Santander Announces Sale of 49% of Santander Polska to Erste Group Bank and 50% of Its Asset Management Business in Poland

| For Amaya Uriarte | 0 Comentarios

Banco Santander has agreed to sell to Erste 49% of the capital of Santander Polska for approximately 6.8 billion euros and 50% of its asset management business in Poland (TFI) not controlled by Santander Polska for about 200 million euros, bringing the total amount to around 7 billion euros. The transaction is subject to customary conditions in this type of deal, including the corresponding regulatory approvals.

The transaction, entirely in cash, will be carried out at a price of 584 zlotys per share, which values the bank at 2.2 times its tangible book value per share as of the end of the first quarter of 2025, excluding the announced dividend of 46.37 zlotys per share, and at 11 times 2024 earnings. Additionally, it represents a 7.5% premium over Santander Polska’s May 2, 2025, market closing price, excluding the dividend, and a 14% premium over the volume-weighted average price of the past six months. Santander Polska shares will trade ex-dividend on May 12, 2025.

Following the transaction, Santander will hold approximately 13% of Santander Polska’s capital and intends to acquire the entirety of Santander Consumer Bank Polska before closing by purchasing the 60% currently held by Santander Polska.

The closing of these transactions, expected around the end of 2025, will generate an approximate net capital gain of 2 billion euros for Santander, representing an increase of about 100 basis points in the group’s CET1 capital ratio, equivalent to approximately 6.4 billion euros, and will place the pro forma CET1 capital ratio around 14%.

Strategic collaboration

In addition to the acquisition, Santander and Erste announce a strategic collaboration to leverage both entities’ capabilities in Corporate & Investment Banking (CIB), and to allow Erste access to Santander’s global payment platforms, in line with the group’s strategy to become the world’s best open financial services platform.

In CIB, both Santander and Erste will leverage their respective regional strengths to offer local solutions and knowledge of their respective markets to corporate and institutional clients through a referral model that will facilitate client interactions and an agile service offering. In addition, Santander will connect Erste clients with its global product platforms in the United Kingdom, Europe, and the Americas. Both entities will collaborate as preferred partners with the aim of building long-term, mutually beneficial relationships that maximize joint business opportunities.

In payments, the entities will explore opportunities for Erste, including Santander Polska after the transaction closes, which will allow it to leverage Santander’s capabilities and infrastructure in this area, including its PagoNxt payments business.

Santander’s strategy is focused on generating sustainable value for clients and shareholders, through common platforms across each of its five global businesses, enabling the best client experience at the lowest service cost and taking advantage of the group’s network and economies of scale.

Since announcing a new phase of value creation in 2023, Santander has added 15 million new clients, improved its efficiency ratio from 46.6% to 41.8%, and increased its earnings per share by 62%.

Regarding this sale, Ana Botín, Executive Chair of Banco Santander, commented: “This transaction represents a key step in our shareholder value creation strategy, based both on accelerating platform development through ONE Transformation and on increasing the group’s scale in highly connected markets. Santander is achieving very attractive multiples for its bank in Poland, and Erste is acquiring an exceptional business with a first-rate team that will continue generating value for customers, employees, and other stakeholders of Santander Polska. We will allocate the capital generated by this transaction according to our capital allocation hierarchy, which prioritizes profitable organic growth. We plan to dedicate 50% of the amount (about 3.2 billion euros) to accelerate the execution of the extraordinary share buyback programs by early 2026, possibly exceeding the announced buyback target of up to 10 billion euros, given the attractiveness of these transactions at current prices, subject to regulatory approvals. I especially thank Michał and the entire team in Poland for their outstanding contribution to the group over all these years. It has been an honor and a pleasure to work with you.”

Financial impact

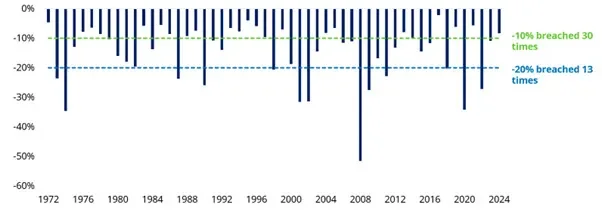

Following the transaction’s closing, the group will temporarily operate with a CET1 ratio above the target range (12%-13%), with the intention of gradually returning to that range by reinvesting capital according to the guidelines set in its capital strategy, which prioritizes profitable organic growth and investment in its businesses to achieve cumulative growth in profits, profitability, book value, and shareholder remuneration.

Santander plans to distribute 50% of the capital released by this transaction through a share buyback of approximately 3.2 billion euros. This will accelerate the achievement of the up to 10 billion euros share buyback target from 2025 and 2026 results and projected excess capital. As such, the previously announced target could be exceeded, given the attractiveness of buybacks at current valuations, subject to regulatory approval.

The transaction is expected to have a positive impact on earnings per share starting in 2027/2028, thanks to the reinvestment of capital in a combination of organic growth, share buybacks, and potential complementary acquisitions that meet the group’s strategic and profitability criteria. The generated capital will allow Santander greater strategic flexibility to invest in other markets where it already operates in Europe and the Americas with the goal of accelerating growth, increasing income derived from network collaboration across its five global businesses, and maximizing benefits for clients and shareholders.