In a context of slowing global consumption, growing geopolitical tensions, and imminent trade disputes, High-Net-Worth Individuals (HNWIs) are adjusting their priorities, according to the new 2025 edition of Julius Baer’s Global Wealth and Lifestyle Report.

“Although data collection concluded before the U.S. announced its new tariffs, our findings still indicate a notable shift,” the report states. One of its main conclusions is that, for the first time since its launch, the report has recorded a 2% decrease, based on measurements in U.S. dollars—a surprising development in a segment that has traditionally outpaced average consumer price growth. “While services declined slightly by 0.2%, goods prices dropped by a significant average of 3.4%,” it clarifies.

As Christian Gattiker, Head of Research at Julius Baer, explains, “In light of current events and the uncertainty brought on by trade tensions and tariff escalations, our findings emerged before the truce declared by the Trump administration expires, so next year’s edition of the Wealth and Lifestyle Report will certainly offer relevant and fascinating data from a retrospective viewpoint.”

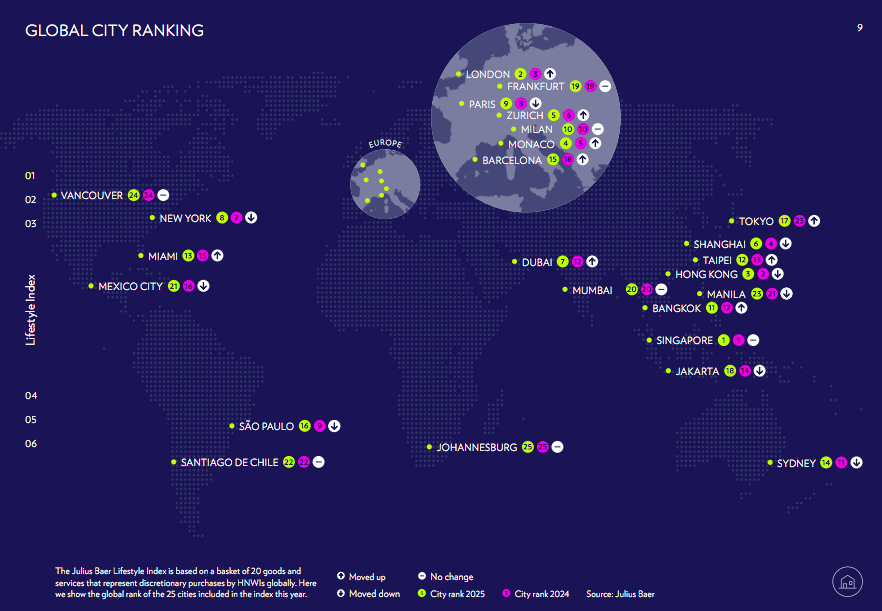

One of the report’s findings is that the city rankings remain highly competitive. In this regard, Singapore maintains its position as the most expensive city for HNWIs worldwide, followed by London, which rises to second place. Hong Kong rounds out the top three. However, significant movement is observed elsewhere, with Bangkok and Tokyo each climbing six places, and Dubai continuing its upward trajectory.

The EMEA Region

Focusing on the EMEA region (Europe, the Middle East, and Africa), its cities once again stand out, now representing more than half of the global top 10. London leads the region, rising to second place globally, while Monaco and Zurich each move up one position to fourth and fifth place, respectively. Dubai has climbed five spots to seventh, solidifying its position as a serious contender among traditional wealth hubs. Milan and Frankfurt maintained their positions, while Paris dropped slightly in the ranking. Johannesburg remains at the bottom despite some price increases.

“Price developments in EMEA have been moderate overall, with local currency prices stable or even falling in cities like Zurich. The most notable price increase in the region occurred in Paris, where higher travel and accommodation costs led to a 5% year-over-year rise. Private education costs in London also soared, driven by recent legislative changes,” the report explains.

Other Geographic Regions

The report’s authors note with interest that Singapore remains the most expensive city in the world, underlining the ongoing importance of Asia-Pacific. The region recorded only slight price decreases, averaging 1%, making it the most stable of all regions this year. In terms of rankings, Bangkok and Tokyo saw the greatest progress, each climbing six positions to 11th and 17th place, respectively. In contrast, Shanghai dropped from fourth to sixth place.

In Asia-Pacific, spending on goods remains high, though consumer preferences continue to evolve. Notably, technology prices dropped sharply (by 21.4%), while business class airfares increased by 12.6%. The growing wealth of the Asia-Pacific HNWI population, along with rising interest in health, wellness, and experiences, continues to shape spending patterns across the region.

In the Americas, New York remains the highest-ranked city in the region (eighth globally). Miami moved up two spots to 13th, while São Paulo and Mexico City dropped in the rankings.

Price Trends

Another conclusion from the report is that while average prices of goods in U.S. dollars fell in the Americas, the region recorded some of the largest increases in business class flights (+39.3%) and hotel suites (+17.5%). These increases have significantly raised the cost of travel and hospitality, now 41% higher than the global average. Notably, local currency price increases were much steeper in Latin America, with Mexico City and Santiago experiencing rises of up to 16% and 15%, respectively.

In this sense, the 2025 Index reflects diverging trends across categories. The steepest global price drop was seen in technology (-22.6%), driven by falling prices on items like MacBooks. Conversely, business class flights saw the most significant price hike (+18.2%), fueled by changes in airline business models, limited aircraft supply, and sustained demand for premium travel. The cost of private education also rose considerably (+5.1%), especially in London following the British government’s VAT change on private school tuition. Watches experienced a 5.6% increase, reflecting continued demand for exceptional, high-quality models.