On May 19, 2025, Coinbase will officially be added to the S&P 500, becoming the first major crypto platform to join the world’s most iconic stock index. For experts in the crypto space, this milestone marks an unprecedented level of institutional validation for the digital asset sector.

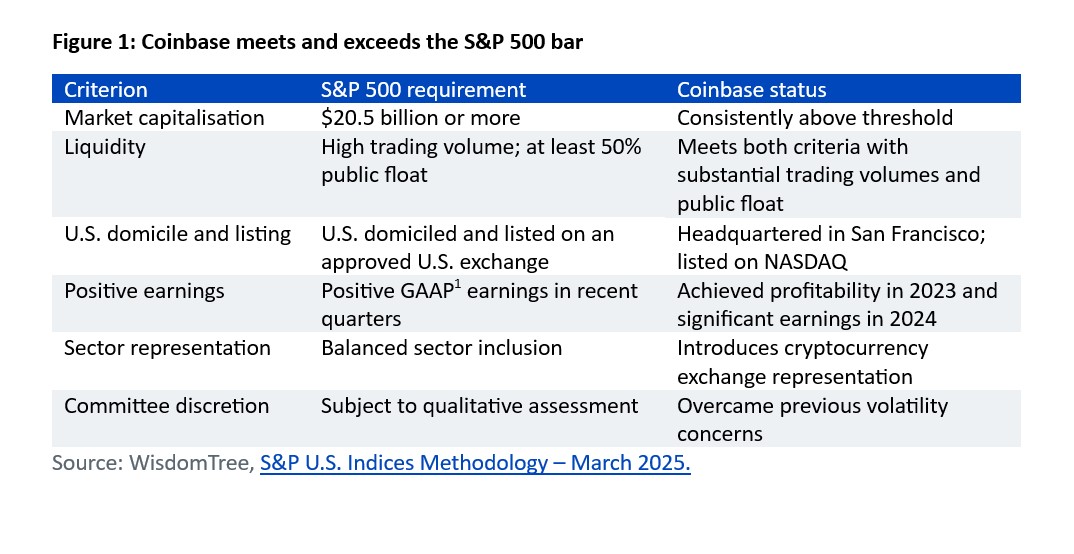

“This is not a symbolic gesture but a structural confirmation: Coinbase has met the rigorous standards for stability, liquidity, and profitability required by the index committee, which only admits well-established companies from the U.S. corporate elite,” says Dovile Silenskyte, Director of Digital Assets Research at WisdomTree.

Coinbase’s inclusion coincides with a moment of strong momentum in the market: Bitcoin has surpassed $100,000, and altcoins such as Solana, Ether, and XRP are seeing significant capital inflows. “This reinforces renewed investor interest in the crypto ecosystem, and inclusion in the S&P 500 means Coinbase will begin channeling passive flows from the trillions of dollars tracking this index,” adds Silenskyte.

In the first week of May, Bitcoin surged past $100,000 and is now very close to its all-time high of $110,400. “Altcoins also rallied, in some cases even outperforming Bitcoin. Ethereum, for example, gained 28% against Bitcoin last week, driven both by the trade agreement and the successful rollout of the long-awaited ‘Pectra’ upgrade on the Ethereum mainnet. On the more speculative end of the market, memecoins posted even steeper gains, in some cases up to 125%,” notes Simon Peters, analyst at eToro.

However, experts remain cautious, and the current rally in crypto assets comes with nuances. For example, Manuel Villegas, Next Generation Research Analyst at Julius Baer, points out that Ethereum is not to silver what Bitcoin is to gold. “Their fundamental drivers are very different. In the short term, volatile —and noisy— macroeconomic conditions may obscure these distinctions, causing Ethereum to behave like a high-beta version of Bitcoin, but in the long run, each token’s fundamentals will prevail. Flows into Ethereum ETFs have been minimal —at best—. At the same time, we clearly see institutional interest in collateral management and stablecoins, where significant activity may concentrate on Ethereum. Meanwhile, its supply remains inflationary, as network activity is still limited,” Villegas notes.

The Coinbase Case

Focusing on Coinbase, it’s worth highlighting that the company, which survived the bear market and regulatory pressure of 2022–2023, successfully transformed itself: it cut costs, diversified revenues into areas like staking, custody, and blockchain infrastructure, and posted GAAP profits in 2024, which cemented its eligibility.

“This inclusion accelerates the institutionalization of the crypto world and removes barriers for traditional investors, who now see Coinbase as a legitimate gateway to the sector. It also sends a clear signal to traditional financial firms: Wall Street is no longer watching from afar—it is participating, allocating capital, and gaining exposure —even passively— to crypto. What was once marginal is now an integral part of the global financial architecture. Crypto assets are no longer knocking on the system’s door — they’ve been handed the keys,” concludes Silenskyte.

Bull Market

Current market conditions are dominated by macroeconomic and geopolitical factors, suggesting that volatility driven by external events will remain present. As for this asset class, crypto regulation in the U.S. and the UK is expected to remain one of the most relevant drivers throughout the rest of the year, with stablecoins being the key issue in the U.S. and spot ETFs the top priority in the UK.

According to Julius Baer, the crypto market’s rally reflects an improvement in risk sentiment, driven by the easing of trade tensions between the U.S. and China. Silenskyte explains that Bitcoin’s price increase is fundamentally based on its scarcity, with institutional demand outpacing supply. Meanwhile, due to differing fundamentals, Ethereum is likely to continue diverging from Bitcoin in the long term, despite currently being influenced by similar macroeconomic trends. “Regulatory developments in the U.S. and the UK will be key factors shaping the market going forward. Investors should act with caution, as macro-driven volatility will remain,” she notes.

In their view, sentiment in the crypto market appears to have shifted significantly, in line with improved sentiment across financial markets following signs of easing U.S.–China trade tensions. “That said, both Bitcoin and Ethereum have also rallied due to multiple acquisitions happening in the background, among which Coinbase’s $2.9 billion acquisition of the non-listed options trading platform Deribit marked a turning point in the pause in crypto sector M&A activity,” concludes the Julius Baer analyst.