Prioridades regulatorias y de supervisión de FINRA para 2017

| Por Fórmate a Fondo | 0 Comentarios

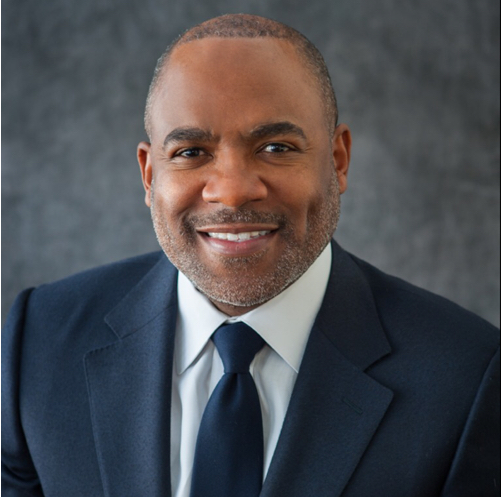

Cada año, FINRA publica su carta anual de prioridades regulatorias y de supervisión para resaltar los asuntos importantes para los programas reguladores de FINRA. En la carta de este año, Robert W. Cook, presidente y CEO de FINRA, proporciona información sobre las áreas que el regulador planea inspeccionar en su exámenes de supervisión de 2017 en base a la observación de los programas regulatorios, y las aportaciones de diversas partes interesadas, incluyendo firmas asociadas, otros reguladores y defensores de los inversores.

Robert W. Cook, dice: «Como verán, un hilo común a lo largo de la carta de prioridades es el enfoque en las cuestiones centrales de cumplimiento normativo, supervisión y gestión de riesgo. La mayoría de los temas abordados en la carta de este año se han destacado en años anteriores, pero las áreas específicas de énfasis se han actualizado o modificado en base a recientes observaciones y experiencias. Prestar atención a los requisitos normativos básicos identificados en la carta -y cómo abordarlos a la luz de los nuevos retos empresariales y la evolución del mercado- será útil para inversores y los mercados.

Sus continuos comentarios sobre aspectos existentes o emergentes que ponen los inversores y la integridad del mercado en riesgo es muy importante. Compartimos un objetivo común de promover la confianza de los inversores, y les pido que nos comunique cualquier área en la que crea que FINRA debería concentrar sus recursos regulatorios para proteger a los inversores y fortalecer la integridad del mercado.

Desde que me uní a FINRA en agosto, he estado comprometido en un viaje continuo de escucha, reuniéndome con firmas asociadas, reguladores y grupos de inversores, entre otros. Estoy agradecido por la información recibida y el tiempo que muchas personas me han dedicado. En los próximos meses, tengo previsto proporcionar más información sobre algunos pasos concretos que estamos planeando -basados en el viaje continuo de escucha, así como otras aportaciones- para examinar de nuevo ciertos aspectos de los programas y operaciones de FINRA y para identificar oportunidades de hacer nuestro trabajo más eficazmente. Mientras tanto, quiero compartir con ustedes dos modestos pasos más que ya estamos planeando dar.

En primer lugar, he escuchado frecuentemente de firmas asociadas y otros interlocutores que sería útil conocer lo que FINRA está viendo a través de sus programas de examen y supervisión. Se nos ha sugerido que la publicación de los resultados habituales de nuestros exámenes ayudaría a las empresas a estar informadas de las deficiencias que FINRA observa, incluyendo las áreas de prioridad, y permitiría corregir deficiencias similares a las empresas que aún no hayan sido examinadas. Estoy de acuerdo y, a partir de este año, publicaremos un informe resumido que resalte los hallazgos más importantes de los exámenes en ciertas áreas seleccionadas. Este documento alertará a las firmas sobre lo que estamos viendo con una perspectiva nacional y, por lo tanto, servirá como una herramienta adicional que las firmas podrán utilizar para fortalecer el contexto de control en su negocio.

Otra sugerencia que surgió de mis reuniones es que muchas pequeñas empresas quisieran que exploráramos cómo podemos proveer más, y quizás diferentes, herramientas y recursos de cumplimiento regulatorio para ayudarles a cumplir con los requisitos regulatorios aplicables. Ya he pedido a nuestro personal que desarrolle varios nuevos recursos en este sentido, y en 2017 introduciremos un «calendario de cumplimiento regulatorio» y un directorio de proveedores de servicios de cumplimiento normativo. Además, para reunir más información en esta área, recientemente enviamos una breve encuesta a pequeñas empresas que nos permitirá conocer qué herramientas y recursos de cumplimiento regulatorio encontrarían valiosos. Hemos recibido aportaciones muy útiles por parte de las empresas hasta ahora, pero todavía no es demasiado tarde para participar. Si es usted una firma pequeña y no ha completado la encuesta, por favor hágalo para ayudarnos a ayudarle mejor.

Un área de atención el próximo año será el reconocimiento del importante papel que juegan las pequeñas firmas -igual que las grandes empresas-, en facilitar la formación de capital a través de firmas pequeñas y emergentes, motores vitales de nuestra economía y de la creación de empleo. Buscaremos oportunidades para apoyar estas actividades, incluyendo la orientación cuando sea apropiado, para alentar modelos de negocios innovadores y la utilización de nuevas tecnologías en el espacio Fintech, consistente con el mantenimiento de una protección importante de los inversores.

Algunos me han preguntado cuándo terminará mi gira de escucha. La respuesta corta es: nunca. Como ya señalé anteriormente, en los próximos meses compartiré con ustedes algunos pasos adicionales que llevaremos a cabo, producto de mi gira de escucha, y estoy muy ilusionado con la buena marcha de estas iniciativas. Pero la escucha no terminará durante mi mandato. Espero que siempre se sienta libre de comunicarse directamente conmigo o con cualquier persona de nuestro equipo con sus ideas y sugerencias sobre cómo FINRA puede cumplir mejor su misión de protección de los inversores y de la integridad del mercado”.

Puede acceder a los documentos que siguen a la carta aqui.