonds.

Moreover, it’s worth remembering that China, in particular, has reduced its purchases of U.S. bonds by nearly 40% since 2013. This move has been replicated by several central banks in Southeast Asia, increasingly inclined to align with the Chinese yuan rather than the dollar on the monetary front. In contrast, Japan, which remains the largest foreign holder, has maintained the absolute value of its portfolio, but the percentage has dropped sharply, from 10% of total U.S. negotiable debt in 2010 to less than 5% today. Meanwhile, other developed countries have globally maintained their percentages but without increasing them, and only the United Kingdom has effectively increased its investments in U.S. debt.

It is inappropriate to assert that these movements are driven by geopolitical intent, but we can indeed analyze the likelihood of such a scenario. For example, Eiko Sievert, director of public and sovereign sector ratings at Scope Ratings, considers it unlikely for the EU. “The possible sale and rebalancing of reserves into other currencies or assets would be gradual and unlikely to result from a legislative act or moral suasion by EU authorities in response to Trump’s retaliations. Moreover, private investors will be very careful not to harm the value of their portfolios, which could occur if large amounts of U.S. debt were sold in a short period,” he explains.

According to Sievert’s analysis, such a sale of assets would also entail risks to a greater or lesser extent, depending on the pace and scale of the sale. And given the interdependence, unless those selling U.S. debt purchase EU or member state debt, there would be a contagion effect on EU spreads as well. “The implications could be far-reaching, as reduced demand for the U.S. dollar could also lead to a strengthening of the euro, which could weaken economic growth in EU member states focused on exports. In fact, on a global level, a massive sell-off would likely generate volatility, widen spreads, and affect the money market, with possible implications for global liquidity, potentially prompting intervention by monetary authorities,” he concludes, describing a scenario that remains quite distant.