Three Reasons Investors Should Look to Emerging Markets

| By Marcelo Soba | 0 Comentarios

As volatile as U.S. stock and bond markets have been this year, emerging markets (EM) have had it worse. EM stocks are currently in one of their longest bear markets, with the MSCI Emerging Markets Index down about 40% from its February 2021 peak.

The cause of this poor performance has a lot to do with China and its regulatory crackdowns on its global technology franchises, restrictions on debt restructuring among homebuilders and zero-COVID policy, which has produced rolling lockdowns and interrupted economic momentum.

Together, these have produced disappointing growth. And because China is a major trading partner to virtually all other EM regions, and accounts for one-third of the market capitalization in most EM benchmark indices, its fate weighs heavily on investor willingness to allocate to EM.

Global inflation in oil and food prices and the strong U.S. dollar have further dragged on the markets. The strong dollar raises the cost of dollar-denominated debt and imports for emerging markets.

Together, these challenges have led global investors to slash EM positions and shun the asset class, driving historically cheap valuations. The MSCI EM Index now trades at about 10 times forward earnings estimates, and the MSCI China Index about eight times.

This is in marked contrast to the S&P 500 Index, which still boasts a forward price-to-earnings ratio of 17 and is over-owned by investors globally.

Three Potential Catalysts for a Rebound

A more pro-growth, stimulus-oriented stance in China: Morgan Stanley economists believe China will begin prioritizing economic development over some of its goals related to security and social stability, which have been front and center for the past two years. We also see a possible end to China’s zero-COVID policy by the new fiscal year in April 2023. A full re-opening could allow private consumption to rebound substantially and boost China’s inflation-adjusted GDP growth from below 3% to 4.5% in 2023. Importantly, as China pursued a very different policy response to COVID from most of the West, it is not experiencing high inflation or rising interest rates. This gives Beijing significant runway for stimulus.

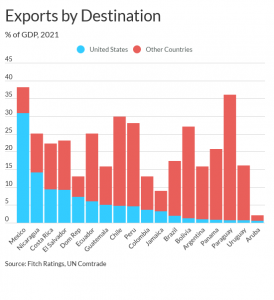

A peak in the strength of the U.S. dollar: We may see the dollar losing momentum as the Federal Reserve’s rate-hiking cycle matures and as relative economic growth outside of the U.S. improves. As the dollar potentially weakens, EM countries could benefit from the relative appreciation of their own currency. Additionally, commodity exporters, such as countries in Latin America, could see commodity prices strengthening due to greater global demand.

Shifting global trade relationships: While U.S.-China relations remain complicated, the reorganization of strategic supply chains could create new opportunities for EM nations other than China. In areas such as consumer and industrial goods, we anticipate new relationships between the U.S. and India, Latin America and non-China-linked countries in Southeast Asia. Meanwhile, we also expect China to continue to court economic integration with some of those same countries, extending efforts first nurtured through its Belt and Road infrastructure program.

All in, we think it may be time for investors to reassess their exposure to emerging markets. Investors should consider rebalancing EM exposure with an eye toward China onshore companies, as well as opportunities in South Korea, Taiwan and Brazil.

This article is based on Lisa Shalett’s Global Investment Committee Weekly report from November 14, 2022, “Dawn for Emerging Markets.”