AI in 2026: Major Investments, Real Growth, and Healthy Corrections

| By Marta Rodriguez | 0 Comentarios

The recent correction in the tech sector reflects more of an adjustment than a structural break in the AI investment cycle. In this sense, investment firms have no doubt: artificial intelligence will continue to be one of the most important drivers of technology and the economy this year. According to Nicolas Bickel of Edmond de Rothschild, major cloud companies and OpenAI are making historic investments in AI infrastructure, more than $1.6 trillion between 2025 and 2028. “These investments are already yielding results: AI is improving cloud services, e-commerce, and digital advertising, and many software companies that have adapted to AI are seeing growing interest in their products,” he notes.

However, as AI becomes more tangible, market corrections have also arrived. Although the S&P 500 had only dropped 3% from its highs as of Thursday’s close, the situation feels much worse. “That 3% loss is a combination of much steeper declines this year in areas that had attracted most assets, such as bitcoin (-49%), software giants (-25%), and the Magnificent 7 (-6%). Meanwhile, the shares of the other 493 companies have risen between 1% and 6% since the market lows in November, which is even more reassuring. We consider the current tech correction to be healthy, though not yet complete,” explains the Federated Hermes equities team.

A Healthy Correction

Although some experts compare the current situation to the year 2000, many argue that today’s conditions are significantly different: listed companies driving the current capex boom often have strong cash flows and the financial flexibility to invest, even if some of that spending ends up being misallocated. One such voice is Fabiana Fedeli, CIO of Equities, Multi-Asset and Sustainability at M&G Investments, who acknowledges that concerns about increased capex and software companies overpromising on AI-driven revenue are valid, but believes we are not at a turning point. In her view, this is more of a reset, as markets reassess their expectations.

“The speed of market movements has increased, amplifying volatility and contributing to the magnitude of the recent purge. These adjustments are now broader and faster than in previous cycles, and investors will need to sharpen their ability to distinguish noise from truly meaningful signals,” she adds.

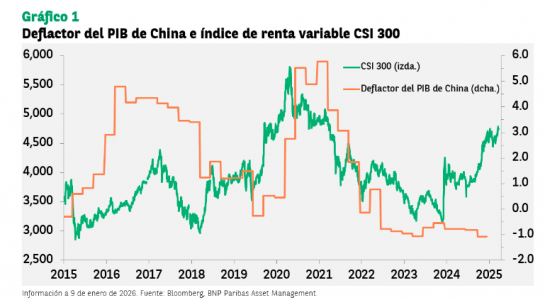

For Fedeli, this is not the end of the AI bet, but rather an expansion of the opportunity set beyond the narrow group of large U.S. tech companies that have captured investor attention. “The race for AI is global, and while we still believe that some of the ‘enablers’ of AI, the hardware makers building the supporting infrastructure, still hold potential, we increasingly see opportunities among AI beneficiaries: companies across sectors like consumer, media, financials, materials, and industrials that are deploying AI to reduce costs, increase revenues, and optimize customer acquisition. Moreover, AI investment is global, and we must look beyond the U.S. market. That said, the current relative weakness of U.S. tech will offer active investors new opportunities, as broad-based innovation continues to show structural strength. This is a recalibration, not a trend reversal, and the main beneficiaries of the AI investment boom may not be the capex spenders, but those best positioned to leverage it,” says the M&G expert.

Meanwhile, Federated Hermes analysts expect the market shift toward smaller-cap and value stocks to likely continue for some time. One reason supporting this “healthy correction” view relates to the evolution of AI itself. For example, they explain that hyperscalers are beginning to move away from the “asset-light” model that once made them so attractive: high incremental margins, modest capital intensity, and extraordinary free cash flow generation. That landscape is changing quickly.

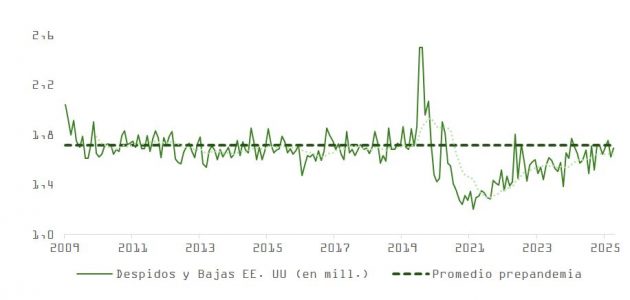

“In addition, the software sector faces a mix of serious issues that are underappreciated. First, many companies are still absorbing excess licenses sold during the remote work surge of the pandemic. Renewal cycles remain focused on optimization and downsizing, not expansion. Second, AI is threatening the traditional license-based model. And also, the market is broadening as companies outside the tech realm, which had previously led the market, are now improving,” they add.

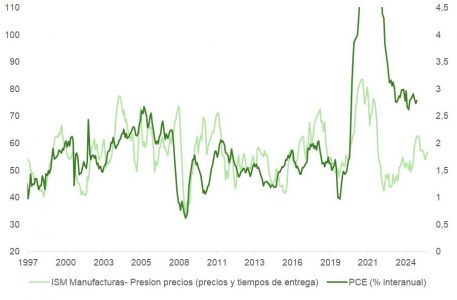

Finally, Thomas Hempell of Generali AM acknowledges that the market can be volatile due to the concentration of investments in tech companies and their high valuations. But unlike the dot-com bubble of the 1990s, today’s growth is supported by real earnings. AI has enormous potential to transform businesses and boost productivity, even in an economic environment that remains favorable.

Outlook for This Year

These recent adjustments do not undermine the case for investing in AI. According to Paddy Flood of Schroders, the benefits of AI are not always immediately visible. Many companies are using it to make their services more efficient, from virtual assistants to personalized recommendations, without users paying for it directly. “Even if it’s not always seen, AI is already generating economic value throughout the tech chain,” says Flood.

Joe Davis, of Vanguard, notes that AI investment is still in its early stages, much like the early days of the internet or electricity. The next phase will depend on so-called “AI scalers”, companies with the resources to ramp up computing power, data storage, and large-scale AI models. These investments will drive not only technology itself but also related sectors such as semiconductors, data centers, and energy. This marks the beginning of a long-term transformation in the economy.

According to Johnathan Owen, portfolio manager at TwentyFour AM, after a year of AI hype, markets are starting to show discipline. The massive issuance of AI-linked bonds, which could reach between $1 and $3 trillion in the coming years, raises concerns about whether investors can absorb so much supply in such a short period. While demand remains strong, the timing and volume of these issuances could slow price growth and increase credit risks. Owen recommends focusing on essential assets like data centers and infrastructure, carefully evaluating debt levels and risks, as returns may take time to materialize.

Lastly, Mark Munro and Anthony Merola of Aberdeen point out that tech giants are increasingly turning to public bond markets to finance AI expansion, moving away from relying solely on cash flow or private capital. In just the past three months, Meta, Alphabet, Amazon, and Oracle have issued billions of dollars in bonds. They compare the current pace of investment to the internet boom of the 1990s. According to them, the need for funding will continue to grow, driven by costly data centers and rising energy demand. For investors, this means tactical opportunities in short-term, high-quality bonds, while long-term funds will need flexibility to take advantage of major upcoming issuances.