Surge in Flows to Active ETFs in the First Half of 2025

| By Marta Rodriguez | 0 Comentarios

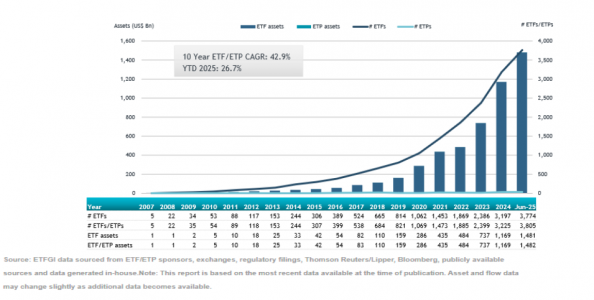

Global assets in actively managed ETFs reached $1.48 trillion by June, representing a growth of 26.7% during the first six months of the year, according to the latest data published by ETFGI. This figure was driven by inflows that also broke new records: $46.77 billion in June alone, which raised the cumulative net inflows for the year to a record $267.02 billion, according to the report.

Subscriptions to actively managed ETFs are gaining increasing relevance relative to overall inflows in the total ETF market. According to figures published by ETFGI, investment flows into exchange-traded funds totaled $897.65 billion in the first half of the year, $167.29 billion more than in the same period last year, a 22.9% increase. Of the investment inflows into ETFs from January to June, a total of $267.02 billion corresponded to actively managed ETFs, an amount $112.98 billion higher than in the first half of 2024, or in other words, 73% higher.

Therefore, inflows to actively managed ETFs this year already represent 29.7% of total ETF subscriptions, compared to 21% during the same period last year. At the end of 2024, this percentage stood at 19.9%. The positive market performance also lifted the assets of actively managed ETFs worldwide.

Regarding the industry composition, by the end of June, there were 3,805 actively managed ETFs listed globally, managed by 573 providers and traded on 42 stock exchanges across 33 countries.

Flow Dynamics

Analyzing June’s flows, it stands out that actively managed equity ETFs, listed worldwide, recorded net inflows of $24.65 billion, bringing the total accumulated for the year to $148.98 billion, surpassing the $89.35 billion registered in the same period of 2024.

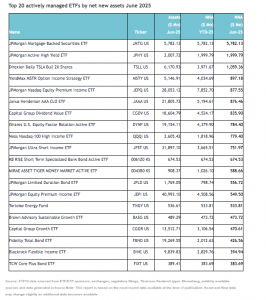

For actively managed fixed income ETFs, net inflows of $20.51 billion were reported in June, reaching accumulated inflows in 2025 of $102.6 billion, “well above the $54.49 billion recorded up to June 2024,” explain ETFGI. They indicate that the substantial inflows can be attributed to the 20 actively managed ETFs with the highest net flows, which together captured $19.7 billion during June.

Two recently launched JPMorgan ETFs, the JPMorgan Mortgage-Backed Securities ETF (JMTG US) and the JPMorgan Active High Yield ETF, led the inflow rankings. The former recorded $5.78 billion in inflows.

Strong investment inflows are notable in collateralized debt ETFs, such as the Janus Henderson CLO AAA ETF, which registered subscriptions of $876 million last month. It is the largest CLO ETF in the world, with over $21 billion in assets under management. This year, it has already received flows close to $5.2 billion.

Interest in dividend ETFs is also remarkable, such as the Capital Group Dividend Value ETF, which received investment inflows of $835.9 million in June alone, raising its subscriptions this year to $4.524 billion.