Why Will Equities Be One of the Major Stars of the Second Half of the Year?

| By Amaya Uriarte | 0 Comentarios

The presentation of the semi-annual outlook by international asset managers has highlighted three common ideas: the impact of monetary policy decisions by major central banks, the increase in geopolitical risks, and the importance of being invested in both traditional and alternative assets. In this context, the main risk for investors is staying out of the market, given the numerous sources of uncertainty and volatility on the horizon for the next six months.

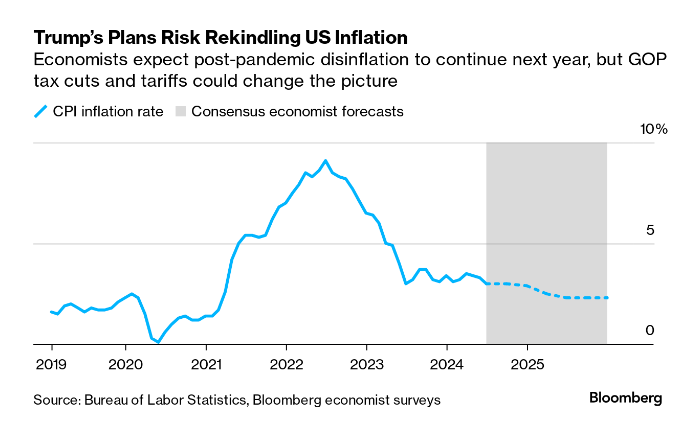

According to the managers’ projections, global growth expectations are set at 3.1% in 2024 and 3% in 2025. Inflation is expected to normalize in 2024, allowing central banks to continue cutting rates, although not all at the same time. In this regard, a renewed spike in inflation after the U.S. elections is a risk that investors should watch.

Benjamin Melman, Global CIO of Edmond de Rothschild AM, notes that a year ago, the economy presented many uncertainties, as disinflation remained tepid and there were fears of a recession in the United States. However, political difficulties were relatively contained at that time. Since then, the issues have reversed. “While the economic environment now seems quite promising, it is overshadowed by political problems. The only constant has been the continuous deterioration of the geopolitical environment. This means that there could be some volatility triggered by political turmoil in France or the potential return of Trump to the White House. The good news is that markets can sometimes overreact to political crises, which can create some attractive opportunities,” Melman states.

Taking this into account, the CIO of Edmond de Rothschild AM suggests that “considering the returns recorded so far this year and the strength of the global economy, it makes sense to remain well exposed to equities.”

Opportunities in Equities

“The economic context supports profits and risk assets, but most of the upside potential is already priced in by the markets, and it will be challenging to find clear catalysts for new gains. To navigate this uncertain transition to the next phase of the cycle, we favor high-quality equities, along with a positive bias in duration and commodities to protect against inflationary risks,” adds Vincent Mortier, Group CIO of Amundi.

When discussing specific opportunities, Melman notes that within equity markets, “while the main geographical decisions (U.S. versus Europe) will largely be determined by the aforementioned political issues, the investment teams prefer Big Data and Healthcare, as well as European small caps, which are trading at very attractive valuations considering the more favorable economic environment and the monetary easing that has already begun.”

Mortier expands on his idea of high-quality equities: “Avoid concentration risks and focus on quality and valuation.” He adds that opportunities abound in U.S. quality and value stocks and global equities. “Also consider European small caps that could capitalize on the economic cycle recovery, with attractive valuations. In terms of sectors, our position is balanced between defensives and cyclicals at the lower end of the range. We are more positive on financials, communication services, industrials, and healthcare,” states Mortier.

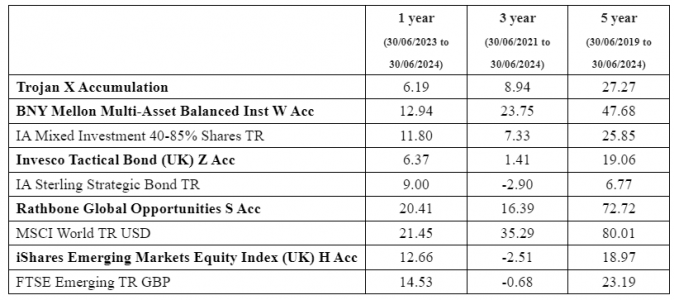

He also believes that emerging market equities offer interesting opportunities and relatively attractive valuations compared to the U.S. “We favor Latin America and Asia, highlighting India for its robust growth and transformation trajectory,” he adds.

Ronald Temple, Chief Market Strategist at Lazard, expects to see a broadening of the equity market rally driven by better earnings growth outside the technology sector. “This broadening does not mean that tech and AI stocks will stop performing. However, it is likely that the gap between tech leaders and the rest of the market will narrow, or even reverse, as investors realize that the rest of the market has largely stagnated for more than two years and now offers more attractive return potential,” he argues.

Temple also notes that non-U.S. markets are trading at much less demanding valuation multiples and are expected to benefit from accelerated growth while the U.S. market slows down. “Additionally, non-U.S. companies are often more exposed to variable-rate debt, which should benefit them as the ECB and other central banks ease monetary policy before the Fed, and they could also experience a more significant recovery in revenues and profits from current levels,” he concludes.

Ashish Shah, Chief Investment Officer, Public Investing at Goldman Sachs Asset Management, estimates that in equity markets, stronger business models have demonstrated margin resilience, with recent earnings seasons in the United States exceeding expectations. Performance has expanded beyond the so-called Magnificent Seven.

“The second half of 2024 may present opportunities for investors to broaden their horizons beyond the largest names, with U.S. small-cap companies poised to rebound, offering attractive absolute and relative valuations. Small-cap companies can provide access to greater growth potential from future mid- and large-cap leaders. Certainty around rate cuts should provide additional tailwinds,” Shah points out.

Regarding Europe, he adds that “the improved growth and inflation mix in Europe, combined with better corporate earnings dynamics and modest valuations, bodes well for continental European equities.” In the Japanese equity market, he sees great opportunities as structural changes are driving good performance after decades of deflation.