Investors can’t afford to ignore credit, especially European investors.

We find that a balanced mix of euro investment grade credit and euro high yield credit would have outperformed an equally balanced allocation split between German government bonds and European equities over the period since a European high yield index was first launched in 2001. What’s more, the credit portfolio’s return and risk profile has been better in both rising and falling interest rate environments.

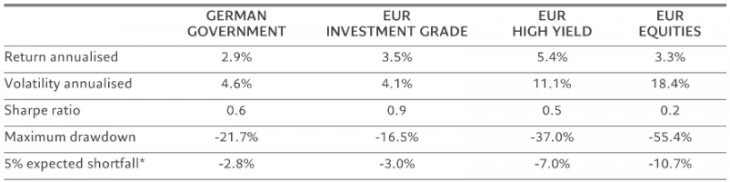

Overall, credit offers better Sharpe ratios – the balance between risk and return – than the more traditional asset classes. So, for instance, euro investment grade credit has offered better returns at lower volatility than German government bonds – the standard “risk-free” instrument. And high yield credit has generated considerably better returns for substantially lower risk than European equities. At the same time, investment grade and high yield credit have had substantially lower maximum drawdowns than German government bonds and European equities respectively (see Fig. 1), while corporate failure is more catastrophic to equity investors than to corporate bond holders.

Figure 1 – Performing credit

Asset class summary 2001-23

*Average return of the 5% worst months over the 2001-2023 period. Source: Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

And unlike investing in equity where market timing can make a very significant difference in long-run returns, the fact that bonds come with fixed maturities makes market timing less important. Economic growth matters less to holders of corporate debt than it does to owners of equity. And while credit is often seen as a hybrid asset class, showing both bond- and equity-like characteristics, that’s also true of equities, especially in some sectors.

In a nutshell, investors need to re-think the role of credit in their portfolios. Credit should be core.

When investors think of credit, they tend to focus on risk. Investment grade credit is seen in light of corporate uncertainty while government debt represents safety. High yield is often associated with default risk whereas equities represent opportunities such as growth and value. To be sure, investors ought to balance opportunities and risks. The evidence shows that credit offers a better risk-reward profile than corresponding equities and government bonds.

History shows investing in credit delivers steady returns. The asset class’s drawdowns have been temporary, and have always been followed by strong performance rebounds, rewarding the patient investor.

Since 2001 (when data was first available) European investment grade has generated superior returns to German bunds for a similar level of annual volatility, resulting in a significantly better Sharpe ratio.

Over the same period, European high yield credit has generated better returns at lower volatility than European equities, which have failed to compensate investors for the very high level of risk taken, resulting in a poor Sharpe ratio, and have been exposed to extreme negative returns, as shown by the maximum drawdown and expected shortfall.

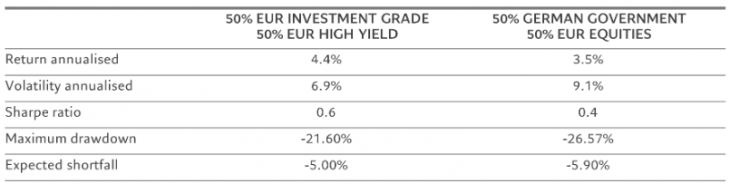

As a result, replacing German government bonds with European investment grade credit and European equities with European high yield credit delivers 0.77 percentage points more in annual return, with significantly less volatility and less drawdown. At the same time, the credit portfolio posts smaller average losses during the worst market downturns (see Fig. 2).

Figure 2 – A fine balance

Asset class combinations, 2001-23

Source: Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

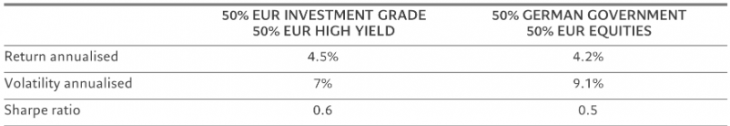

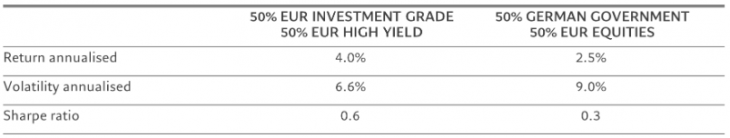

This result remains the same whether central banks are raising interest rates or cutting them (see Figs. 3 and 4). Setting the 10-year German sovereign rate as the reference rate, the properties of the two portfolios have been computed during the years when the interest rate has been increasing (10 years out of 23) and during the years when the interest rate has been decreasing (13 years out of 23). In both environments, the credit portfolio exhibits superior returns with lower volatility, and therefore a better Sharpe ratio, in comparison to the mix of government debt and equities.

Figure 3 – When rates go up…

Blended portfolio performance in rising rate years

Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

Figure 4 – …and when they fall

Blended portfolio performance in declining rate years

Pictet Asset Management Developed Markets Credit, ICE BofA, Bloomberg. Data covering period 31.01.2001 and 30.11.2023.

When faced with interest rate and growth risk, investors also often downplay credit as a hybrid asset class relative to “pure” equities and government bonds. That’s a mistake. In reality, all of these asset classes incorporate opportunities and threats that are related to interest rates and systemic risks. Credit, however, offers better risk-adjusted returns and stronger recover rates after temporary downturns.

Opinion article by Ermira Maricka, Head of Developed Markets Credit at Pictet Asset Management.

Discover how to optimise your portfolio with European credit here.