Oil Oversupply May Offset Uncertainty Around Iran and Venezuela

| By Marta Rodriguez | 0 Comentarios

The geopolitical risk premium on oil is likely to remain limited due to the oversupply in the global market, despite increased oil price volatility, according to Fitch Ratings.

Any potential supply disruption in Iran can be absorbed by an oversupplied market. OPEC’s future strategic stance, volume versus value, will be key in shaping the oil market.

“Our Brent oil price estimate for 2026 is $63/bbl, while our ratings for oil and gas companies focus on credit metrics based on our mid-cycle price of $60/bbl,” the agency’s note states.

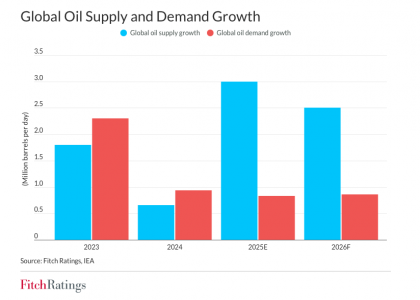

The global oil market will remain oversupplied in 2026. Fitch estimates a supply increase of 3 million barrels per day (MMbpd) in 2025, and forecasts an additional increase of 2.5 MMbpd in 2026, while demand is expected to grow by only about 0.8 MMbpd annually.

Oil production from non-OPEC+ countries accounts for 55% and 48% of these increases, respectively, driven by the United States, Canada, Brazil, Guyana, and Argentina, according to the International Energy Agency. Fitch expects some moderation in non-OPEC+ production growth in 2027.

U.S. oil producers need a WTI price between $61 and $70 per barrel to drill a new well profitably, according to the Dallas Federal Reserve Energy Survey.

Data on Venezuela’s Production

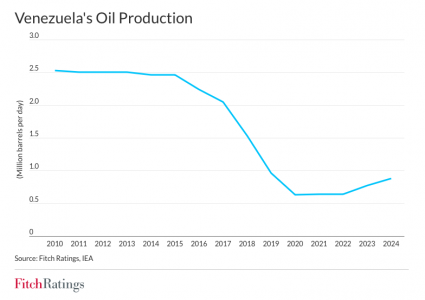

Venezuela holds 17% of global proven reserves, the largest oil resource base in the world, but accounted for just 0.8% of global crude output in November 2025. Venezuelan oil production has declined sharply over the past 15 years, from 2.5 million barrels per day (bpd) in 2010 to 0.88 million bpd in 2024, due to sanctions and lack of investment. Output hovered around 1 million bpd between September and October 2025, but fell to 0.86 million bpd in November 2025 amid renewed sanctions and tensions with the United States. Oil exports dropped to 0.67 million bpd.

The sale of stored crude in Venezuela, both floating and onshore, and the lifting of sanctions could temporarily boost oil production to around 1 million bpd. However, this is unlikely to have a significant impact on the global market.

Venezuela Faces Structural Challenges to Boost Oil Output

Venezuela will face significant challenges in raising production by 1 to 1.5 million barrels per day (MMbpd), which could allow a long-term return to its 2010 output level of 2.5 million bpd. Achieving this would require substantial investment to modernize the country’s deteriorated infrastructure. Most of Venezuela’s reserves are extra-heavy/sour crude, the production of which demands advanced technical expertise typically provided by major international oil companies. Renewed investment from U.S. and other foreign oil firms would depend on a reliable regulatory framework and fiscal stability in the sector, especially given the expropriation of U.S. oil company assets in 2007.

Iran and Russia’s Position in the Global Market

Iran remains a significantly larger oil supplier globally, with production at 3.5 million bpd and exports of approximately 2 million bpd. Iranian crude supply has remained relatively stable despite tighter U.S. sanctions (in its November sanctions, the Office of Foreign Assets Control targeted a network of Iranian trading and shipping companies). Major disruptions to Iranian oil production would push prices higher, although the overall impact would likely be limited due to the current global supply surplus.

Russia’s oil production remains virtually unchanged at 9.3 million bpd under sanctions, with most exports redirected to China and India. Recently imposed U.S. and U.K. sanctions on Russian oil companies Lukoil and Rosneft could reduce Russian oil exports, as these producers account for around 50% of total exports. Conversely, a peace agreement between Russia and Ukraine and the lifting of sanctions would likely have a limited short-term impact on Russian volumes but could increase price volatility in an already oversupplied market.

OPEC+ spare capacity, estimated at 4 million bpd, will support the market in the event of supply disruptions. OPEC’s strategy and its balance between price support and market share retention will remain a key factor for the oil market, particularly in the face of potential disruptions or rising supply from non-OPEC countries.