The electoral aftermath continues following Donald Trump’s victory and the Republicans’ success in the US elections last week. There is much to analyze regarding the impact of this new administration and which legislative initiatives from his entire electoral program will be implemented. One of the main focuses is what his proposed tariffs and aggressive trade policy toward China, and consequently for investors, will entail.

According to MFS Investment Management, US presidents generally have significant discretion over trade policy. However, during his campaign, Trump proposed imposing reciprocal tariffs on US imports, equivalent to the tariffs other countries impose on US exports. Specifically, he proposed a universal basic tariff of 10%-20% on all US imports and a 60% tariff on imports from China. Additionally, he suggested applying tariffs to certain automobile imports from Mexico.

From T. Rowe Price, they believe that the tariff increase is likely to be part of the budget debate. “Putting aside the specific figures, these statements indicate that Trump is likely to take an aggressive stance on trade policy that would extend beyond China. This approach could set the stage for obtaining concessions from other countries, whether on trade or to advance other political objectives, such as pressuring European allies to increase defense spending. However, unilateral tariff actions would likely provoke retaliation from affected countries,” said Gil Fortgang, Washington Associate Analyst, U.S. Equity Division at T. Rowe Price Investment Management.

“It is likely that a Trump administration would be negative for emerging market equities (EM). The possibility of widespread tariff enforcement on imports to the US, with a particularly significant increase in tariffs on China, is the most notable risk for emerging markets. Tariffs would likely cause weakness in the currencies of exposed countries, especially due to the potential depreciation of the renminbi. Moreover, the imposition of high tariffs could trigger a more significant political response from China to defend its growth,” added Tom Wilson, Head of Emerging Market Equities at Schroders.

In the opinion of James Cook, Head of Investment Specialists – Emerging Markets at Federated Hermes Limited, the announcement of new tariffs on China is likely to be a negotiating position from the Trump administration in search of an agreement to moderate the trade deficit with China. “Given China’s significant under-consumption compared to global standards, we believe an agreement is possible. Domestic demand could absorb a much larger portion of China’s productive capacity than currently, so the terms of the agreement could include rebalancing China’s economy toward consumption and some restructuring of the supply side. This may not be bad for China in the long run,” he explained.

From Allianz GI, they believe that if tariffs on imports are approved, they could trigger retaliation from other countries, increasing the risk of a trade war that could lead the US into a recession. “We foresee an increase in the relocation of companies to diversify their supply chains, which could pressure their balances. The increase in tariffs could negatively impact European and emerging market stocks, particularly those dependent on the US market, such as luxury goods manufacturers, automobile companies, aerospace firms, and steelmakers. On the other hand, more defensive sectors, such as oil, finance, and potentially infrastructure, could benefit from this situation. In this context, active management will be crucial to identify the winners and losers,” they noted.

The Ball in China’s Court

According to Gilles Moëc, Chief Economist at AXA IM, the 10% tariff on European products is likely manageable, but the 60% tariff on Chinese products could be very disruptive, either by reducing Chinese demand, triggering a massive devaluation of the yuan, and/or encouraging Chinese producers to compete more aggressively with European suppliers outside the US market. However, for Moëc, China still has its own tasks to complete: “While awaiting more concrete measures, we are struck by how the market is reacting positively to the noises around a significant increase in debt issuance by the central government. In fact, in the current configuration of China, greater debt issuance is not necessarily a reflection, or a promise, of higher fiscal stimulus. If a significant fraction of this additional debt is simply used to back a swap with real estate-related debt currently on the local authorities’ balance sheets, the impact of the activity will depend on how much this swap could boost sentiment in China, and secondly, incentivize local authorities to be more active in ordinary spending – i.e., non-real estate related. Given the relatively strong financial position of the central and local governments, a swap would likely be positive for financial stability, but for now, we remain cautious in our judgment on overall fiscal stimulus in China.”

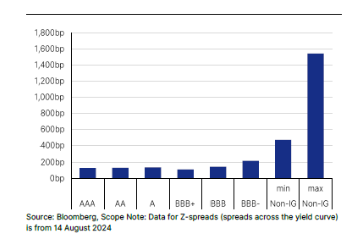

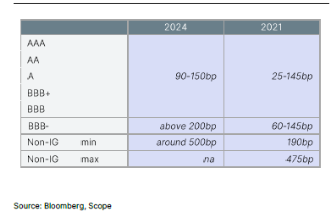

This view is also shared by Caroline Lamy, Head of Equities at Crédit Mutuel Asset Management: “His trade war with China may continue to pressure imports, but China is likely to react. The market will wait for these announcements.” Experts at Scope Rating believe that these tariffs also increase the probability of trade conflicts and could lead to an increase in credit spreads, especially in emerging markets.

Returning to the assumption that the US ends up imposing the 60% tariff, Fabiana Fedeli, CIO of Equities, Multi-Assets, and Sustainability at M&G, believes that “Chinese companies are much better prepared for tariffs than during the last Trump administration, as many have moved their manufacturing facilities and final markets outside the US. Following the National People’s Congress, the market expects an announcement regarding the size of a stimulus package. We suspect that Trump’s victory will trigger a large package from the Chinese authorities.”

“If no agreement is reached and 60% tariffs are imposed, we expect China to react with fiscal and monetary stimulus and a devaluation of its currency. China’s response will have global implications, and we believe all parties will try to avoid this outcome. However, even in the worst-case scenario, this turmoil could serve as a catalyst for a fundamental reform of the Chinese economy, which could have positive and far-reaching results in the long term. We must remain attentive to these possible rays of hope,” says Cook.

On the other hand, Sandy Pei, Senior Portfolio Manager of the Asia ex Japan Fund at Federated Hermes, agrees that China is focused on doing whatever it takes to restart its economy. However, the manager acknowledges, “Trump’s victory could lead to greater stimulus and a quicker response. We haven’t seen a dramatic market reaction, with investors taking their time to digest the news. Obviously, this isn’t the first time US tariffs have been a potential problem, and this time, Chinese companies are more prepared. We have seen many diversify their production base by setting up plants in Southeast Asia, Mexico, and Eastern Europe. Chinese exports have continued to grow. While they have slowed to the US, they have increased in other regions of the world, and high-value-added products continue to perform well in international markets.”

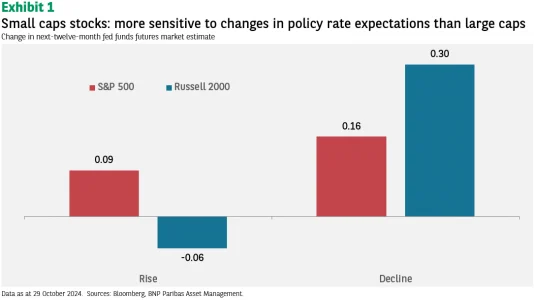

Foreign Policy

According to the analysis of the asset managers, the tariffs on China are just one example of the impact Trump could have on China and the Asian region. According to Wilson, looking further ahead, what matters is that the trade tariffs and other policies of the Trump administration could be inflationary for the US. “The expected result would be a stronger dollar, higher inflation, less monetary easing by the Fed, and a higher US yield curve. Overall, none of this helps the profitability of emerging market equities, puts pressure on currencies, and limits the actions of central banks,” the Schroders expert emphasized.

Additionally, he points out that another issue is US foreign policy and how isolationist the US could be under a Trump presidency. According to Wilson, this could raise risk premiums in certain markets. “In Asia, we wouldn’t expect US commitment to Taiwan to change notably, given Taiwan’s importance to US interests in the technology supply chain. However, it is important that the relationship with China is managed carefully to avoid exacerbating the risk. It may happen that a Trump administration pushes for a faster resolution of the conflict in Ukraine. This could have positive or negative outcomes (reconstruction of Ukraine vs. concerns that the agreement reached may not last long). One likely effect would be a continued increase in European defense spending,” he adds.

After Trump’s victory, the market reaction in emerging countries was swift. As Wilson summarizes, “China showed weakness, and India showed strength, while Asian markets sensitive to the Federal Reserve showed weakness. This aligns with expectations. India is less exposed than other emerging markets to the impact of Trump’s policies, so it could adopt a defensive stance in the short term. In China, the market now has more solid political backing. Despite trade uncertainty, we remain cautious about deviating from our current neutral stance, given the potential for greater political stimulus and supportive positioning.”

In the opinion of Allianz GI, a more aggressive stance toward China is expected, as well as a possible confrontation with Iran and tensions in the Middle East. “On the other hand, Trump could try to reach an agreement with Putin to end the war in Ukraine, which could lower commodity prices as Russia returns to the markets. However, Europe would be forced to increase its military spending, raising its debt and limiting other productive spending. We also expect more tensions with some European countries, with potential increases in import taxes that could weigh on European growth,” the asset manager notes.

Emerging Engines

There is no doubt that trade and foreign policies will impact emerging markets. However, and following the argument that China is more prepared for this impact, some asset managers believe that this reflection is not only applicable to China, but to other emerging markets as well. “Despite short-term negative sentiment, we do not expect Trump’s second term to alter the structural growth engines of emerging markets. Many countries have pivoted toward internal consumption, increasing investment in infrastructure, and the penetration of digitalization is helping drive greater efficiency and productivity gains. Moreover, emerging economies control significant portions of critical resources, and many remain leaders in the supply chains of critical technology with no credible alternatives in developed markets. Most emerging economies benefit from favorable demographics, providing an abundant supply of cheap labor, thus avoiding the wage spiral faced by many developed markets,” said Cook.

According to Cook, the fundamentals of emerging markets are solid, and China is signaling more significant support for the domestic economy, addressing issues in the real estate sector. “Economic vulnerability is low, structural growth engines are intact, equity markets are undervalued, and valuations show a significant discount compared to developed markets. Most emerging economies have not significantly cut interest rates, and some have even started to raise them, continuing with the history of monetary policy prudence in these economies,” he noted.

Finally, the expert considers that, although macroeconomic factors will dominate market movements and trigger episodes of volatility, “We continue to prioritize value and growth, along with valuations that offer a margin of safety. We focus on companies with strong balance sheets that benefit from structural growth factors that we expect to persist despite the changing US political landscape. Fundamentally, our portfolio is geographically diversified, while expressing stronger conviction in technology, specific industrials, Internet, telecommunications, healthcare, and online finance and insurance to benefit from higher rates in the long term,” he concludes.