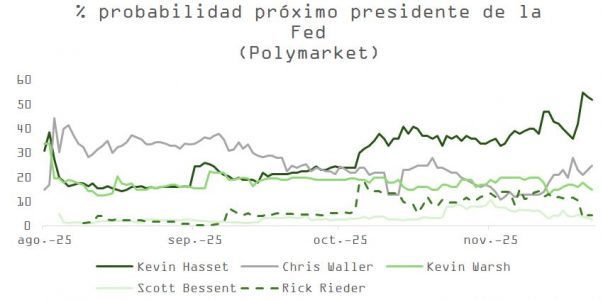

After weeks of fragmentation within the FOMC, the market now assigns an 80% probability to a 25-basis-point cut at the December 10 meeting. The shift in expectations accelerated after rumors emerged positioning Kevin Hassett—current Director of the NEC—as the leading candidate to chair the Federal Reserve.

Powell appears to have gained internal leeway to move forward with a “risk management” decision given the slowdown in consumption, the risk posed by the “K-shaped” economy, weakness in some manufacturing indicators, and the absence of significant inflationary pressures.

Mixed Macro, but With a Dovish Tone

Although the industrial recovery has yet to take hold, the set of data released this week supports an accommodative decision:

Regional Surveys:

Philadelphia: Overall index improves (from -12.8 to -1.7) despite a decline in new orders.

Dallas: Improvement in orders, but overall index deteriorates (from -5 to -10.4).

Richmond: Sharp decline (from -4 to -15).

Flash PMI:

United States: Rebound to 54.8, driven by services.

Eurozone/Germany: Manufacturing remains weak and the Ifo index declines (from 91.6 to 90.6), confirming stagnation.

Retail Sales: +0.2% (vs. +0.4% expected).

Core PPI: Below consensus.

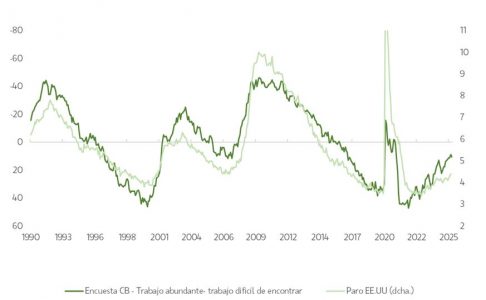

Conference Board: Confidence stabilizes but remains on a downward trend. The reading for the labor market is still…

This environment reduces the immediate inflationary risk but increases that of a two-speed or “K-shaped” economy, in which the slowdown hits middle- and low-income consumption, while corporate investment—especially in AI—remains strong.

In Europe, the Ifo index (which falls from 91.6 to 90.6) also comes in below expectations and confirms the readings from the ZEW index a couple of weeks ago and the preliminary PMIs: growth will remain stagnant. The United States is performing better than Europe.

Employment: Risks Contained, but Not Null

The Beige Book reflects an economy with stable activity, but less momentum in sales and hiring. Labor demand is easing, but there are still no signs of pressure for mass layoffs.

This aligns with a view of a benign slowdown, sufficient to justify a cut, but without the panic associated with a severe short-term contraction.

Toward December: Mixed Signal Risks

Although the general expectation points to a cut in December, the tone of communication will be key to the market’s reaction. If Powell suggests that this is the last move of the cycle, or if the curve must adjust its expectations to a less accommodative monetary policy outlook for 2026, several side effects could arise:

High-multiple assets (tech, crypto, growth) could correct or move sideways if the market interprets the cut as the end of the road.

The dollar would be supported, hurting sensitive assets like gold, emerging markets, or bitcoin.

High-yield corporate credit, with spreads still tight, could suffer due to expectations of higher long-term rates.

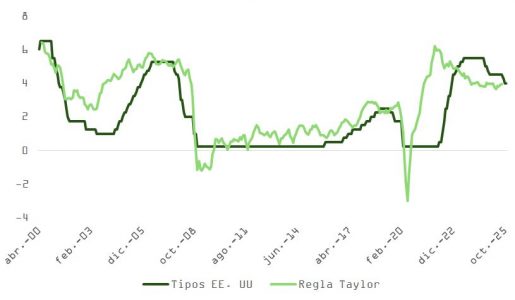

The Taylor Rule indicates that fed funds are at reasonable levels; if a higher neutral rate is mentioned due to productivity or asset price bubbles, the market would interpret this as more hawkish than expected.

More Fuel for 2026?

The December cut and “pause” could be anticipated as a precaution in light of uncertainties in the labor market and a potential overheating in 2026, when the OBBA fiscal plan comes into full effect (contributing between 0.3% and 0.4% to GDP growth).

Added to this is the possibility of a targeted fiscal injection for low- and middle-income households, aimed at revitalizing consumption. While politically useful, this approach would further accentuate the divergence between consumption and savings across income groups, exacerbating the structure of the “K-shaped” economy.

AI, Investment, and Imbalances: The Boom That Divides

Corporate investment in AI continues to expand, supporting a narrative similar to that of 1995–1999. The process is evident, but still far from its peak.

However, the boom in productivity (and income) has not been distributed evenly. The top 10% of the population by income already accounts for more than 50% of total spending in the United States, which increases inequality in access to consumption and investment. This structural imbalance puts pressure on the Fed to continue cutting rates, even if inflation remains contained or surprises to the downside.

Valuations, Liquidity, and Volatility: Beware of Overheating

The combination of expansionary fiscal policy, tech-driven narrative, and expectations of rate cuts is pushing valuations to levels that warrant close monitoring. Despite comparisons to the dotcom bubble, the current environment includes:

Greater accounting transparency.

More profitable business models.

Lower operational and financial leverage.

High investment levels relative to cash flow generation, but still far from the excesses seen in the 1999–2000 TMT space.

Nonetheless, conditions can change rapidly. If the Fed is forced to reverse course in 2026, assets with more demanding multiples would be the most vulnerable.

The parallel with the 1995–1999 period remains valid: a structurally upward trend, but with greater volatility. In this context, taking strategic protection remains a reasonable decision, without giving up the underlying positive bias.

Conclusion

Everything points to a cut in December, driven more by a policy of prevention than reaction. But what matters most will not be the move itself, but how Powell communicates it.

Investors will need to balance three key axes:

AI narrative + expansionary fiscal policy = structural support.

Risks of uneven slowdown + reactive monetary policy.

Threat of overheating in 2026 = risk of reversal.

At this point in the cycle, the prudent course is to continue participating in the trend, but with discipline in risk exposure, close monitoring of consumption, and attention to signals of monetary reversal.