Estamos transitando un período de gran incertidumbre. A nivel macro, los conflictos geopolíticos parecen escalar, los términos del comercio global están siendo redefinidos, y la situación fiscal de EE. UU. y otros países es cada vez menos sostenible.

Sin embargo, es muy posible que la situación del sector empresario, o la «micro», sea todavía más compleja. Este ritmo de innovación inédito que estamos viviendo es tremendamente disruptivo, y muchas industrias están evolucionando muy rápidamente, dejando atrás a aquellas empresas que no logren adaptarse.

En este contexto, incluso las empresas que lideraron la transformación digital de las últimas décadas por primera vez se encuentran con modelos de negocios vulnerables, requiriendo de inversiones récord para seguir innovando y evolucionando sus productos y tecnologías. De hecho, las inversiones de capital (o capex) llevadas a cabo durante 2024 por las «7 Magníficas» sumaron $239 billones de dólares, casi 4 veces más que 5 años atrás, y se estima que durante el 2025 crecerán otro 57% (a $333 billones de dólares). Nadie invierte estos montos porque quiere, sino porque (siente que) debe. Como dijo hace unas pocas semanas atrás el empresario Michael Dell, CEO de Dell Technologies, «el verdadero peligro es quedarse quieto».

Sin embargo, varias de estas empresas (y muchas otras similares) siguen cotizando a valuaciones récord – valuaciones que no reflejan la incertidumbre actual. Y lo que realmente complica esta situación es que muchos inversores, conscientes o no, están muy invertidos en estas empresas – y en muchos casos «sobre-invertidos» – por lo tanto corriendo riesgos preocupantes. Difícil saber las razones, pero posiblemente influenciados por la inercia de lo que «funcionó durante muchos año». En definitiva, todo esto ocurre en un momento donde, justamente, se requiere ser particularmente selectivo, prudente y disciplinado.

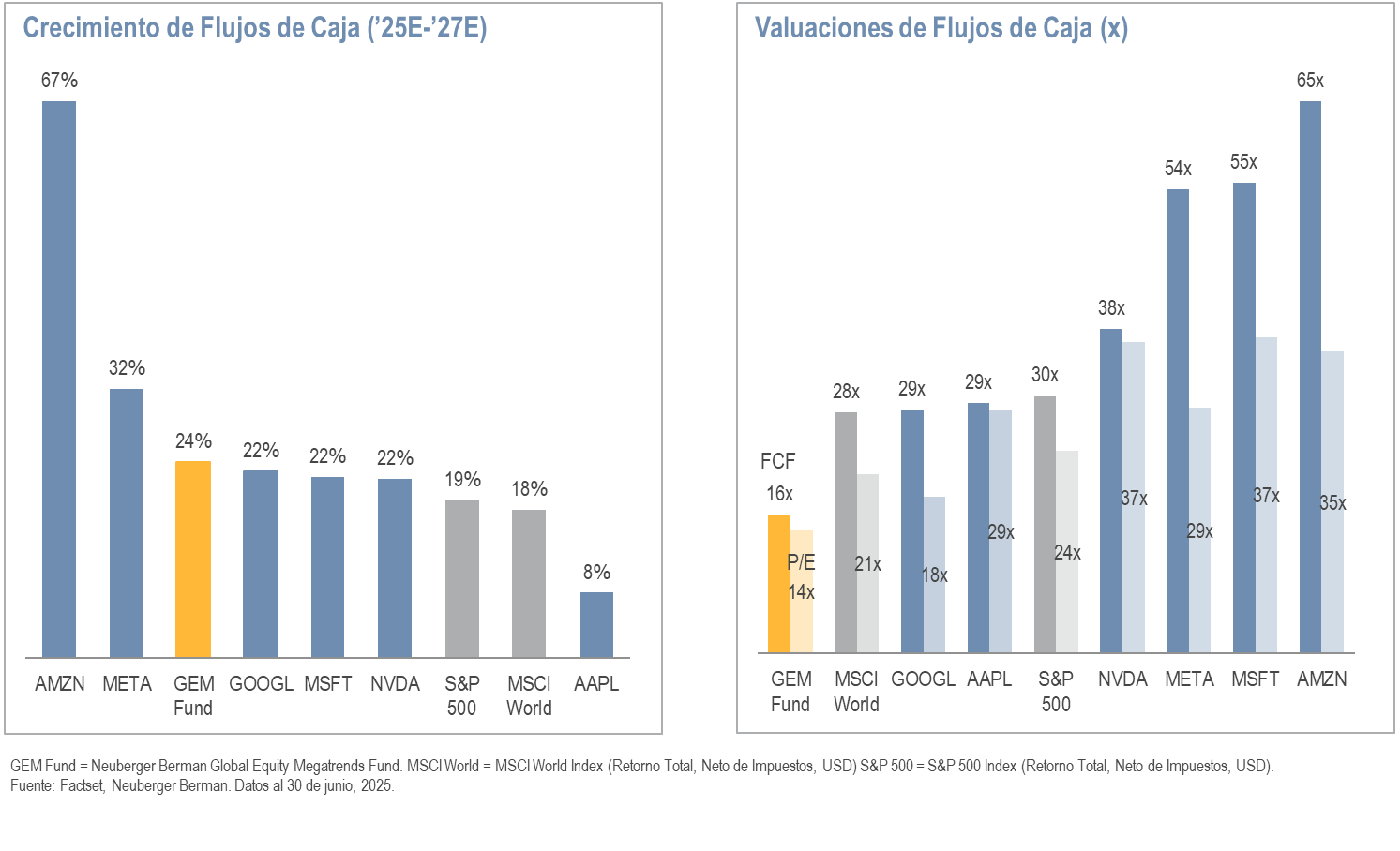

Afortunadamente, el portfolio de Neuberger Berman Global Equity Megatrends está diseñado para navegar este tipo de mercados: está invertido en muy pocas empresas seleccionadas cuidadosamente, todas con oportunidades de crecimiento muy previsibles, y cotizando a valuaciones muy razonables, lo que resulta en un perfil de riesgo-retorno atractivo – a pesar del contexto adverso. De hecho, el portfolio actualmente cotiza a 16x flujos de caja (o Free Cash Flow), un descuento muy significativo comparado con los típicos índices accionarios o las «7 Magníficas», lo que es particularmente atractivo considerando que las empresas del portfolio debieran crecer estos flujos al 24% (ver cuadro abajo) anualmente durante los próximos años, un crecimiento realmente envidiable.

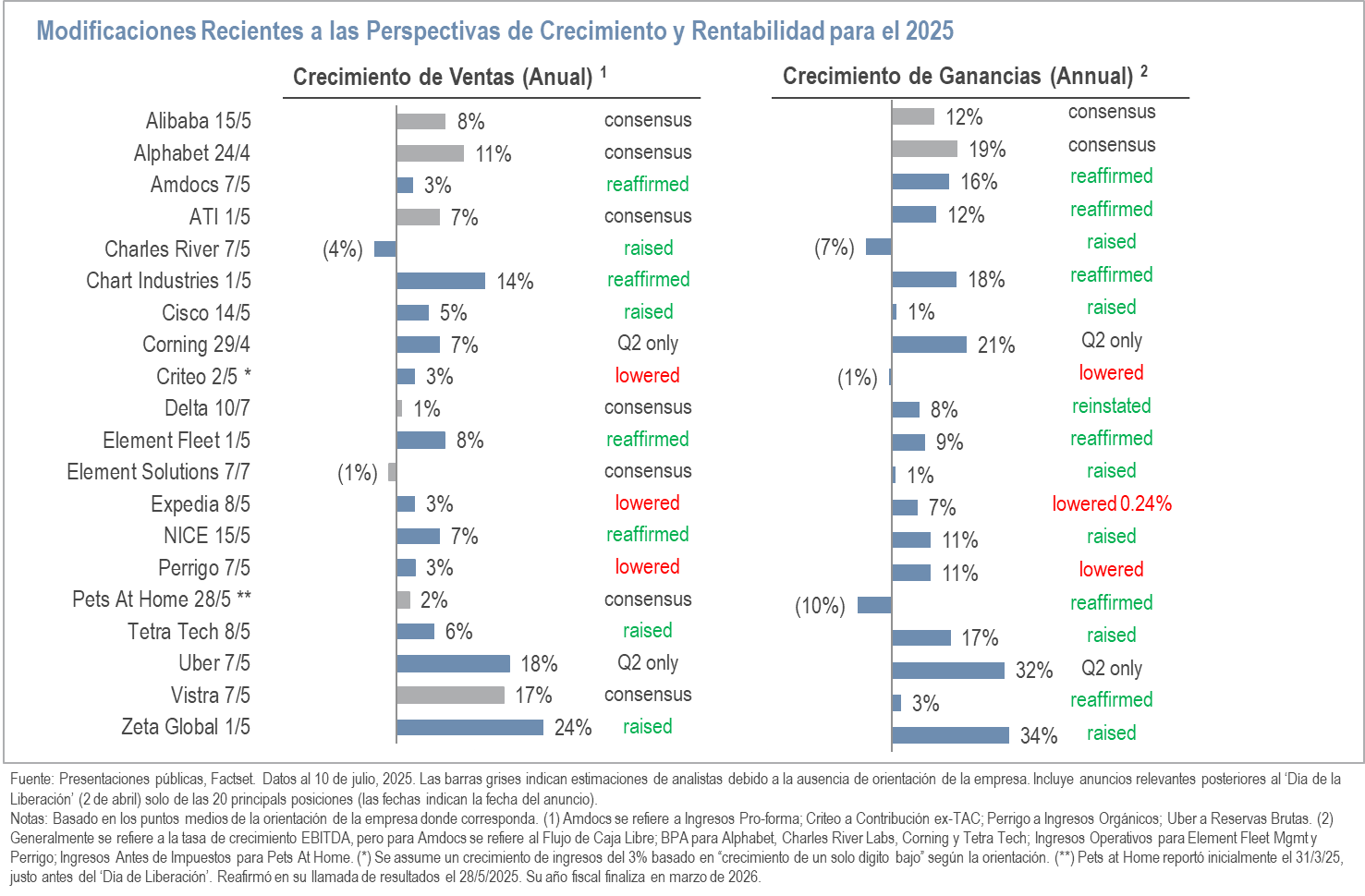

Además, desde la compañía indicaron que les entusiasma ver a las empresas del portfolio responder positivamente en el contexto actual. Desde principios de abril, cuando Trump anunció esta nueva guerra comercial, la mayoría de nuestras empresas reconfirmaron –o inclusive incrementaron– sus perspectivas de crecimiento y rentabilidad para este año (ver tabla debajo). Esto no debiera sorprender a los inversores: la estrategia de Neuberger Berman Global Equity Megatrends está diseñada para enfocarses en empresas con perspectivas de crecimiento más previsibles y menos sensibles a la «macro». Sin embargo, tranquiliza ver que esto es efectivamente así.

Desde 1991, ese enfoque «temático» los llevó a invertir en empresas protegidas por «megatendencias» (o «vientos de popa») que, por lo tanto, cuentan con perspectivas de crecimiento más previsibles. Por ejemplo, desde hace muchos años viene invirtiendo en «Infraestructura Energética«, es decir, en empresas que facilitan la transformación (necesaria) de los sistemas energéticos de los países más importantes del mundo.

Históricamente, invertir en el sector energético no ha sido demasiado interesante. La demanda de electricidad prácticamente no ha crecido en las últimas décadas: en EEUU creció solo 0.1% anualmente entre 2010 y 2020; en Europa ha caído desde su pico en el 2008. Sin embargo, ahora todo está cambiando, y muy rápidamente.

La digitalización de nuestras vidas no solo produce mayor consumo energético, sino que permitió un crecimiento explosivo en la cantidad de información digital, fundamental para el progreso de la Inteligencia Artificial, la cual requiere de una cantidad impresionante de electricidad. En un reporte reciente, la consultora McKinsey estima que en los próximos 5 años el consumo energético de «datacenters» en EEUU se triplicará a aproximadamente 90 giga watts (¡más de tres veces el consumo de toda la ciudad de Nueva York!). Esta demanda incremental requiere de mayor capacidad productiva e infraestructura, y de repente, este sector «aburrido» resulta muy atractivo.

Las empresas que participen de esta transformación energética tienen un futuro interesante, pero eso no garantizará un final feliz para quienes inviertan a valuaciones excesivas, o ignoren otros riesgos, incluyendo la inevitable volatilidad inherente. No alcanza con identificar empresas que disfruten de cualquier «viento de popa». Consideramos que es clave invertir en empresas con productos, servicios o tecnologías «únicas», posicionadas para beneficiarse del «viento de popa» que las protege. Además, preferimos asociarnos con líderes enfocados en mejoras operativas que resulten en mayores márgenes y crecimiento sostenido de ganancias. Finalmente, es muy importante invertir a valuaciones razonables porque esto protege el portfolio durante períodos difíciles: «¡No duele lo mismo caer desde el primer piso que desde el octavo!». «Estas son las practicas que desde 1991 nos han dado resultados muy satisfactorios», aseguró Maximilano Rohm, Co PM de Neuberger Berman Global Equity Megatrends.

Tribuna de Florencio Mas, CFA, y José Noguerol y Lucas Martins, CAIA, Managing Directors de Becon IM

Risk Considerations

Market Risk: The risk of a change in the value of a position as a result of underlying market factors, including among other things, the overall performance of companies and the market perception of the global economy.

Liquidity Risk: The risk that the fund may be unable to sell an investment readily at its fair market value. In extreme market conditions this can affect the fund’s ability to meet redemption requests upon demand.

Counterparty Risk: The risk that a counterparty will not fulfill its payment obligation for a trade, contract or other transaction, on the due date.

Operational Risk: The risk of direct or indirect loss resulting from inadequate or failed processes, people and systems including those relating to the safekeeping of assets or from external events.

Concentration Risk: The fund’s investments may be concentrated in a small number of investments and its performance may therefore be more variable than the performance of a more diversified fund.

Derivatives Risk: The fund is permitted to use certain types of financial derivative instruments (including certain complex instruments). This may increase the fund’s leverage significantly which may cause large variations in the value of your share. Investors should note that the fund may achieve its investment objective by investing principally in Financial Derivative Instruments (FDI). There are certain investment risks that apply in relation to the use of FDI. The fund’s use of FDI can involve significant risks of loss.

Currency Risk: Investors who subscribe in a currency other than the base currency of the fund are exposed to currency risk. Fluctuations in exchange rates may affect the return on investment. Where past performance is shown it is based on the share class to which this factsheet relates. If the currency of this share class is different from your local currency, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency.

For full information on these and other risks, please refer to the fund prospectus and offering documents, including the KID or KIID, as applicable.

Disclaimer

This document is addressed to professional clients/qualified investors only.

European Economic Area (EEA): This is a marketing document and is issued by Neuberger Berman Asset Management Ireland Limited, which is regulated by the Central Bank Ireland and is registered in Ireland, at 2 Central Plaza, Dame Street, Dublin, D02 T0X4.

United Kingdom and outside the EEA: This document is a financial promotion and is issued by Neuberger Berman Europe Limited, which is authorised and regulated by the Financial Conduct Authority and is registered in England and Wales, at The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ.

Neuberger Berman Europe Limited is also a registered investment adviser with the Securities and Exchange Commission in the US, and the Dubai branch is regulated by the Dubai Financial Services Authority in the Dubai International Financial Centre.

This fund is a sub-fund of Neuberger Berman Investment Funds PLC, authorised by the Central Bank of Ireland pursuant to the European Communities (Undertaking for Collective Investment in Transferable Securities) Regulations 2011, as amended. The information in this document does not constitute investment advice or an investment recommendation and is only a brief summary of certain key aspects of the fund. Investors should read the prospectus along with the relevant prospectus supplements and the key information document (KID) or key investor information document (KIID), as applicable which are available on our website: www.nb.com/europe/literature. Further risk information, investment objectives, fees and expenses and other important information about the fund can be found in the prospectus and prospectus supplements.

The KID may be obtained free of charge in Danish, Dutch, English, Finnish, French, German, Greek, Icelandic, Italian, Norwegian, Portuguese, Spanish and Swedish (depending on where the relevant sub-fund has been registered for marketing), and the prospectus and prospectus supplements may be obtained free of charge in English, French, German, Italian and Spanish, from www.nb.com/europe/literature, from local paying agents (a list of which can be found in Annex III of the prospectus), or by writing to Neuberger Berman Investment Funds plc, c/o Brown Brothers Harriman Fund Administration Service (Ireland) Ltd, 30 Herbert Street, Dublin 2, Ireland. In the United Kingdom the key investor information document (KIID) may be obtained free of charge in English at the same address or from Neuberger Berman Europe Limited at their registered address.

Neuberger Berman Asset Management Ireland Limited may decide to terminate the arrangements made for the marketing of its funds in all or a particular country.

A summary of the investors’ rights is available in English on: www.nb.com/europe/literature

For information on sustainability-related aspects pursuant to Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector please visit www.nb.com/europe/literature. When making the decision to invest in the fund, investors should take into account all the characteristics or objectives of the fund as described in the legal documents.

Notice to investors in the United Kingdom: Neuberger Berman Investment Funds plc is authorised and regulated in Ireland by the Central Bank of Ireland but is not authorised by the Financial Conduct Authority in the UK. The UK Financial Ombudsman Service (FOS) is unlikely to be able to consider complaints in relation to Neuberger Berman Investment Funds plc, its management company Neuberger Berman Asset Management Ireland Limited or its depositary Brown Brothers Harriman Trustee Services (Ireland) Limited. Any losses relating to the management company or depositary are unlikely to be covered by the UK Financial Services Compensation Scheme (FSCS). Prospective investors should consider getting financial advice before deciding to invest and should see Neuberger Berman Investment Funds plc’s prospectus for more information.

Notice to investors in Switzerland: This is an advertising document. Neuberger Berman Investment Funds plc is established in Ireland as an investment company with variable capital incorporated with limited liability under Irish law, and the sub-funds are also authorised by the Swiss Financial Market Supervisory Authority (FINMA) for offering and/or advertising to non-qualified investors in and from Switzerland. The Swiss representative and paying agent is BNP Paribas, Paris, Zurich Branch, Selnaustrasse 16, CH-8002 Zürich, Switzerland. The prospectus, the key investor information documents, the memorandum and articles of association and the annual and semi-annual reports are all available free of charge from the representative in Switzerland.

This document is presented solely for information purposes and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security.

We do not represent that this information, including any third-party information, is complete and it should not be relied upon as such.

No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of any investment, and should consult its own legal counsel and financial, actuarial, accounting, regulatory and tax advisers to evaluate any such investment.

It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. Investors may not get back the full amount invested.

Any views or opinions expressed may not reflect those of the firm as a whole.

All information is current as of the date of this material and is subject to change without notice.

The fund described in this document may only be offered for sale or sold in jurisdictions in which or to persons to which such an offer or sale is permitted. The fund can only be promoted if such promotion is made in compliance with the applicable jurisdictional rules and regulations. This document and the information contained therein may not be distributed in the US.

Indices are unmanaged and not available for direct investment.

An investment in the fund involves risks, with the potential for above average risk, and is only suitable for people who are in a position to take such risks. For more information please read the prospectus which can be found on our website at: www.nb.com/europe/literature.

Past performance is not a reliable indicator of current or future results. The value of investments may go down as well as up and investors may not get back any of the amount invested. The performance data does not take account of the commissions and costs incurred by investors when subscribing for or redeeming shares.

The value of investments designated in another currency may rise and fall due to exchange rate fluctuations in respect of the relevant currencies. Adverse movements in currency exchange rates can result in a decrease in return and a loss of capital.

Tax treatment depends on the individual circumstances of each investor and may be subject to change, investors are therefore recommended to seek independent tax advice.

Investment in the fund should not constitute a substantial proportion of an investor’s portfolio and may not be appropriate for all investors. Diversification and asset class allocation do not guarantee profit or protect against loss.

No part of this document may be reproduced in any manner without prior written permission of Neuberger Berman.

The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.

© 2025 Neuberger Berman Group LLC. All rights reserved. WF2455151