The correction in the S&P 500’s price at the beginning of August was resolved almost as quickly as it occurred, and the market is once again suffering from the same symptoms of overvaluation and technical and sentiment-driven excesses.

The market is nearing overbought territory again, and retail investor surveys are once more showing excessive confidence, as evidenced by investors’ reaction to Nvidia’s results on Wednesday, with a post-market drop that reached 7%.

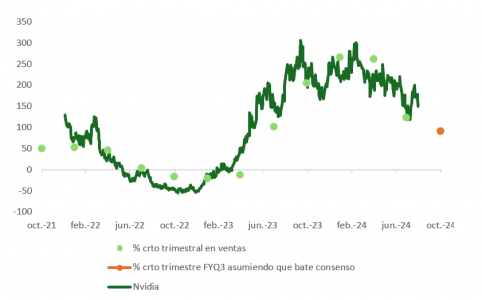

The numbers highlighted the potential of the business: the company continues to exceed consensus expectations in sales, margins, and EPS quarter after quarter. Its outlook for medium-term demand maintained the optimism of previous quarters. “We expect to grow our data center business significantly next year. Blackwell is going to completely change the game for the industry,” said Jensen Huang, CEO of Nvidia. Additionally, concerns about delays in the launch of its new product, Blackwell, were alleviated. However, the strong performance and the CEO’s comments—unclear regarding the ROI impact of the massive GPU investments by companies like Microsoft, Google, Amazon, or Meta—did not fully satisfy investors’ optimism.

This is relevant because Nvidia is one of those rare cases where a single company, or sometimes a single industry, like technology in 1999, becomes so significant that it comes to dominate the macroeconomic landscape by embodying the essence of the generative AI theme. This is the underlying idea behind the stock market rally over the last two years, since the official launch of ChatGPT in November 2022.

The numbers don’t lie: this year, the GPU company contributed about 230 points to the S&P 500 before the earnings release, accounting for 27% of the total returns the U.S. index has generated so far this year.

Maintaining business momentum like the one Nvidia has shown over the past 12 months is not sustainable, and its growth is slowing both year-over-year and quarter-over-quarter—although, to be clear, sequential growth is expected to pick up again in the fourth quarter as Blackwell begins reaching end customers, while demand for Hopper remains strong.

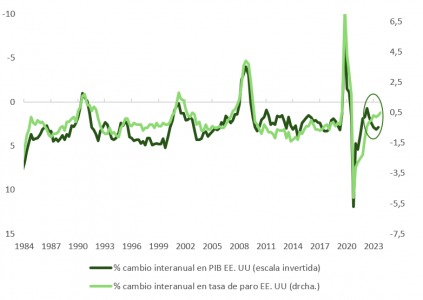

At a macro level, a similar situation is unfolding, despite the desire to celebrate Jerome Powell’s comments at Jackson Hole a few weeks ago. Despite the strong U.S. GDP data for the second quarter and the July retail sales figures, there is evidence of weaker growth. Manufacturing activity has contracted again, and the U.S. consumer, the main driver of global expansion over the past two years, is now less dynamic.

Real disposable income is growing at only 0.9% year-over-year, and a number of multinationals tied to household spending disappointed during earnings season (e.g., McDonald’s, Ford, Alphabet, or LVMH). The excess savings accumulated during the pandemic have been spent, fiscal policy will be less generous—regardless of who ends up in the White House in 2025, and especially if it’s Donald Trump—and the labor market is showing signs of fatigue.

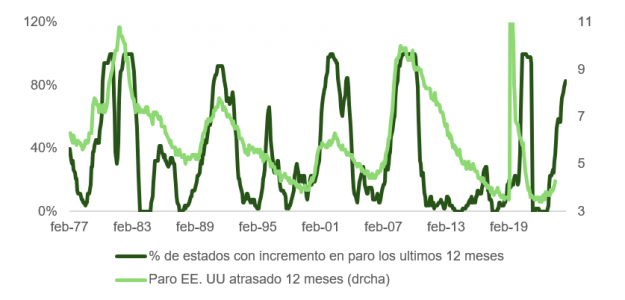

Cumulative unemployment claims suggest that companies are reluctant to hire, and while the most optimistic observers attribute the activation of the Sahm rule to the exceptional nature of Tropical Storm Beryl, which impacted the U.S. Gulf Coast in July, the rise in unemployment over the past 12 months is affecting not just Texas but 80% of the 51 states that make up the union.

While it is true that payroll growth continues to be positive—and is usually negative in the context of economic contractions—this fact confirms that immigration is likely the main cause of the rise in unemployment from a low of 3.4% to 4.3%. We find ourselves in the unusual situation of rising unemployment alongside a growing economy because the imbalance is coming from the supply side of workers.

Demand is moderating, as indicated by the JOLT (Job Openings and Labor Turnover Survey) data on voluntary quits and hires. Although the economy is still creating a reasonable number of jobs each month, and inflation-adjusted private sector wages are increasing by 2.5%, these figures do not pose an imminent threat to GDP. However, growth has peaked, is deflating, and raises doubts about the ability to meet the ambitious EPS growth projections that consensus is forecasting for 2025.

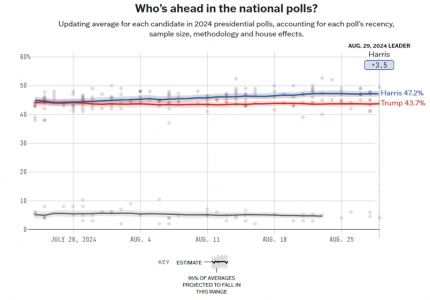

On the geopolitical front, the potential implications of Harris overtaking Trump in betting markets (according to PredictIt, but not Polymarket) and in polls do not appear to be adequately priced into stocks. Investors don’t like the economic platform of either candidate, but in Harris’s case, it is assumed that Republicans will control the House of Representatives or the Senate (if not both), which would prevent much of her fiscal agenda from coming to fruition. In Trump’s case, he would have near-unilateral authority on tariffs, creating risk regardless of what happens with Congress.