Private investment funds based in the United States currently manage approximately $7.26 trillion in assets, according to a report by Ocorian.

More than half (52%) of global private investment fund assets are held in vehicles domiciled in the U.S., according to the firm’s Global Assets Monitor. This compares to one quarter (25%) in Asia and around one fifth (19%) in Europe.

The total value of assets in U.S.-based private investment funds has surged over the past 10 years, rising more than 300% since 2015, when the value stood at $1.81 trillion, and over 500% since 2009, when it was $1.07 trillion.

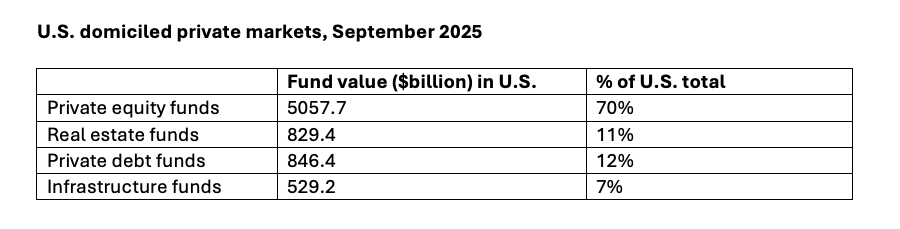

The report breaks down the distribution of U.S.-domiciled private investment funds by type. Out of the total $7.26 trillion, private equity markets account for the largest share, with $5.06 trillion in assets (70%), followed by private debt with $846 billion (12%), real estate with $829 billion (11%), and infrastructure with $529 billion (7%).