In April 2025, the Citi GPS report: Digital Dollars anticipated that it would be the moment for institutional adoption of blockchain technology, with stablecoins acting as a decisive catalyst in this transformation. One year after this prediction, recent events and data confirm that this revolution is occurring at a rapid pace, driven primarily by digitally native companies, technological advancements, and an increase in transactional activity.

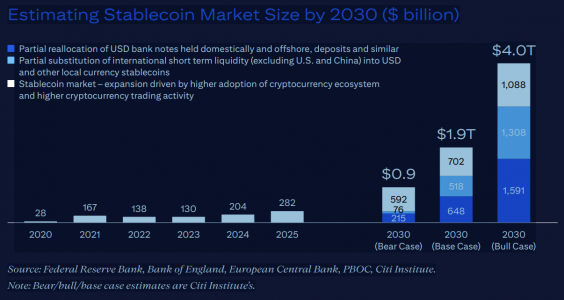

The volume of stablecoin issuance has experienced remarkable growth, rising from approximately $200 billion at the beginning of 2025 to nearly $280 billion today. This momentum has led the Citi Institute to revise its projections for total stablecoin issuance in 2030, adjusting the base case to $1.9 trillion, up from the initially forecasted $1.6 trillion, and the optimistic scenario to $4.0 trillion, compared to the previous $3.7 trillion. This growth reflects both the partial relocation of U.S. dollar cash, domestic and offshore, and the gradual replacement of short-term international liquidity with stablecoins denominated in dollars and other local currencies, in addition to a boom in crypto ecosystem adoption and increased cryptocurrency trading.

A New Financial Ecosystem: Coexistence and Evolution

The evolution of digital assets such as stablecoins and bank tokens is marking a shift. However, far from representing a threat to the traditional financial system, these innovations contribute to reimagining and strengthening it. The reality points toward integration and coexistence of models.

Although stablecoins offer a valuable financial tool, especially for digital companies, investors, and households in emerging markets seeking an efficient and secure option, they are not a universal solution for all markets. In many countries, national payment systems already provide fast, secure, and low-cost solutions. In contrast, cross-border payments continue to present challenges that both fintechs and large banks are addressing through advanced technologies.

For certain market segments, bank tokens offer a simpler alternative aligned with traditional infrastructures, and transaction volumes using these tokens are expected to surpass those of stablecoins by 2030. Rather than competition, this diversity of formats represents progress toward smarter, more agile, and programmable finance.

Market Projections and Transactional Activity

The Citi Institute estimates that stablecoins could support nearly $100 trillion in annual transactional activity in its base-case scenario for 2030. In the optimistic scenario, this figure could double to $200 trillion, placing stablecoins at the center of the global financial infrastructure of the future.

At the same time, bank tokens, which combine the trust, familiarity, and regulatory security of traditional bank money, are projected to reach similar or even higher volumes. These tokens could play a key role in the financial ecosystem, especially in corporate transactions where institutional trust and regulation are fundamental.

Programmability and Efficiency: The Key for Corporate Treasuries

One of the most valued features for large corporations is the programmability of digital money, which enables real-time settlements and reconciliations, with built-in regulatory compliance at the point of transaction and significant friction reduction. Both stablecoins and bank tokens are positioned to offer these capabilities, which will attract growing interest from corporate treasuries seeking to optimize cash management and improve operational efficiency.

Dollar Dominance and Geographic Expansion

U.S. dollar denomination will continue to predominate in on-chain money volumes, generating incremental demand for U.S. Treasury bonds. Nevertheless, the relevant activity is not limited to the United States. Innovative financial centers such as Hong Kong, the United Arab Emirates, and other emerging jurisdictions are undergoing rapid development in blockchain technology adoption, reflecting a diversified and global geographic expansion.

Context and Comparison With Traditional Flows

While the projected annual turnover figures for stablecoins and bank tokens, $100 trillion and over $100 trillion, respectively, may seem astronomical to the general public, in context they remain smaller compared to the daily flows handled by major banks, which range between $5 trillion and $10 trillion. This highlights the enormous growth potential of on-chain digital money, which still represents a fraction of total global payment volumes.