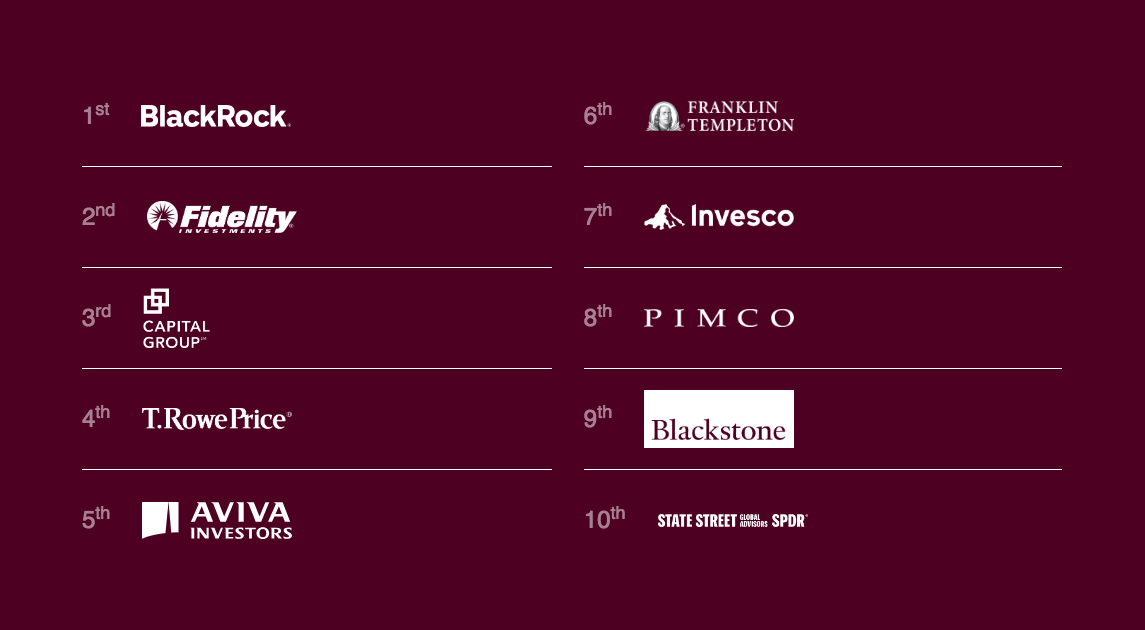

Brand building has become a valuable factor for the competitiveness of international asset managers. According to the annual Global 100 Asset Management Marketing Report, prepared by BCG, BlackRock, Fidelity Investments, and Capital Group are the top three investment firms with the strongest brands, followed by T. Rowe Price and Aviva Investors.

Brand Building Becomes a Key Competitive Factor for Asset Managers

Brand building has become a key asset for international asset managers seeking to strengthen their competitiveness. According to the annual Global 100 Asset Management Marketing Report, published by BCG, BlackRock, Fidelity Investments, and Capital Group are the top three investment firms in brand strength, followed by T. Rowe Price and Aviva Investors.

“The Global 100 2025 shows that the asset management sector continues to go through a period of profound change. It’s clear that many managers are facing existential questions. How can we scale? Should we consider inorganic growth? How do we incorporate artificial intelligence into our business practices and marketing without losing what makes us unique? How do we breathe new life into a stagnant brand? It has never been more important for senior marketing leaders to make data-driven decisions in executive-level conversations,” the report’s authors state.

The report finds that 45% of firms are experiencing stagnation or decline in brand recognition, a figure that, while not as high as in previous years, still indicates that nearly half of executives are failing to create brand value. “This is clearly a challenge for a sector that relies on visibility and whose strategy, for many firms, is focused on reaching new audiences—especially retail clients and wealth groups,” the report notes. The global share of voice (SOV) has also declined by 5% compared to two years ago, signaling increased competition for media coverage.

Among firms focused exclusively on private markets, 88% had below-average media perception, and over 75% received clearly negative sentiment. “Among major players, Blackstone and Apollo scored only 4/10 in media perception. Top private market players like Blackstone appear to have become ‘lightning rods’ for the sector, attracting ten times more search interest than similarly sized firms outside the private equity space,” the report says.

The report also highlights slow progress in paid media strategies. 39% of firms still lack a permanent paid search strategy, only a slight improvement from 43% in 2023. 85% of firms had no sustained presence in paid media in 2025, compared to 80% in 2023, indicating stagnation in paid media adoption.

Using the Peregrine Frame analysis model, the report finds that most firms cluster around 16 recurring key message areas, with client focus, ESG criteria, and research-based investing being the most common. Over 90% of firms list client focus among their top three core messages, suggesting that messaging often gravitates toward consensus rather than differentiation. “In a sector where consolidation is accelerating and the competitive landscape remains intense, brands need to be bolder in their positioning,” the report warns.

The report emphasizes that brand positioning is not superficial; it is material and deeply linked to bottom-line outcomes. “Peregrine’s analysis shows a strong correlation between high category authority (message distinction and niche dominance) and AUM growth, and the reward is exponential.” Firms with low authority are not only less likely to achieve significant AUM gains but are also more prone to AUM losses. 27% of firms with low scores saw their AUM decrease, compared to less than 10% among firms with high scores.

The combined forces of retailization and the rise of active ETFs are reshaping the asset management landscape, making visibility among emerging audience segments a key driver of competitiveness. At the same time, margin pressure is intensifying, placing cost control at the top of the corporate strategic agenda, according to BCG’s analysis.

However, the impact on decision-making varies by firm type and market niche. Alpha generators—such as alternative asset managers and active firms—are focusing on talent attraction and retention while strengthening their corporate narrative around the uniqueness of their human capital. This trend is particularly visible in large multi-strategy managers. In contrast, beta factories—large managers with heavy exposure to passive strategies—are emphasizing operational efficiency, scale, and technology as the core of their value proposition. For distribution powerhouses and solution providers, brand is becoming an increasingly important factor at the decision-making level.

The central challenge, BCG concludes, is to transform marketing leadership into AUM leadership, thereby solidifying a firm’s position in an increasingly competitive and diversified market.