Risk Assets and Emerging Markets: Two Key Ideas from Amundi for 2025

| By Amaya Uriarte | 0 Comentarios

Amundi summarizes its vision for 2025 with the phrase “Rays of light amid anomalies.” According to the asset manager, political and geopolitical developments are creating an increasingly fragmented world, but the global reordering is also generating new investment opportunities. Amundi projects more modest global growth, at 3.0% in 2025 and 2026, with the growth differential between emerging and developed markets expected to stabilize at 3.9% for emerging markets and 1.6% for developed economies.

Amundi’s base scenario predicts a slight slowdown in the U.S. economy, moving toward a soft landing, with modest growth of 1.9% and 2.0% in 2025 and 2026. This reflects a cooling labor market and slower consumption. A gradual recovery in Europe is expected, where growth potential should rise modestly, supported by lower inflation and monetary easing. Asia remains a key driver of global growth, with India leading the way and China focusing on economic stabilization and structural transformation.

Amundi anticipates that the confirmation of a disinflation process will encourage more accommodative monetary policies. By the end of 2025, interest rates are expected to reach 3.5% in the U.S., 2.25% in the Eurozone, and 3.5% in the U.K. In contrast, the Bank of Japan may implement two more rate hikes, while emerging market central banks will likely pursue gradual monetary policy easing.

Vincent Mortier, Group Chief Investment Officer at Amundi, highlighted the need to balance inflation risks while capitalizing on opportunities in risk assets. “Expanding equity exposure beyond large-cap U.S. stocks, seeking returns in both liquid and illiquid assets, and employing hedges in a fragmented world will be key in 2025.”

Monica Defend, Head of the Amundi Investment Institute, emphasized that in a world of anomalies, identifying opportunities created by political decisions and geopolitical shifts will be as important as protecting against the risks they bring.

De la Morena pointed out that in an environment characterized by economic and financial anomalies, strategic diversification and dynamic portfolio management are more crucial than ever. Investment opportunities arise both in resilient sectors and those leading global structural transformations, such as technology (especially artificial intelligence), energy transition, and demographic trends.

An Unconventional End of Cycle

Amundi’s outlook for the U.S. points to a scenario of soft landing, with a slight deceleration to slower growth rates of 1.9% and 2.0% in 2025 and 2026, as the labor market cools and consumption slows. The magnitude and timing of policy implementations will affect growth and inflation prospects, potentially influencing the Federal Reserve’s response and financing conditions. Amundi expects the new administration to prioritize tariff and immigration policies, followed by tax cuts and other budgetary measures.

Europe is preparing for a modest recovery toward potential growth, underpinned by lower inflation and monetary easing to support investments and channel savings into demand. The Eurozone’s largest economies will show mixed results, with fiscal policies becoming a significant differentiating factor. In the long term, Europe must address productivity restoration, potentially under pressure from a Trump administration to enhance cooperation on defense.

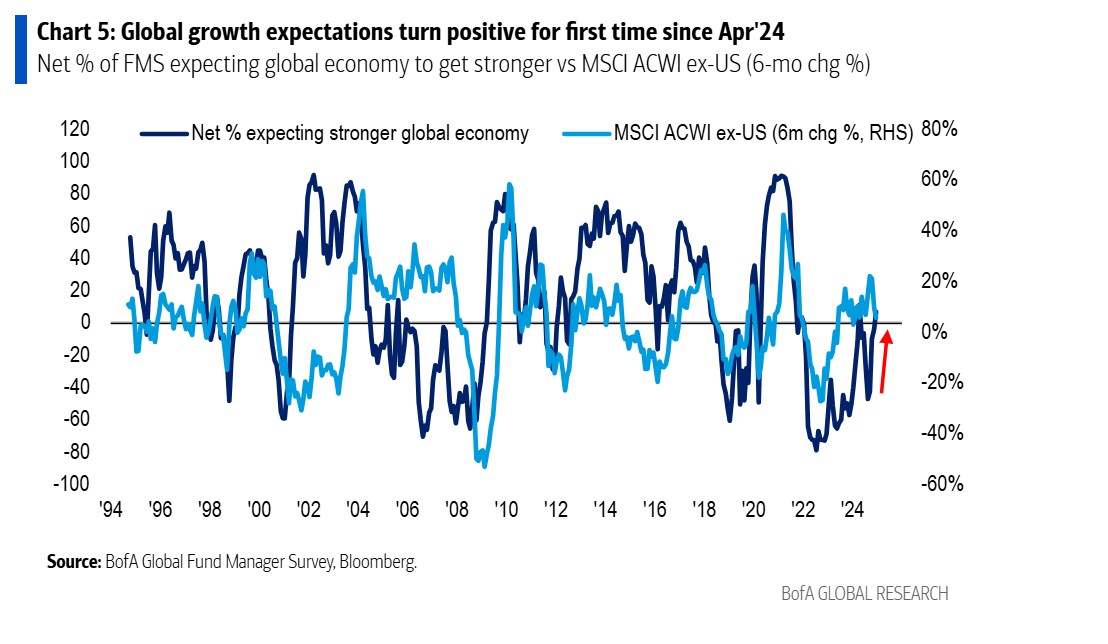

In emerging markets, Asia will remain a key driver of global growth in 2025. Relatively benign inflation prospects support more favorable policies in the region. Emerging Asia is already focusing on strategic objectives, demonstrating robust growth while strengthening regional ties and resilience. India is expected to be a major growth driver, while China will likely encourage economic stabilization and structural transformation.

Downside risks to Amundi’s central scenario could stem from a potential re-acceleration of inflation due to escalating trade tensions. Upside risks include reduced geopolitical tensions as major conflicts ease and accelerated structural reforms that translate into greater growth potential.

Amundi describes this unconventional end of cycle as a mix of economic and financial anomalies. Resilient economies, abundant macroeconomic liquidity, eased financial conditions, and disinflation coexist with elevated political uncertainty. At the same time, equity markets show high concentration, expensive valuations, and low volatility, contrasting with high volatility in fixed income markets.

Investment Ideas

In this environment, Amundi’s stance for 2025 is slightly risk-positive, balanced with assets resilient to inflation. Diversification on multiple fronts is essential, as potential policy changes can easily alter the investment framework. Current anomalies demand frequent reassessment and dynamic adjustments, with a particular focus on risk assets in the first half of the year. To identify the best opportunities, investors should explore sectors benefiting from long-term transformative themes, including demographic trends, geopolitical and industrial changes, the effects of climate change, technological innovation, and the cost of the energy transition.

Despite anticipated volatility, the low likelihood of recession, combined with greater central bank moderation, favors credit markets overall, given higher yields than in the past and strong credit fundamentals. Fixed income is likely to gain traction, with attractive income opportunities in government bonds, investment-grade credit, short-term high-yield bonds, leveraged loans, emerging market bonds, and private debt. European governments also provide diversification opportunities as inflation slows.

In equities, there is potential for the rally to extend beyond U.S. megacaps and adjusted valuations, given earnings and liquidity outlooks. Amundi favors a globally diversified approach, seeking pockets of value in U.S. equal-weighted indices, Japan, and Europe. Sector preferences include financials, utilities, communication services, and consumer discretionary. Value investing and mid-cap companies offer good hedges against potential declines in growth stocks and large-cap equities.

Amundi also sees opportunities in emerging market bonds, which are expected to benefit from a favorable macroeconomic backdrop and declining interest rates. In hard currencies, high-yield bonds are preferred over investment-grade ones, while in local currencies, the focus is on those offering attractive real yields. Within emerging Asia, India and Indonesia present the best long-term options and are more insulated from potential tariff increases.

Finally, challenges justify a more nuanced diversification strategy, seeking opportunities across volatility (hedge funds and absolute return strategies), liquidity (private markets), and macro/geopolitics (gold and inflation-linked bonds). Infrastructure and private debt combine robust growth prospects, inflation protection, and diversification benefits. In equities, dividend-paying stocks tend to be more resilient to inflation.