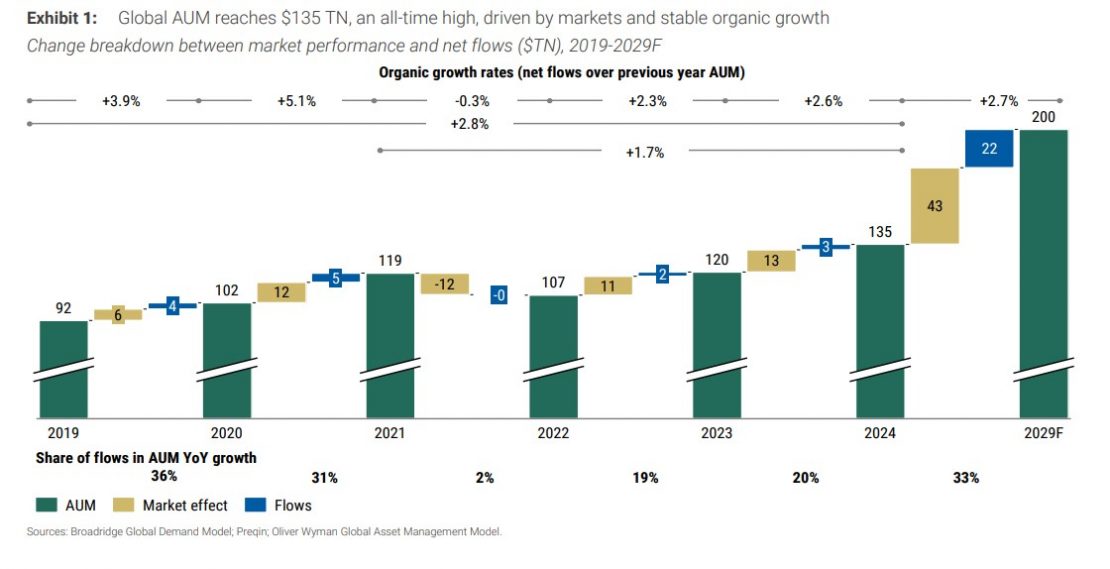

In 2024, assets under management reached a record 135 trillion dollars, representing a 13% year-over-year increase. However, according to the latest report by Morgan Stanley and Oliver Wyman, by 2029, global assets in the asset management industry could reach 200 trillion dollars, implying an annual growth rate of around 8% and a cumulative increase of 48%. In addition, they estimate that average annual net flows will be around 2.7% through 2029.

These projections are based on the assumption that markets will maintain strong performance and that we are in an environment with lower interest rates, which are redirecting funds from guaranteed deposits back into capital markets. They also consider a context in which there is an ongoing shift from collective pension plans (defined benefit) to individualized retirement plans (defined contribution). All of this, they argue, could further sustain flows in the future.

Passive Management and Private Markets

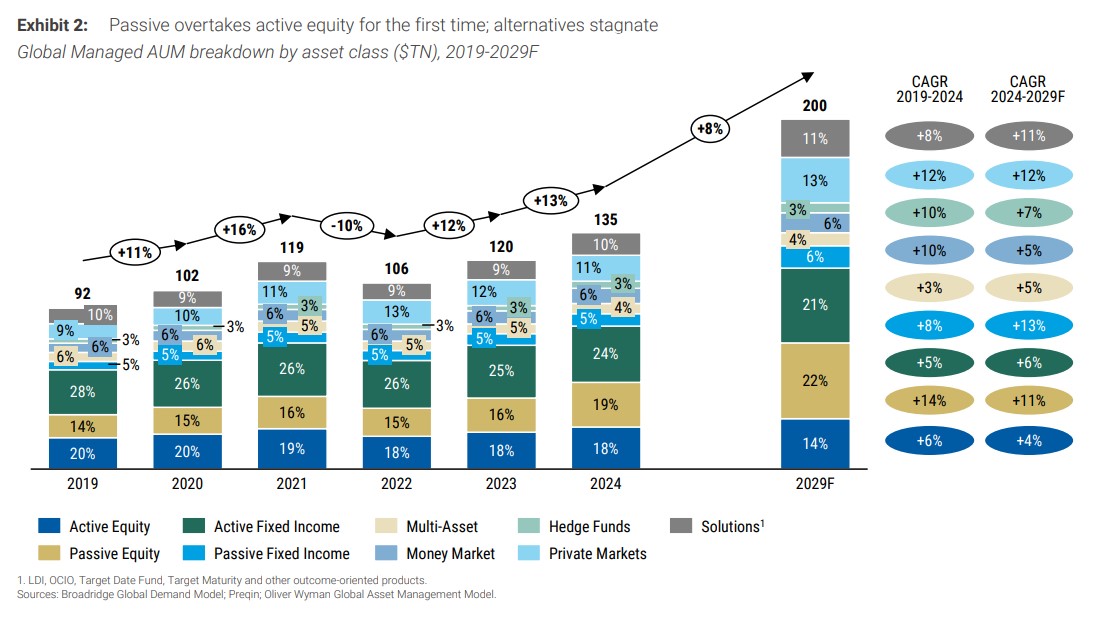

In this global overview of what asset growth will look like, the report identifies several trends that will shape the evolution of the industry and asset managers’ business models. First, it notes that, for the first time globally, passive equity will surpass active equity. “Passive equity management continues to expand, especially in established markets like U.S. retail and in underpenetrated regions such as Europe and Asia-Pacific. In contrast, active equity funds are facing persistent outflows at the industry level, sustained only by a few managers delivering top-quartile performance,” the report states.

Notably, the fixed income segment shows a similar trend: “Although passive fixed income assets are expected to grow twice as fast as active assets, they will remain a relatively small segment of the market by 2029.”

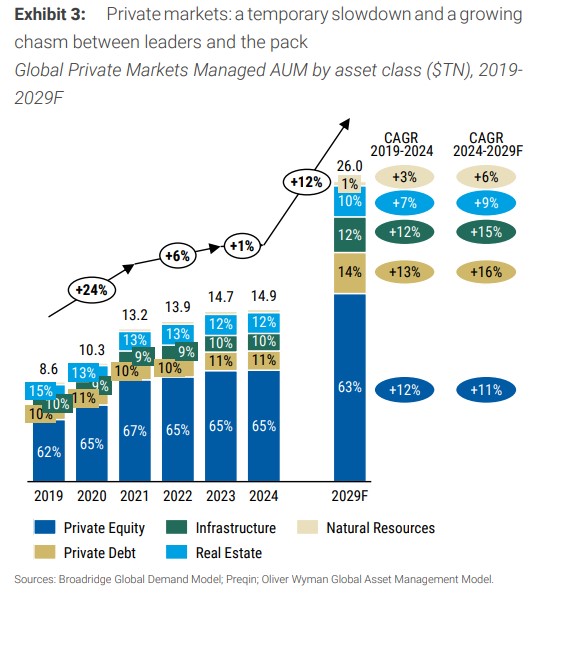

Regarding Private Markets, the report considers that we are currently in a “plateau” phase following the boom from 2019 to 2022 and the stagnation of 2024. “This plateau masks a growing disparity between leading firms and smaller players. The top 10 private asset funds by assets captured 14% of fundraising in 2024, compared to 10% in 2020, a figure that rises to 48% and 58% of the capital raised in 2024 for private debt and infrastructure, respectively,” the report notes.

Their interpretation is that larger firms, benefiting from proprietary capital and deal generation, continue to outperform their competitors, securing the bulk of new capital flows and charging premium fees. “Smaller managers face fundraising challenges and often compete by offering fee discounts—a divide that is likely to intensify as wealth distribution channels (where most of the growth is expected) increasingly favor larger and more recognized brands,” they argue. Looking ahead, however, they expect significant growth across all private markets, driven by their increasing penetration into retail client portfolios.

Growth Drivers

Regionally, the report identifies Asia-Pacific as standing out for its higher organic net flows into both retail and institutional markets, particularly in China. It explains that, despite recent slowdowns, a significant portion of household wealth remains in low-yield deposits, highlighting untapped potential—especially in Japan.

In addition, global retail channels are projected to grow at twice the rate of institutional segments, which are experiencing net outflows except in certain niches such as general insurance accounts and some defined benefit pension markets (e.g., Japan, Australia). “Asset growth in Europe is expected to benefit from regulatory efforts encouraging retail participation and from the ongoing shift toward individualized retirement plans, through new vehicles and incentives (France, Germany) or mandatory auto-enrollment in defined contribution plans (United Kingdom),” the report states.

In this context, asset managers have found a path to continued growth, specifically through solution-based offerings. “These are becoming a key growth area, with the segment expected to expand at an annual rate of 11% through 2029,” the report notes.

The document explains that asset managers are increasingly adopting solutions in the form of model portfolios, sub-advisory mandates, and retirement-focused products to differentiate themselves. According to the analysis, this growth is being driven by rising demand for retail retirement investment products (e.g., target-date funds, target-maturity funds, decumulation products), with average organic growth over the past three years of 12% in APAC, 15% in Europe, and 7% in the Americas, as well as by the expansion of institutional solutions in the Americas, particularly outsourced chief investment officer (OCIO) mandates, which have grown organically by 7% since 2021.

Margins and Business Sustainability

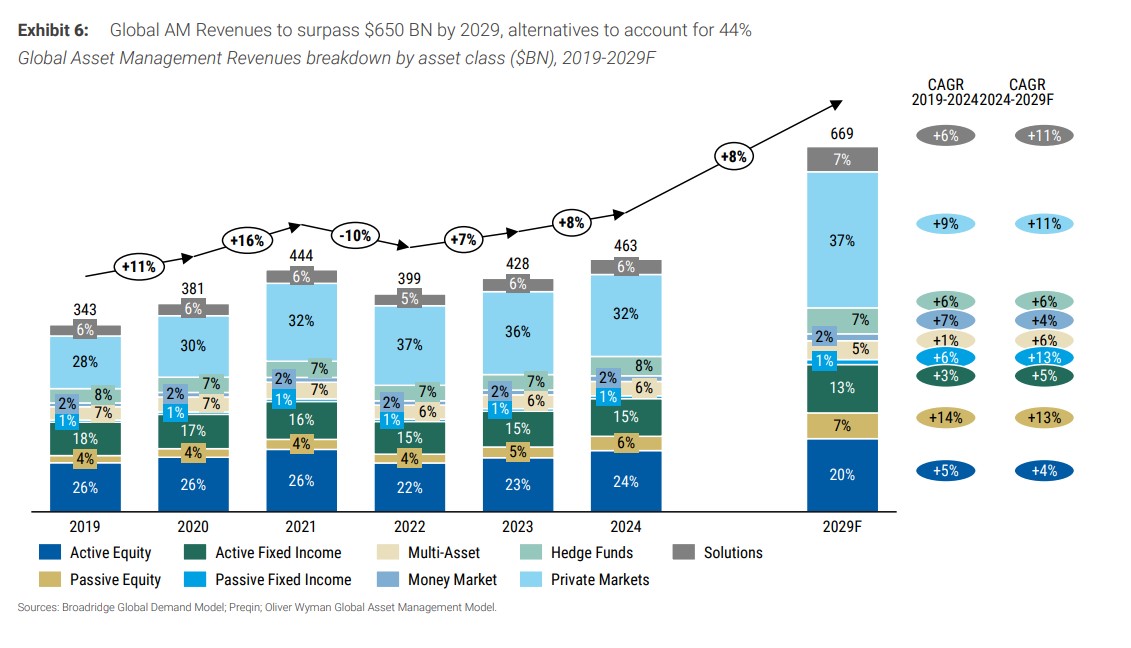

In terms of revenue, the report concludes that the asset management industry will generate more than 650 billion dollars by 2029, in line with the estimate that assets will grow at an annual rate of around 8%. According to the report, alternatives are expected to claim an increasingly larger share, representing 44% of total revenue, while the share of active equity and fixed income funds declines.

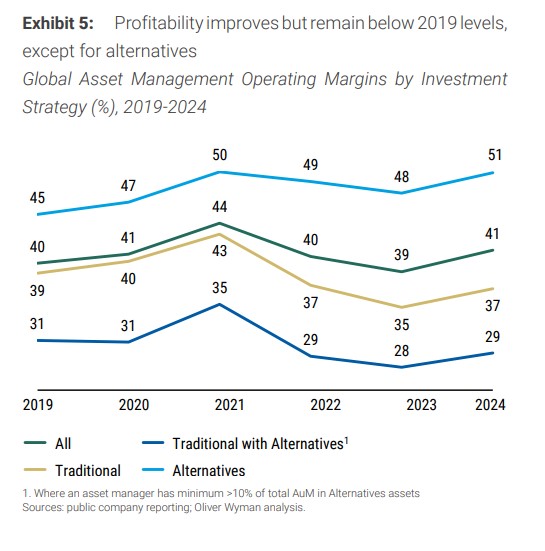

This positive news is accompanied by a very clear warning: fee compression persists, though it is being offset by the shift toward higher-margin private markets and retail growth. “Asset managers’ operating margins improved in 2024, particularly among alternatives, which reached a record 51%. However, traditional managers continue to face structural profitability challenges amid ongoing fee pressure and cost-control demands—especially those using hybrid operating models (combining traditional and alternative asset management) who struggle to efficiently integrate distribution and product development,” the report concludes.

Finally, the report notes that, in this growth context, asset managers must address four themes that are reshaping the industry and present both challenges and opportunities.

First, leaders are facing increasing pressure to demonstrate value for money in Europe and APAC. Second, they must organize their product and distribution forces to serve a growing retail market that increasingly demands institutional-quality coverage. Third, they need to deploy operating models capable of blurring liquidity boundaries to address the burgeoning semiliquid product space. Finally, they must think beyond the active/passive dichotomy and build investment engines suited to address the full spectrum of tracking error.