U.S.: RIAs Experience Record Pace of M&A in the First Half of 2025

| By Amaya Uriarte | 0 Comentarios

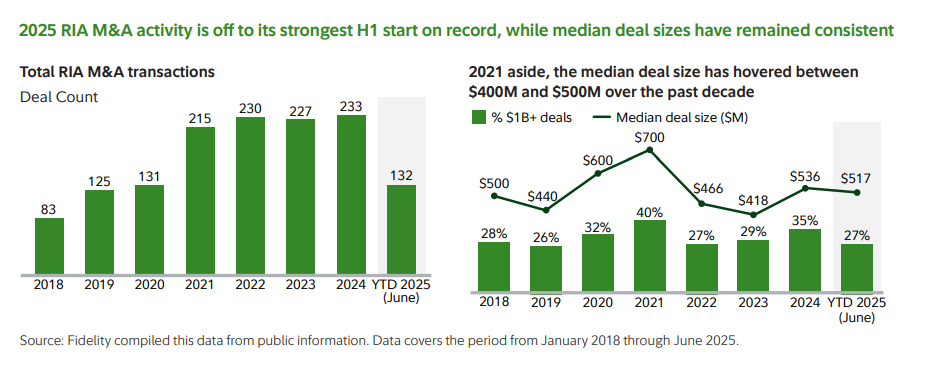

The RIA industry is undergoing an unprecedented stage of consolidation in the United States, according to the latest M&A report from Fidelity Investments. In the first half of 2025, 132 purchase-sale transactions were carried out in the sector, totaling $182.7 billion in assets, representing a year-over-year increase of 25%. This made the period the strongest start to the year since the firm began tracking merger and acquisition activity in 2015. In all of 2024, there were 233 transactions.

More specifically, the second quarter recorded 61 transactions totaling $88 billion in acquired assets, including April 2025, which was the strongest April on record in terms of transaction volume, with 26 transactions. This followed the strongest January and March recorded to date, with 36 and 23 transactions, respectively.

The rebound was marked by record activity in January, March, and April, underscoring the intensity of the momentum in transactions. And private capital remained the dominant force, accounting for 86% of the transactions and 91% of the assets acquired. “PE has set its sights on the wealth management sector, in addition to its investments in vertical sectors such as energy, healthcare, and real estate,” the report states.

In its conclusions, Fidelity affirms that the pace of M&A will continue in the future. “Buyer demand remains exceptionally strong”; the market is not constrained by a lack of capital or interest, but rather by supply: “We don’t see a line of sellers wrapping around the block, but rather buyers lining up. The ceiling appears to be defined by the number of business owners looking to sell their firms,” the report concludes.

Three Key Trends of the Semester

The report indicates that during the period, the median transaction size remained stable over comparable time frames.

In 2023, Fidelity removed the $30 billion cap in its reports to include large-scale mergers (mega-mergers). However, deals under $1 billion still represent around 70% of total volume. In the first half of 2025, the median transaction was $517 million, within the historical range of $400 to $600 million. This reflects a growing appetite for all firms, both large and small, according to the firm.

On the other hand, the first half of 2025 marked the strongest pace recorded, driven by market fundamentals. According to Fidelity’s report, “despite macroeconomic volatility (tariffs, geopolitical tensions), the fundamental reasons for M&A in wealth management — such as advisor aging, lack of generational replacement, and the growth potential of RIAs — remained strong. The trend points to a resilient M&A market, with buyer and capital sponsor confidence intact.”

Another point highlighted in the report is that M&A transactions are becoming increasingly “strategic and structured. A decade ago, mergers were scattered; later, the near-zero cost of capital created a FOMO (fear of missing out) environment. Today, strategic buyers have dedicated teams, structured and intentional processes. In addition, private equity has shifted from being a passive investor to playing an active role in firms’ strategic vision and growth.”

According to Fidelity, in the financial services sector, private capital is expanding its targets beyond RIAs and helping firms acquire adjacent and complementary practices, such as turnkey asset management programs (TAMPs), wealth tech companies, and asset managers.