BlackRock Acquires Preqin to Expand in Private Markets Data Segment

| By Beatriz Zúñiga | 0 Comentarios

BlackRock has reached an agreement to acquire Preqin, an independent provider of private markets data, for $3.2 billion. According to the asset manager, the combination of Preqin’s data and analytics tools with Aladdin’s capabilities will create a “unified platform that will establish a preeminent provider of private markets technology and data.”

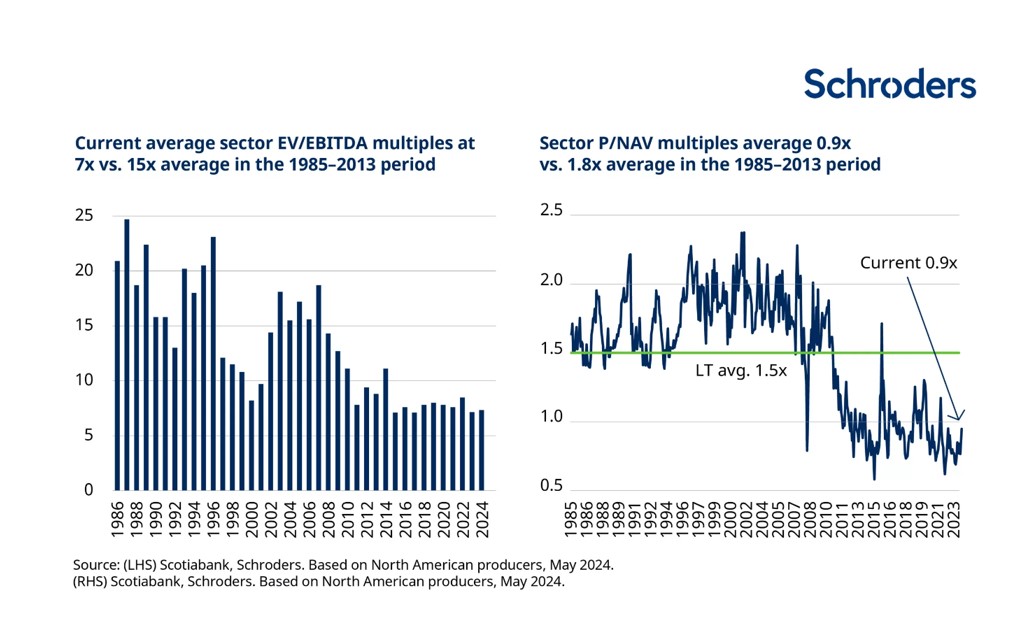

Specifically, this operation adds a highly complementary data business to BlackRock’s investment technology, marking a strategic expansion in the rapidly growing private markets data segment. BlackRock highlights that private markets are the fastest-growing asset management segment, with alternative assets expected to reach nearly $40 trillion by the end of the decade. As institutional and wealth investors increase allocations to alternatives, BlackRock has increased its focus on private markets to meet this client demand.

In fact, the asset manager believes there is an even greater need for standardized data, benchmarks, and analytics that enable investors to better incorporate private asset classes into their portfolios and provide fund managers with better data and tools to deliver results to clients. It estimates that private markets data represents a total addressable market of $8 billion and is growing at 12% per year, reaching $18 billion by 2030.

Preqin and Aladdin

Preqin empowers investors to make better decisions by providing data and information that increase transparency and access in the global alternatives market. With a 20-year history, Preqin is a leading independent provider of private markets data solutions with global coverage of 190,000 funds, 60,000 fund managers, and 30,000 private market investors, reaching over 200,000 users, including asset managers, insurers, pensions, wealth managers, banks, and other service providers. In 2024, Preqin is expected to generate approximately $240 million in recurring revenues and has grown at approximately 20% per year over the last three years.

On the other hand, through the Aladdin platform, BlackRock provides technology solutions to over 1,000 clients. The combination of Preqin with eFront, Aladdin’s private markets solution, brings together data, research, and the investment process for fund managers and investors in fundraising, deal sourcing, portfolio management, accounting, and performance. Preqin will also continue to be offered as a standalone solution.

Transaction Terms

According to the asset manager, BlackRock will acquire 100% of Preqin’s business and assets for a total consideration of $3.2 billion in cash. The transaction is expected to close before the end of 2024, as it is still subject to regulatory approvals and other customary closing conditions.

In this transaction, Barclays acted as BlackRock’s lead financial advisor, with Skadden, Arps, Slate, Meagher & Flom acting as legal advisors. Goldman Sachs International acted as sole financial advisor, and Macfarlanes acted as legal advisor to Preqin.

Key Statements

Regarding the transaction, Rob Goldstein, BlackRock’s Chief Operating Officer, stated: “BlackRock’s vision has always been to combine investments, technology, and data to provide solutions that meet our clients’ needs across their entire portfolio. As clients evolve from selecting products to building portfolios, this shift requires technology, data, and analytics that create a ‘common language’ for investing in public and private markets. We see data driving the industry through technology, capital formation, investment, and risk management. Each acquisition has been an opportunity to strengthen our capabilities for clients, and indeed, we have been Preqin clients for many years, and we look forward to welcoming Preqin’s talented team to BlackRock.”

On the other hand, Sudhir Nair, Global Head of Aladdin, added: “Together with Preqin, we can make investing in private markets easier and more accessible, while building a better-connected platform for investors and fund managers. This presents a substantial opportunity for Aladdin to close the transparency gap between public and private markets through data and analytics.”

From Preqin, Mark O’Hare, the firm’s founder, declared: “BlackRock is known for its excellence in both investment management and financial technology, and together we can accelerate our efforts to provide better private markets data and analytics to all our clients at scale. I look forward to joining BlackRock and continuing to play a role in the ongoing growth and success of Preqin and our clients.” Additionally, Preqin’s founder Mark O’Hare will join BlackRock as Vice Chairman after the transaction closes.

Finally, Christoph Knaack, CEO of Preqin, added: “Private markets continue to evolve and so does Preqin. I am incredibly excited about the opportunities this next phase of growth, together with BlackRock, promises to our clients and employees.”