Triple Event: Data Will Guide the Decisions of the Fed, BoE, and BoJ

| By Amaya Uriarte | 0 Comentarios

On Wednesday and Thursday, there will be a triple event for central banks: the US Federal Reserve (Fed), the Bank of England (BoE), and the Bank of Japan (BoJ) will hold their respective monetary policy meetings. Each institution faces its own challenges and has its messages for the market. However, they all have one thing in common: dependence on the evolution of macro data, particularly inflation.

In the case of the Fed, everything indicates that it will maintain interest rates in this upcoming meeting, which will be interpreted as preparing for a possible first cut in September. However, things are not as clear for the Bank of England (BoE), where the sentiment for a possible cut is only 50%, despite what the data suggests. Lastly, experts explain that this BoJ meeting is important because it will provide more details on the plan to reduce the asset purchase program (QT), the next step to normalize monetary policy. The main conclusion is that there will be no rate hike, as it will be a gradual process to give the market time to digest the bonds and avoid a spike in yields.

The Fed in the US

According to Christiaan Tuntono, senior economist for Asia Pacific at Allianz Global Investors, the prospect of a rate cut in the US and the rebound in demand for semiconductors and electronics, in general, are currently very favorable factors for part of the Asian economy and many local equity markets. “In this sense, we expect the Federal Reserve to keep interest rates unchanged next week but to acknowledge the improvement in US inflation, which could open the door to a rate cut by the end of the summer,” Tuntono points out.

Regarding the importance of data, Pramod Atluri, manager at Capital Group, highlights that “the US economy has largely adapted to this new interest rate environment, and I expect growth to remain above 2% in 2024.” In his opinion, this resilience shown by the US economy has led investors to adjust their expectations regarding interest rates. Although Atluri believes that the arguments for future rate cuts are no longer as evident, the central bank seems inclined towards cuts.

In this regard, the views and analysis from international managers coincide with Tuntono Atluri’s assessment. There is also a consensus in interpreting the latest macro data from the country. “Although the labor market shows clear signs of normalization and recent consumer inflation data has been relatively positive, the central bank has been encouraged by macroeconomic data several times over the past 18 months, only to later discover that the economy continued to operate at an excessive pace. Therefore, it is likely that the Fed will argue that it is prudent to observe the next six weeks of data to clearly validate the need for policy easing,” says Erik Weisman, chief economist at MFS Investment Management.

However, in his opinion, more important than what the Fed does in the next month and a half is how the market will gauge the subsequent pace of rate cuts and the eventual landing zone. “The magical soft landing of 1995 was achieved with only 75 basis points of rate cuts, and some argue that we will see a repeat of that episode in the next six months or so. However, the market expects the Fed to cut between 175 and 200 basis points before the first quarter of 2026,” estimates Weisman.

Regarding when the Fed’s first rate cut will be, managers’ analyses also point to the same timeline: September. “We believe that this week’s data, especially the 0.18% month-over-month core PCE and the signs of cooling shelter inflation, continue to reinforce our view that the first cut will occur in September. We expect a moderate hold at the Fed meeting, with Powell indicating during the press conference that a first cut is likely to happen quite soon if data continues to evolve as expected,” says Greg Wilensky, director of US Fixed Income and Portfolio Manager at Janus Henderson.

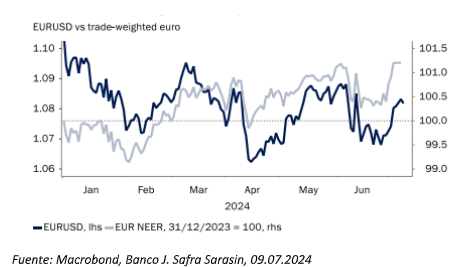

“The lower inflation rates of the past three months should pave the way for a rate cut in September. This is likely to be reflected in the meeting’s conclusions, as the Committee is expected to ensure that confidence in inflation evolving sustainably towards 2% has strengthened and emphasize that the risks to employment and inflation objectives are now balanced. Powell is likely to use his speech at Jackson Hole next month to outline the framework for the easing cycle and remind investors that the Fed will likely lower rates gradually once it begins,” adds Raphael Olszyna-Marzys, international economist at J. Safra Sarasin Sustainable AM.

For his part, Brendan Murphy, head of North American Fixed Income at Insight Investment (part of BNY Investments), expects the committee’s official statement to include some modest changes, reflecting how their key inflation metrics are now close to the target and the labor market shows signs of slowing down. “The central bank may be concerned about a potential sudden deterioration in the labor market at some point, so we expect most members to prefer acting soon to ensure a soft landing for the economy. Chairman Powell could also use next month’s Jackson Hole Symposium to set expectations for the rate-cutting cycle,” comments Murphy.

Looking at the United Kingdom

A completely different case from the US is the Bank of England (BoE). According to Katrin Loehken, economist for the UK and Japan at DWS, the outcome of the BoE’s upcoming meeting on Thursday is not clear at all. “The market expects a rate cut with just over 50% probability, and we also anticipate a reduction in the official rate from 5.25% to 5%. However, uncertainty is high because there are good arguments for both sides,” says Loehken.

In this sense, she explains that if most members of the Monetary Policy Committee (MPC) place more emphasis on a prudent and data-dependent assessment of the current situation, the negative surprise in service price inflation in July would be an argument against a rate cut, as would the slow decline in wage dynamics. “With a wait-and-see attitude, nothing wrong would be done in that case. Chief Economist Pill seems to be in the waiting camp after his last speech,” she clarifies.

On the other hand, the DWS economist highlights that updated growth and inflation forecasts should show that the economy is still growing moderately and that inflation is likely to fall below the 2% target in the medium term. Additionally, the current weakening of the labor market also raises the question of how restrictive the central bank should remain.

“In our view, these arguments are more favorable to a first rate cut and are also consistent with the central bank’s generally pessimistic rhetoric. The assessment of voting behavior is further complicated by the new composition of the Monetary Policy Committee. Therefore, only a narrow majority should vote in favor of the expected rate cut,” comments Loehken.

However, Johnathan Owen, manager at TwentyFour AM (Boutique of Vontobel), believes that the BoE may delay this rate cut. “The latest UK inflation figures will bring some relief to consumers, but behind the headline figure, Bank of England policymakers face a more complex picture that suggests rate cuts could still be far off. The latest data showed that the Consumer Price Index (CPI) inflation fell exactly to 2% in May, in line with market expectations and marking a return to the BoE’s 2% target for the first time since July 2021,” argues Owen.

According to him, before Wednesday’s CPI data, markets had largely ruled out any chance of the Bank of England cutting rates in June, although the probability of a cut in August was at 44%. “Despite the Bank of England achieving its headline inflation target of 2%, the rigidity of services inflation, driven by strong wage growth and resilient demand in certain sectors, makes a rate cut in August increasingly unlikely, in our opinion,” defends the expert from TwentyFour AM.

Lastly, Peder Beck-Friis, economist at PIMCO, maintains his outlook and points out that the BoE will make two rate cuts in 2024. “Core inflation is likely to decline as the effects of the pandemic fade, monetary policy remains restrictive, and the labor market rebalances. Rachel Reeves’ comments yesterday show that the new government is firmly committed to fiscal discipline, reducing the upside risks to inflation in the coming years,” explains Beck-Friis.

Japan and Its Historic Monetary Policy

Finally, according to analysts at Banca March, in Japan, investors are betting on a rate hike at the July meeting, especially after the long silence from Governor Ueda—he will arrive at the meeting with more than 40 days without public interventions—and in light of the recent appreciation of the yen (5% higher against the dollar).

Not only is a rate hike expected, but a reduction in its monthly bond purchases could help strengthen the yen even further. “The possibility of a BoJ rate hike could lead to higher yields on Japanese bonds. However, they could see some volatility in case of a surprise. These actions would represent a significant shift in Japan’s monetary policy, affecting bond yields. Yields fell today and could remain under pressure before the BoJ meeting, although they remain near their highs. Additionally, the risks of escalating geopolitical tensions in the Middle East and elsewhere could drive flows into safe-haven assets, benefiting the yen,” explains Bas Kooijman, CEO and manager at DHF Capital S.A.

According to Magdalene Teo, Asian fixed income analyst at Julius Baer, it is still possible for the BoJ to maintain a hawkish stance by setting the stage to reduce bond purchases with a clear and bold plan to raise interest rates. “In any case, the big decision this week will come from Japan. Any communication error could be costly for the BoJ. The AUD and most Asian currencies, except MYR, IDR, and KRW, depreciated against the USD yesterday,” concludes Teo.