All UCITS categories attracted capital inflows in the first quarter of 2025, demonstrating investor confidence despite ongoing uncertainty around tariffs, according to the latest statistical report published by the European Fund and Asset Management Association (Efama).

In the view of Bernard Delbecque, Director of Economics and Research at Efama, despite the decline in fund asset values, UCITS recorded strong inflows across all categories throughout the quarter. “The fact that fixed income funds remained the best-selling category indicates that investors were still exercising caution; however, rising concerns over impending U.S. tariff hikes did not deter investors from purchasing equity and multi-asset funds,” he noted.

Key Figures

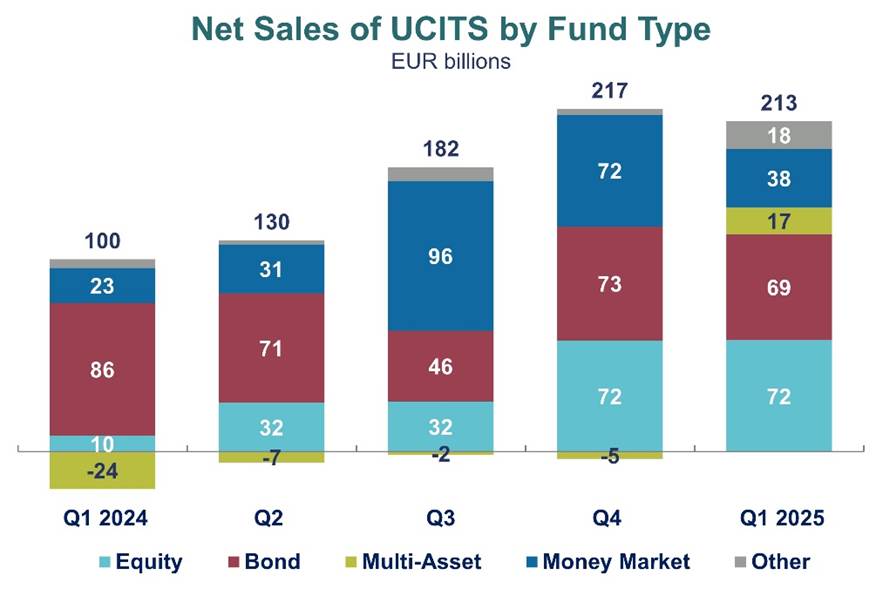

During the first quarter of 2025, net assets of UCITS and AIFs experienced a slight decline of 1.1%, reaching €23.2 trillion. According to Efama, despite this drop, both fund types attracted net inflows totaling €217 billion, showing a slight decrease from the €238 billion recorded in the fourth quarter of 2024. Of these inflows, UCITS accounted for the vast majority with €213 billion, while AIFs recorded €4 billion—a significant decrease from the €21 billion of the previous quarter.

Long-term funds showed solid performance, posting net inflows of €179 billion. All long-term fund categories recorded net inflows, with bond funds remaining the top sellers at €75 billion, although down from €91 billion the previous quarter. Equity funds also performed well, registering €64 billion in net inflows, an increase from €60 billion at the end of 2024. Multi-asset funds rebounded with €20 billion in net inflows, a significant increase compared to €7 billion in the previous quarter.

ETFs continued their growth trajectory, with UCITS ETFs reaching €100 billion in net inflows. Meanwhile, long-term funds under SFDR Article 9 (Sustainable Finance Disclosure Regulation) marked their sixth consecutive quarter of net outflows, totaling €7.9 billion. In contrast, Article 8 funds, which focus on sustainable investments, attracted €42.6 billion.

Finally, European households showed strong interest in fund purchases, with net acquisitions of €79 billion in the fourth quarter of 2024—up from €62 billion in the previous quarter. This marked the second-highest quarterly level since Q2 2021, driven primarily by households in Germany, Spain, and Italy.