Last Major Corporate Deal in the Asset Management Industry Before the End of 2025

Janus Henderson Group plc, Trian Fund Management, L.P. and its affiliated funds (Trian), and General Catalyst Group Management, LLC and its affiliated funds (General Catalyst) have announced that they have entered into a definitive agreement under which Janus Henderson will be acquired by Trian and General Catalyst in an all-cash transaction, with an equity valuation of approximately $7.4 billion. The investor group includes, among others, the strategic investors Qatar Investment Authority and Sun Hung Kai & Co. Limited.

Under the terms of the agreement, shareholders who do not already own or control shares through Trian will receive $49.00 per share in cash, representing an 18% premium over Janus Henderson’s unaffected closing share price on October 24, 2025, the last trading day before the initial proposal from Trian and General Catalyst was made public.

The Key Players

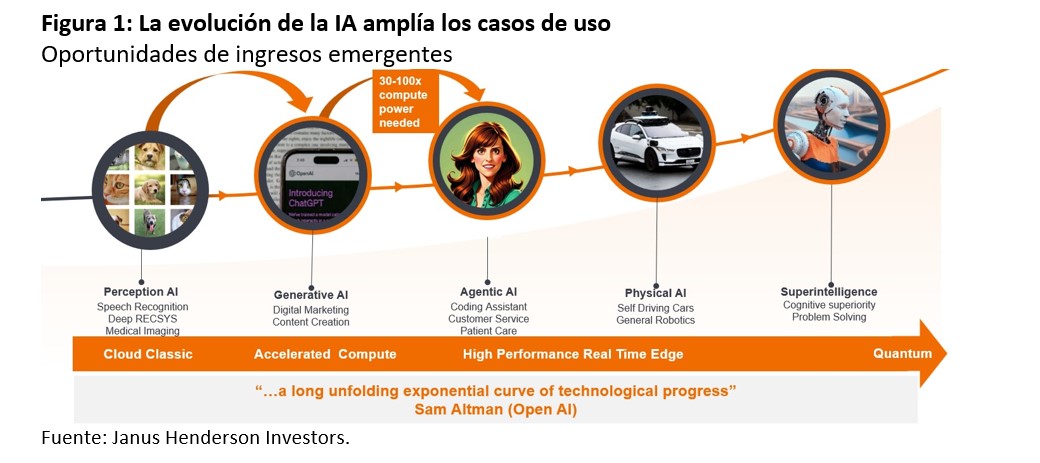

The asset manager recalls that Trian, an investment firm with extensive experience in investing and operating within the asset management sector, currently owns 20.6% of Janus Henderson’s outstanding shares and has been a shareholder since 2020, with board representation since 2022. For its part, General Catalyst is a global investment and transformation firm focused on applying artificial intelligence to enhance business operations. They note that this will be one of several transactions that Trian and General Catalyst teams have undertaken jointly.

Additionally, they clarify that, as a private company, Janus Henderson would continue to be led by the current management team, with Ali Dibadj as CEO, and would maintain its main presence in both London (England) and Denver (Colorado).

According to Janus Henderson, shortly after receiving the proposal from Trian and General Catalyst, the company’s Board of Directors formed a Special Committee, comprised of independent directors not affiliated with Trian or General Catalyst.

“The transaction was unanimously approved and recommended by the Special Committee after evaluating the deal with Trian and General Catalyst and completing a thorough review process. At the Special Committee’s recommendation, the Board subsequently approved the transaction by unanimous vote,” they stated.

Main Reactions

Following this announcement, John Cassaday, Chairman of the Board and Chair of the Special Committee, stated: “After a careful review of the proposed transaction and its alternatives, we have determined that this deal is in the best interest of Janus Henderson, its shareholders, clients, employees, and other stakeholders, and offers attractive certainty and cash value to our public shareholders, with a significant premium over the unaffected share price.”

Meanwhile, Ali Dibadj, CEO of Janus Henderson, said: “We are pleased with Trian and General Catalyst’s interest in partnering with us, which is a strong endorsement of our long-term strategy. Throughout our 91-year history, Janus Henderson has been both a public and private company at various times, and has never lost focus on investing—together with our clients and employees—in a more promising future. Through this partnership with Trian and General Catalyst, we are confident that we will continue investing in our product offering, client services, technology, and talent to accelerate our growth and deliver differentiated insights, disciplined investment strategies, and top-tier service to our clients. This transaction is a testament to Janus Henderson’s employees worldwide, who have executed our strategy of protecting and growing our core business, amplifying our strengths, and diversifying where it makes sense, always putting our clients first.”

Nelson Peltz, CEO and Founding Partner of Trian, added: “Our team at Trian has successfully invested in and driven growth at many iconic public and private companies over the years. As a significant shareholder of Janus Henderson and with board representation since 2022, we are proud of the company’s performance in recent years, led by Ali and his outstanding team. We see a growing opportunity to accelerate investment in people, technology, and clients. The partnership with General Catalyst enables us to bring to Janus Henderson our shared entrepreneurial spirit and complementary strengths in operational excellence and technological transformation. We look forward to working closely with Ali and the JHG team, as well as with Hemant and the General Catalyst team, to build a best-in-class business.”

From General Catalyst, its CEO Hemant Taneja added: “We see a tremendous opportunity to partner with Janus Henderson’s management team to enhance the Company’s operations and customer value proposition through the use of AI, in order to drive growth and transform the business. We are also excited to partner with Trian, with whom we share a long-term vision for success in creating additional value for Janus Henderson, a top-tier organization.”

Finally, Mohammed Saif Al-Sowaidi, CEO of QIA, stated: “QIA is pleased to be part of this agreement to take Janus Henderson private. As a long-term financial investor, we look forward to working with our partners at Trian and General Catalyst to support Janus Henderson in the next phase of its impressive growth story.”

Transaction Details

They explained that the transaction is expected to be completed by mid-2026 and is subject to customary closing conditions, including obtaining the relevant regulatory approvals, client consents, and approval from Janus Henderson shareholders.

The transaction will be financed in part through investment vehicles managed by Trian and General Catalyst, backed by funding commitments from global investors, including Qatar Investment Authority and Sun Hung Kai & Co. Limited, as well as MassMutual and others, along with the retention of Janus Henderson shares currently held by Trian and related parties.