China in the Face of Expectations for the Year of the Horse

| By Marta Rodriguez | 0 Comentarios

China begins the Lunar Cycle with the arrival of the Year of the Horse. In its culture, this animal is associated with dynamism, drive, and movement, three concepts that very well define the vision that international investment firms have of the Asian giant. Its starting point for this new year comes after having managed to close 2025 with 5% growth, although it shows some weakness in its domestic demand.

Its economic policy aims to sustain without unleashing excesses, while attempting to reorient toward consumption and technology/clean energy sectors. In addition, this year the 15th Five-Year Plan will also be launched, an essential roadmap that sets out the policies and direction of the country’s next stage of development. According to Fidelity International, “with greater clarity in strategic priorities, investors can expect more attention to be paid to execution, as policies translate into tangible actions in key sectors over the coming months.”

According to the asset manager’s view, although controlled stabilization remains the working hypothesis for China’s macroeconomic environment, the initial signs of supportive policies for domestic demand increase the probability that reflation will prevail in 2026. “An important aspect is that the risk of a severe slowdown appears limited, as the external environment remains generally favorable, and the real estate sector is showing new signs of stabilization. Deflationary pressures are expected to persist in the short term, as a lasting recovery in domestic consumption has yet to take hold. For now, we believe that the main driver of real growth continues to be supply,” they explain in their latest report.

Fiscal Policy, Monetary Policy, and Currency

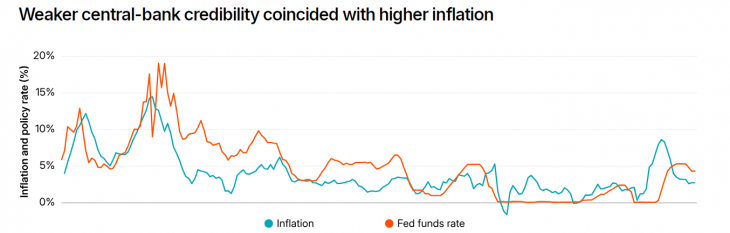

In the opinion of Norman Villamin, chief strategist at UBP, China could surprise to the upside thanks to greater fiscal stimulus. “In addition, the progressive internationalization of the renminbi is emerging as a relevant structural element, reinforcing its role in trade and global financial flows. If the 2026 rate cut is added to this environment, the market would have an additional tailwind, in a context of more flexible monetary and fiscal policy, comparable (though not identical) to the period following the pandemic,” explains Villamin.

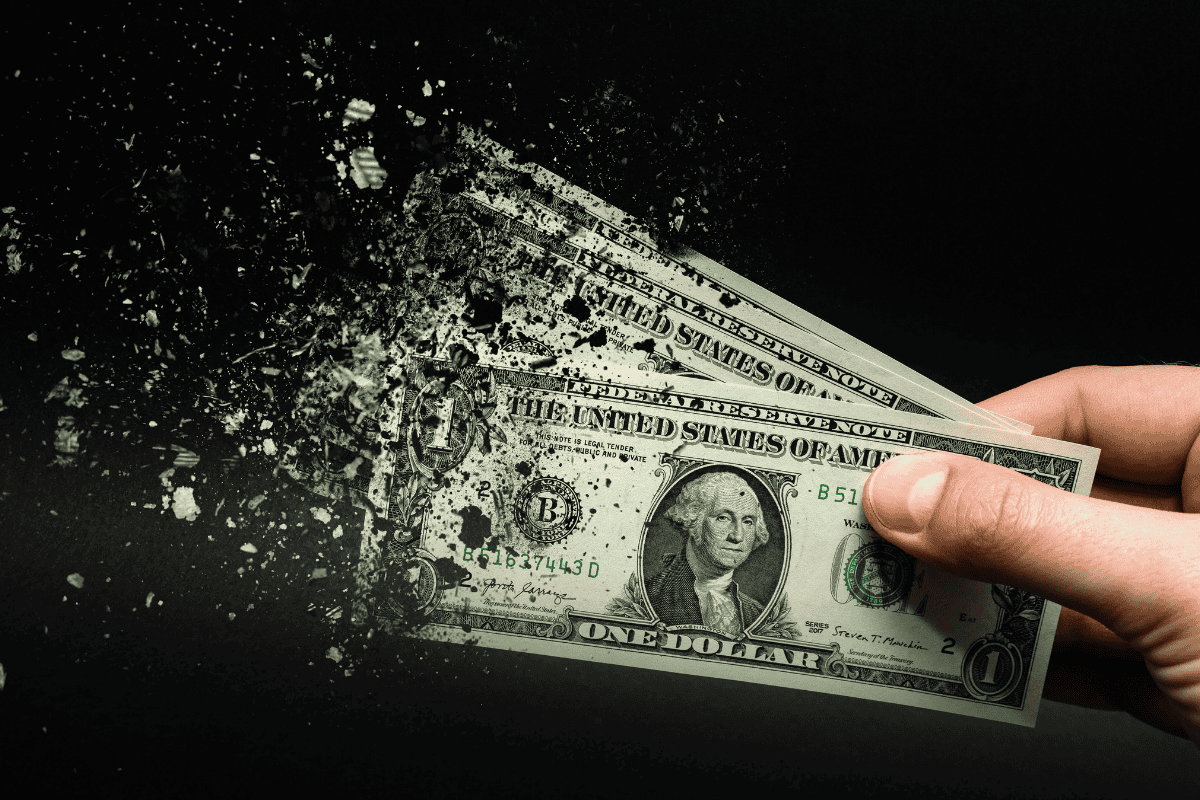

His view is that the country could benefit from two combined factors: greater dynamism in China’s trade and structural weakness of the dollar. “This dollar trend, together with inflation divergence, more contained in China and more persistent in the U.S., supports the appreciation of the CNY (Chinese yuan). Within this universe, emerging debt offers attractive opportunities, especially in countries integrated into China’s economic orbit. However, the central axis goes beyond the economic cycle. Global competition is no longer limited to the commercial or political sphere, but is shifting toward control of strategic resources. Beyond the AI narrative, the true investment driver will be the physical assets that make it possible: metals, energy, and infrastructure,” adds the UBP expert.

The Trade Issue

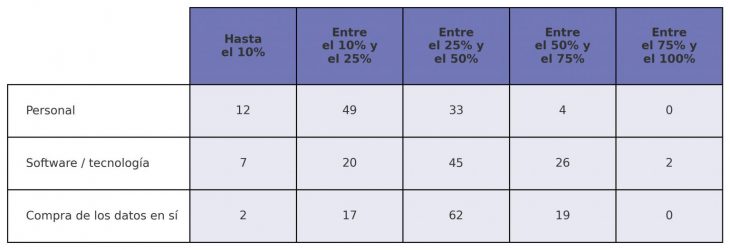

The country’s reality is that, despite rising tariffs and the uncertainty generated by the Liberation Day shock, the composition of Chinese growth is increasingly tilting toward trade. In fact, the share of net trade in GDP growth rose to nearly 33%. In addition, a greater proportion of growth was attributable to consumption, which contrasts with weak retail sales, as spending on services came to the rescue.

“In 2025, for the second consecutive year, the net trade balance was the main engine of growth, helping to offset the lower contribution of investment to GDP. While companies cut prices to support exports, household spending on services was the forgotten hero. Increased government transfers have provided a small offset, but wage and salary growth and substantial savings largely explain spending,” says Robert Gilhooly, senior economist specializing in emerging markets at Aberdeen Investments.

Indeed, growth in disposable income continues to outpace nominal GDP growth, thanks to increased government transfers and despite the sharp moderation in real estate income. The strength of equity markets may also be helping to lift sentiment, although household exposure to equities remains low.

As Gilhooly points out, the record trade surplus of $1.2 trillion has made the People’s Bank of China (PBOC) more comfortable with a stronger currency. “However, in addition to doubts about the rest of the world’s tolerance for further expansion of China’s share in global trade, there is a risk that this could trigger deflation, especially while excess capacity persists. Accepting a stronger currency could boost foreign investor enthusiasm for Chinese assets. It remains to be seen whether the continued fall in housing prices and lower-yield term deposits will encourage households to reallocate their investments toward the stock market,” adds the Aberdeen Investments expert.

Chinese Equities

For investors, Chinese equities remain an attractive asset. The MSCI China index rose 31.4% in 2025, outperforming both the U.S. stock market and developed markets. Innovation-driven themes, especially technology and AI, fueled this rebound following the announcement of the DeepSeek AI model at the beginning of 2025. The positive momentum continued, reflected in the IPOs of Chinese AI and technology companies in Hong Kong at the end of 2025, which attracted strong investor interest.

According to Isaac Thong, senior investment director for Asian equities at Aberdeen Investments, now that China’s economic growth is stabilizing at a long-term rate of 5%, companies are shifting their priorities and seeking a better balance between increasing profits and distributing them to shareholders. “This has been supported by government initiatives on corporate governance, which have encouraged higher payouts. Many companies have begun to pay higher dividends, opening up new opportunities for income funds,” notes Thong.

Significantly, according to LSEG data, total cash dividends from the country’s 2,000 mid- and large-cap companies reached a record 3.4 trillion yuan ($468.84 billion) in 2023. This figure increased by 1.2% in 2024 and could grow another 8.6% in 2025. As a result, dividends have become a more important component of shareholder returns, and these initiatives have also helped improve the overall quality of Chinese companies. “We believe companies have the capacity to pay higher dividends, which could attract more innovative Chinese companies into the universe of income-seeking investors. In this way, the opportunities before us continue to expand steadily,” highlights this Aberdeen Investments expert.

Finally, Fidelity emphasizes that growth-oriented sectors will drive the stock market. “As we move into the Year of the Horse, the Chinese market is beginning to show investors renewed dynamism. Liquidity conditions and capital flows remain favorable, both in the domestic A-share market and in China’s external markets, at a time when authorities continue to push a moderate policy agenda focused on supporting consumption, housing market stability, and structural reforms,” argues Stuart Rumble, Head of Investment Directing for Asia-Pacific at Fidelity International.

For Rumble, technology and innovation continue to present attractive opportunities, but with a view beyond AI and closer to robotics, autonomous driving, future mobility, and advanced manufacturing. “Alongside this, structural reforms, such as capital market liberalization, supply-side modernization, anti-involution measures, and policies to support private enterprise are helping to create a healthier, more innovation-friendly investment environment. These reforms are increasing efficiency in capital allocation and encouraging innovation-driven growth across various sectors,” concludes Rumble.