Three decades after the opening of its first office in the region, Franklin Templeton commemorates its 30th anniversary in South America, emphasizing that this milestone represents, more than a goal achieved, a solid foundation to accelerate its next stage of growth. This is how Sergio Guerrien, Director & Country Manager South America of the asset manager, described it when he sat down with Funds Society in Buenos Aires to discuss the evolution of the business and, above all, the new map of opportunities the company offers to investors in the region.

“It’s been 30 truly interesting years with many challenges,” summarized Guerrien, an Argentine national, who is also celebrating three decades at the company, where he began years ago in a junior position. The executive expressed being “more excited than ever” about what lies ahead for Franklin in the region.

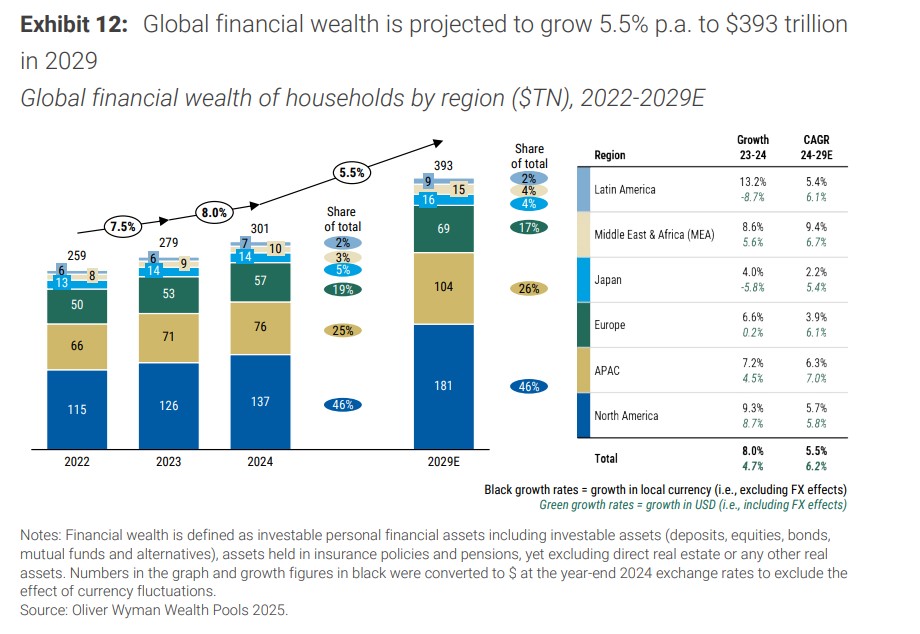

“In the last century, the mutual fund vehicle was neither well known nor widely recognized. Today, 30 years later, it’s part of any client’s investment portfolio. That discussion is no longer relevant,” he explained. “Moreover, in these past decades,” he added, “new, more sophisticated investment vehicles have been introduced, and today the industry in South America has expanded significantly across all countries in the region. These are all new markets that have become part of the international investment landscape.”

From Nascent Market to Diversified Regional Industry

Franklin Templeton landed in South America in 1995 with the opening of its office in Buenos Aires, at a time when the local market was booming and distribution structures were still in their early stages. Over time, its expansion accompanied the development of other key hubs, particularly in the Andean region.

“Later, with the development of markets such as Chile, Peru, and Colombia, we decided to open offices in those countries and in Montevideo,” Guerrien detailed. The strategy responded to a reality that now defines South America: markets with distinctly different DNA, requiring tailored value propositions.

“The Andean region has a strong institutional and pension presence, whereas the Río de la Plata area is more focused on the wealth segment. That led us to create segmented offerings depending on the market,” noted the executive, while highlighting one cross-cutting capability: the ability to serve both retail and institutional clients across the region. “I believe that’s unique in South America,” he stated, “being able to effectively serve both markets with a globally recognized brand.”

A “New Franklin Templeton” With Global Scale

The regional transformation is inseparable from the group’s global evolution. Guerrien emphasized that since 2020, Franklin Templeton has entered a phase of accelerated growth through acquisitions that expanded its global investment platform.

The acquisition of Legg Mason was one of the most relevant and transformative moves, integrating multiple teams and strategies into the parent company. Since then, the asset manager has strengthened its positioning in private markets through acquisitions of specialists in various asset classes, including private credit (Benefit Street Partners), real estate (Clarion Partners), and private equity, particularly in the secondary segment (Lexington Partners).

“Today, we are managing around 270 billion dollars in private markets,” Guerrien highlighted, noting that this scale places Franklin Templeton among the largest global players in the alternative universe. The thesis behind this growth is clear: there are opportunities not represented in public indices that require a more sophisticated approach.

“Democratized” Private Markets and New Doors for Retail

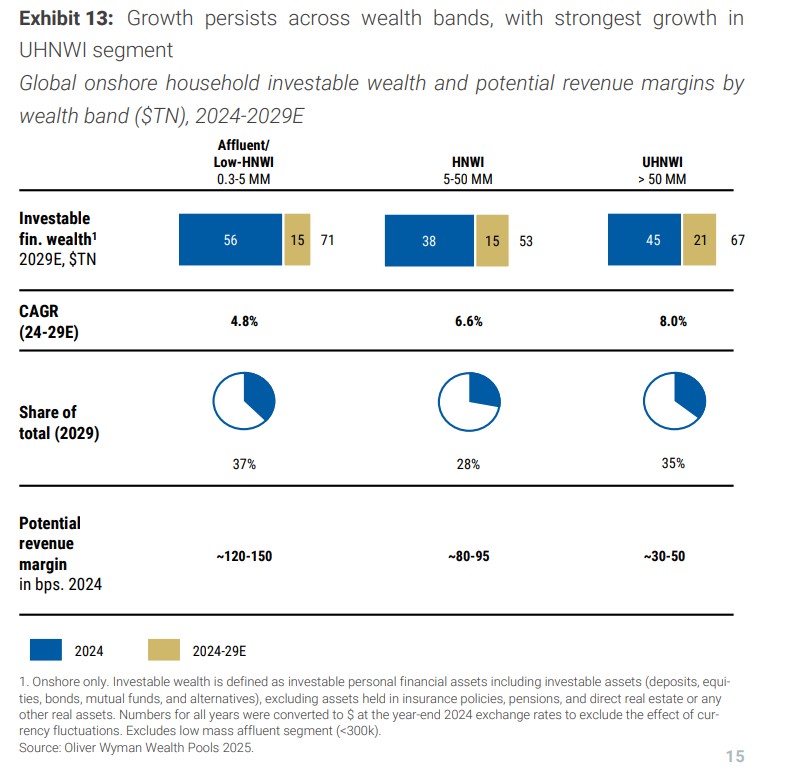

One of the most disruptive changes, according to Guerrien, is the opening of the private world to a broader public. Historically reserved for high-net-worth investors, the alternative universe is moving toward greater accessibility through structures designed for the wealth segment.

“With the democratization of private markets, evergreen funds with quarterly liquidity began to emerge,” he explained. In practice, this allows retail investors to access private credit, real estate, or private equity with lower minimums and a more flexible dynamic.

Adoption of these solutions is not uniform. “Andean markets, such as Peru and Colombia, are adopting them more quickly due to their institutional history; in Argentina and Uruguay, the process is progressing more slowly,” he described.

Regarding the debate over bubble risk or liquidity in alternatives, Guerrien distinguished between subsegments. He acknowledged that private credit appears more “crowded” with tighter spreads, but sees opportunities in other niches. “We’re seeing the opportunity more in asset-backed lending, a large and less crowded market,” he affirmed. The executive also highlighted the current potential of secondary private equity, where attractive valuations are observed.

Guerrien anticipated that Franklin will soon offer investment opportunities in the fourth pillar of private markets: infrastructure, following a recently signed agreement with Actis (Sustainable Infrastructure business of General Atlantic), Copenhagen Infrastructure Partners (CIP), and DigitalBridge, to offer private infrastructure solutions to individual investors.

ETFs: A Second Wave Coexisting With Traditional Funds

Although Guerrien acknowledges the growth of the ETF industry in developed markets, he argued that this is not direct competition with mutual funds but rather a coexistence of tools with different functions. In this regard, Franklin Templeton has built a proprietary ETF platform that has already achieved global scale.

“We have an ETF platform that currently manages around 50 billion dollars,” he stated. Guerrien presented this platform as a strategic step in the group’s modernization and diversification process.

Digital Innovation, Tokenization, and Bitcoin Under Regulation

Another important strategic area is innovation related to digital assets and blockchain. Guerrien highlighted that the group has been a digital innovation leader since the 1960s, launching pioneering products, and that this same culture now manifests in tokenization and the development of vehicles tied to cryptoassets.

One concrete example is the launch of a tokenized money market fund under regulation, an initiative that opened the door for the asset manager in the world of digital investing. “What’s important is that we always do it within a strict regulatory framework. That gives investors peace of mind,” he emphasized.

A Global Trend: Fewer Providers, More Partnerships

Looking ahead, Guerrien identified a trend that is reshaping the industry: global distribution platforms are reducing the number of asset managers they work with. The reasons are operational, regulatory, and cost-related.

“There are so many funds and managers that for large distributors it’s extremely expensive to handle compliance and monitoring for all of them. So they’re narrowing their list and prioritizing firms that offer all capabilities on a single platform,” he explained. In that scenario, Franklin Templeton believes it has a distinctive advantage: a comprehensive investment and service platform that spans public and private markets, ETFs, and digital innovation, all supported by unified global infrastructure.

Financial Education as the Fourth Pillar

The fourth pillar the firm aims to strengthen is education. Guerrien described a training ecosystem that includes programs for financial advisors, macro and geopolitical analysis publications, and academic partnerships with international universities.

“We believe that to achieve the best results, our partners and investors must have strong financial education,” he maintained. The asset manager offers training modules, periodic research, and programs in collaboration with academic institutions such as Singularity University, Oxford, and IE University.

Looking Ahead: The Anniversary as a Springboard

After three decades of trajectory, Guerrien set aside nostalgia and focused on the future. He emphasized that Franklin Templeton is evolving toward a higher phase, with more available resources to meet the growing demands of an increasingly competitive and concentrated industry.

“Today I find myself with a new, renewed Franklin Templeton. I’ve never been as excited as I am now about what we can offer investors,” he expressed. “We are very well positioned to offer unique investment solutions,” he concluded. Indeed, this 30th anniversary, far from marking the end of a cycle, signals the beginning of a new chapter.