BBVA Opens Its Third International Private Banking Hub in Spain, Following the U.S. and Switzerland

| By Amaya Uriarte | 0 Comentarios

BBVA opens its third International Private Banking hub in Spain, after the U.S. and Switzerland

Latin American clients have around half of their wealth outside their country of origin, and Spain is in their sights: it has become an attractive destination, not only in terms of financial and real estate investments, but also due to factors such as language, quality of life, and security. This has led BBVA to create a specialized International Private Banking unit in the country, with the goal of serving global clients who wish to invest in Spain. This new unit joins the platforms already existing in Switzerland and the United States, reinforcing BBVA’s international model and consolidating Spain as a strategic hub in its global offering of high-value-added services.

The entity, which already has 583 international clients in this unit in Spain, with 440 million euros in volume and a growth of 43 clients so far in 2025, had been working over the past three years with Latin American clients through its local private banking; now, the business achieved has provided the incentive to give it this new international structure, with slightly different protocols. Although no specific growth objectives have been set, they are ambitious about what can be achieved in international private banking and believe this is just “the tip of the iceberg,” explained Fernando Ruíz, Head of Private Banking at BBVA in Spain, in a meeting with journalists.

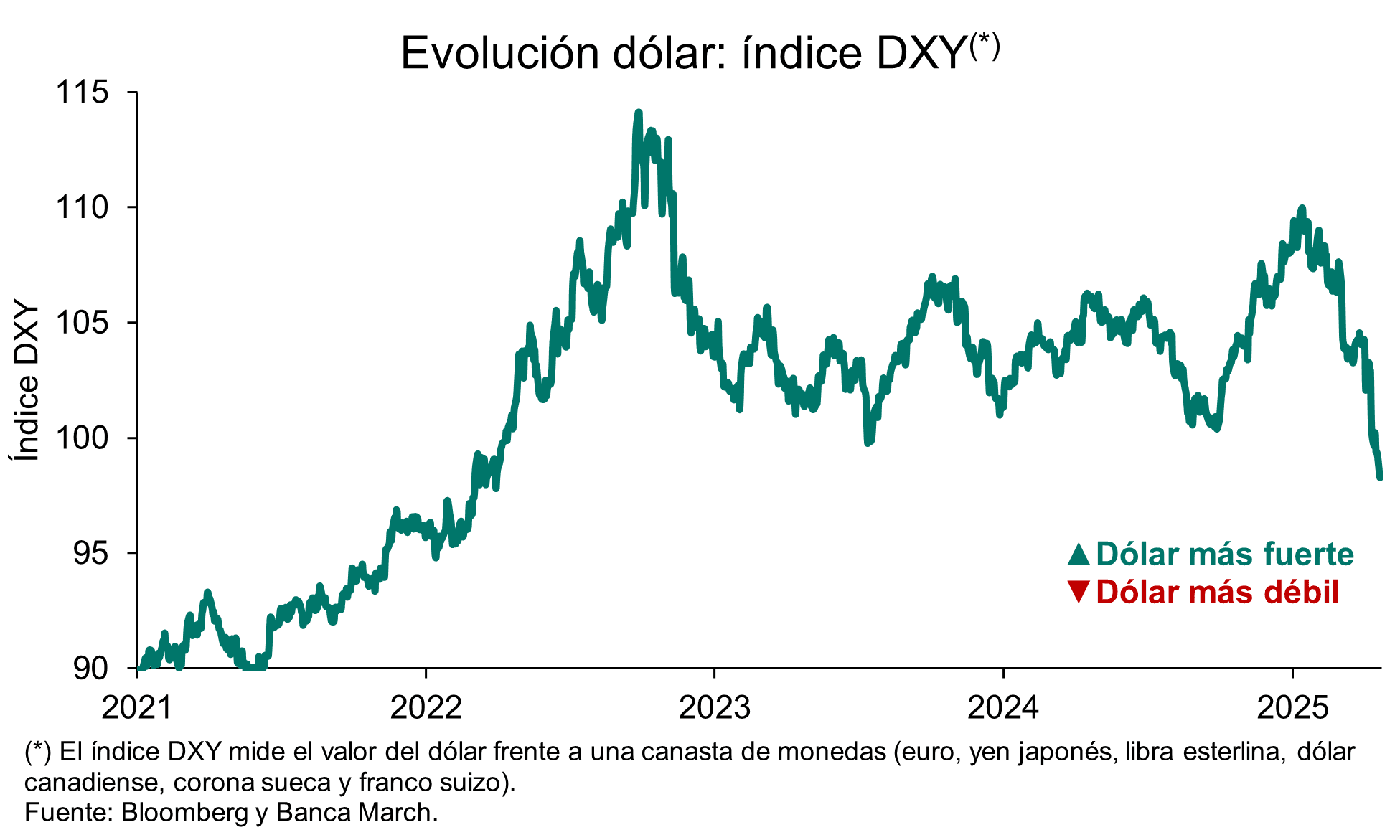

Because the creation of a specialized private banking unit that only serves international clients allows for better adaptation to those clients (who have their particularities, such as, in the case of Latin Americans, the appetite for real estate or investments in dollars), expanding the group’s international offering to a third market and becoming a reference in Spain in international private banking, taking advantage of the group’s positions and synergies in Latin America. “Having a specialized team will allow us to better understand the client, analyze how they invest, and adapt,” he said, with a relationship model that is in-person (through the dedicated office in Madrid and trips to the countries of origin) and digital communication and operational capabilities.

To this office, located at Goya 31, which represents a first step, more centers could soon be added in potential areas such as the Mediterranean coast, cities like Barcelona, or the Northwest area (Galicia especially), leveraging the 218 locations where BBVA’s local private banking is present in Spain. “In the U.S. we started with centers in Miami and then expanded to Houston (Texas) and California. In Spain, we could follow the model, as long as we see that it is convenient for international clients,” stated Jaime Lázaro, Head of Asset Management & Global Wealth.

Colombia, Mexico, and Peru

The new unit is born with the aim of offering an exclusive service adapted to the particular needs of international clients, especially those from countries like Mexico, Colombia, and Peru, who seek to diversify their wealth outside their places of origin. The Goya office has a team of five professionals dedicated to those clients, composed of Javier Domínguez Freijo, as director, and four bankers: Alejandro Valverde Carranza (for clients from Mexico), Silvia Díaz Henao (Colombia), Gonzalo Martín Soria (Peru), and María López Moral (other geographies). All of them—highly specialized bankers with exclusive dedication, capable of understanding the wealth, tax, and legal particularities of each country—were already working in BBVA‘s private banking. The team will also grow with the business, with a preference for internal talent although external hires are not ruled out.

“Latin American clients have 50% of their wealth outside their country of origin. In some cases, they want to diversify and we help them come to Spain; in other cases, the clients are already here and we serve them with the support of the LatAm franchises. In the end, they are usually clients with investments in some Latin American country, who asked us about BBVA’s offering in international private banking and now, as a third path in addition to the U.S. and Switzerland, we can offer them Spain,” added Ruíz. “With this new unit, our goal is to elevate and differentiate international private banking in Spain, replicating the model of excellence we already offer from our offices in Switzerland and the United States. We have created an exclusive, highly specialized team, capable of meeting the specific needs of international clients, in many cases different from those of national private banking. We want to offer a unique service in the Spanish market, both to those who reside in the country and to those who have interests here from other geographies,” he added.

Clients can access the international private banking offering starting from 500,000 euros, under the same conditions as local private banking, and with the same service standards, in which BBVA Patrimonios and the ultra-high-net-worth unit come into play. Currently, the average volume of international clients is around 800,000 euros. Of these clients, about half are from Colombia, 30% from Mexico, and 20% from Peru. According to the firm, the end of the Golden Visa in Spain will not be a determining factor for the arrival or withdrawal of investments, just as it has not been a significant attraction lever in recent years.

Under the umbrella of the international platform

The value proposition of this specialized unit is based on BBVA’s international platform, Global Wealth, which connects all the Group’s local banks and enables global and consistent service in any geography. In this way, the personalized attention provided by the team of the new Madrid office is complemented by close coordination with the bank’s local teams in the clients’ countries of origin, ensuring comprehensive wealth management at the international level, the firm explains.

“Private Banking is one of the strengths of the BBVA Group, and therefore our global private banking unit, Global Wealth, has as a priority objective to provide a unique and consistent experience to clients with interests in different geographies, becoming their best financial ally through a relationship and advisory model that is transparent, complete, and consistent in all our processes and wealth solutions,” stated Lázaro.

The person responsible for these units recalled the strength of their service, between local and global, and the strategic priority represented by the development of private banking for the group, already present in nine markets, in Europe (Spain, Switzerland, and Turkey) and the Americas (Uruguay, Argentina, Peru, Colombia, Mexico, and the U.S.), with 200 billion euros in assets. “We want clients to perceive that they are working with a single bank, even if they have accounts in more than one country,” he said, assuring that the bank’s communication circuits will enable holistic and global advisory and reporting.

BBVA offers these clients not only specialized bankers but also expert teams in wealth planning and strategic analysis. Notably, the Global Wealth Planning area, present in Spain, Mexico, and Switzerland, enables efficient and personalized wealth structuring. The bank also collaborates with prestigious international firms, as well as with local firms in each country, to provide complete coverage on legal and tax aspects.

A tailored value offering

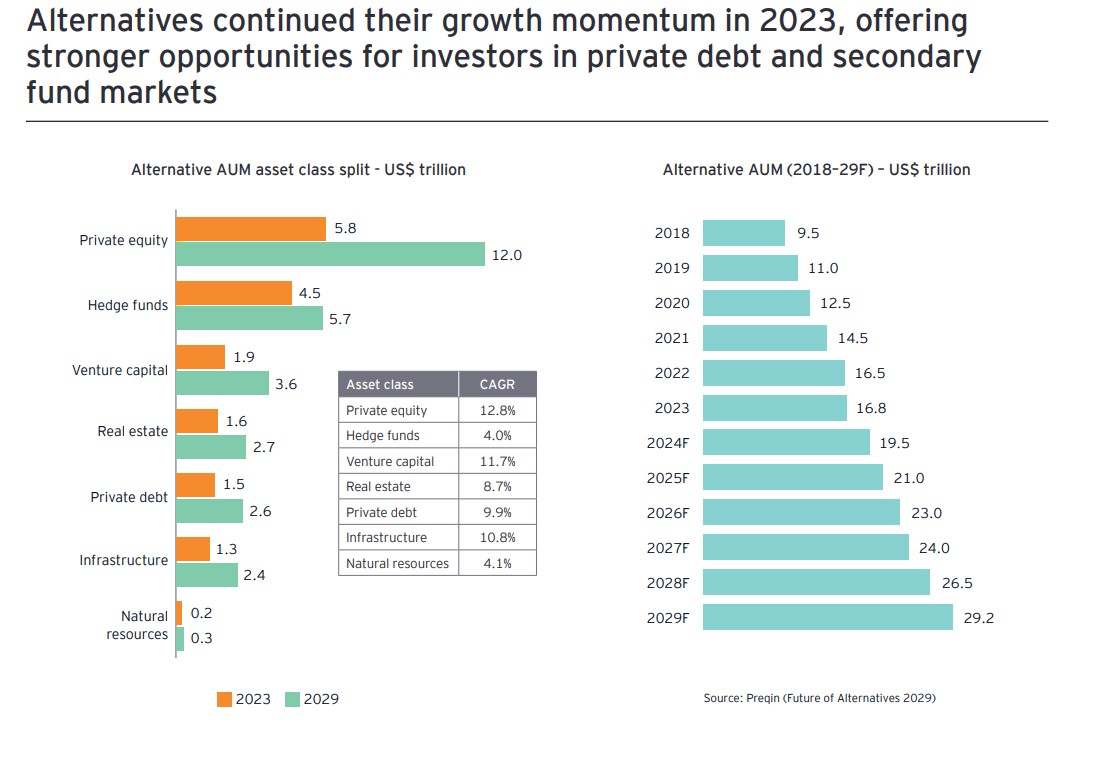

Specifically, the value proposition for international private banking clients—coordinated between the experts of the international unit and the locals in each geography—is focused on wealth planning, as well as services in high demand such as real estate (with BBVA’s agreements with Intrum and CBRE), alternatives (in which the bank has recently launched proposals), financing facilitation, arrival and residency support in Spain (with agreements with leading entities), assistance to companies and families to transfer wealth from generation to generation, and the same products available to local private banking clients.

In terms of investment solutions, BBVA’s international clients have access to discretionary management portfolios or advisory services tailored to their risk profile and currency, proprietary and third-party funds (via Quality Funds), private market opportunities, customized financing, real estate services with specialized brokers, international payments solutions, and premium cards with global benefits, as well as advice on business investments. Thanks to the international network of the BBVA Group and the global capabilities of its various areas such as BBVA Research, BBVA Asset Management, Quality Funds, or Corporate & Investment Banking (CIB), the entity can offer a comprehensive, flexible, and dynamic approach to wealth management, adapted to the circumstances and objectives of each client.

“It’s about giving them the same as in Spain, but with adaptations to their peculiarities—for example, adjusting their investments in dollars. We also remind that in all countries BBVA facilitates product offerings through open architecture via BBVA Quality Funds. We don’t want the client’s preference to be conditioned by the product offering, which is available in the three international private banking centers,” added Lázaro. The offering also includes services beyond traditional financial ones, such as educational, sports, or cultural topics.

Growth in local private banking in Spain

In this context, BBVA’s private banking in Spain continues to grow strongly. The entity manages nearly 140 billion euros in assets under management and has 158,000 clients and 722 bankers. The objective is to reach 200,000 clients in three years and manage 150,000 investment portfolios in the next two years, thus consolidating its personalized advisory model based on the combination of the banker’s knowledge and technological support.