The new U.S. legislation—particularly the Genius Act passed in July—is consolidating the role of stablecoins as a method of payment in the future of finance, one of the five megatrends that experts believe will enhance profitability. At BlackRock, they emphasize that stablecoins are linked to major currencies, mainly the U.S. dollar, and could consolidate the greenback’s dominance in global markets, although other countries are exploring alternatives.

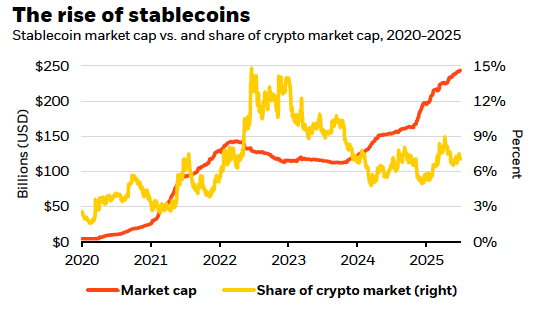

Specifically, they are digital tokens tied to a fiat currency and backed by reserve assets. They combine the frictionless transfer inherent to cryptocurrencies with the perceived stability of a traditional currency. Although stablecoins represent only 7% of the crypto universe, their adoption has grown rapidly since 2020, reaching a volume close to 250 billion dollars.

“We believe that the growing demand for stablecoins will have little impact on short-term Treasury yields. We continue to view Bitcoin as a prominent catalyst for profitability,” argues BlackRock in its latest report. In this regard, 2025 has been an exceptional year for Bitcoin, which has risen 25% so far, while the U.S. advances in approving several key laws aimed at integrating digital payments and assets into the traditional financial system—and turning the country into the world capital of cryptocurrencies.

Implications of the Genius Act

In BlackRock’s analysis, there are two main implications of the Genius Act for the U.S. dollar and Treasury bonds. The first is that the law defines stablecoins as a method of payment, not as an investment product; prohibits issuers from paying interest; and restricts their issuance to federally regulated banks, certain registered non-bank entities, and state-licensed companies.

“This regulation could reinforce the dollar’s dominance by facilitating a tokenized digital ecosystem based on the dollar for international payments. In emerging markets, this could provide easier access to the dollar compared to volatile local currencies. However, in advanced economies, adoption could be limited by the prohibition on interest payments, designed to prevent competition with bank deposits and protect the traditional credit system,” they note.

Secondly, they consider that the law also establishes which assets stablecoin issuers can hold as reserves: primarily repurchase agreements (repos), money market funds, and U.S. Treasury bonds with maturities of 93 days or less. “The main issuers — Tether and Circle — together hold at least 120 billion dollars in Treasury bills, representing only about 2% of the total approximately 6 trillion in circulation. This demand could grow as the stablecoin market expands and drive further purchases of short-term bonds. But the impact on yields is likely to be limited,” they qualify.

The U.S. is not the only country taking action. Hong Kong has launched new regulations to attract innovation in stablecoins, and Europe is exploring the digital euro, although its use would be limited to avoid impacting the banking system. “If other countries allow interest-paying stablecoins, or promote central bank digital currencies (CBDCs), this could weaken the dollar’s role in international trade. Nevertheless, the U.S. could respond by also allowing interest on stablecoins,” the report states.

According to experts, this wave of digital asset adoption by governments — through regulatory frameworks and support from the U.S. administration — foretells greater future adoption, which strengthens the investment thesis on Bitcoin as a differentiated driver of risk and returns in portfolios. “Despite this, stablecoins still represent a relatively small part of the crypto universe, and as this ecosystem evolves, it remains unclear how they will compete against other digital assets,” concludes BlackRock.