Navigating Negative Rates In 2017

| By Fórmate a Fondo | 0 Comentarios

We are facing a world where ‘safe assets’ pay nothing or even charge you to own them, yield can only be found at higher risk levels and markets which have benefited from falling yields are vulnerable to a change in direction. The question for investors is: what to do? We believe there are opportunities worth pursuing, along with risks that require careful mitigation.

Despite these difficulties, we believe a thoughtful approach can help investors to meet these income challenges, by applying six simple rules:

Identify your objectives

You need to clearly define your investment objectives and use these to guide all portfolio decisions. What yield or return do you need? What level of risk tolerance is acceptable? Are

you sensitive to short or longer term capital risk? How much liquidity do you require? If all of these things are broadly realistic, they can guide you in building an appropriate portfolio.

However, if you try to push any of these objectives too far, the balance of outcomes may be unattainable. For example, if you try to chase yield too far, it may increase the risk to capital loss. If you try to push volatility down too low, you may not be able to generate yield or a suitable return.

Diversify your portfolio

Diversification is one of the most powerful tenets of portfolio construction. Assets with different characteristics will often offset each other in terms of risk, but can all still contribute towards performance, thereby improving the return achievable for a given level of risk. This is incredibly useful when trying to balance the need for yield against a limited appetite for volatility.

The key issue here is implementation. We think asset class labels can be highly misleading. For example, we think there is a much closer relationship between equities and high yield bonds than high yield and government bonds. Their respective labels say they are different asset classes, while their underlying performance driver, essentially corporate profitability, is the same for both.

We believe investors need to consider asset behaviour, when building portfolios. This is why we think of assets as exhibiting either ‘growth’, ‘defensive’ or ‘uncorrelated’ characteristics, regardless of the traditional labels. A truly diversified portfolio will have a blend of all three, which is critical to achieving proper portfolio diversification.

Adapt to changing market conditions

What is attractive today will change over time as markets move and economies evolve. Adapting exposure to re ect these changes, and rotating out of asset classes as they become less attractive can help towards achieving the stated objective.

In particular, certain types of assets will typically do well in times of economic expansion, such as equities and high yield bonds, and do poorly in recession, whereas other assets normally exhibit more defensive qualities, such as high quality government bonds. So a fundamentally different mix of exposures makes sense at different stages of the business cycle. It is, however, important to take account of value, as assets tend to go from cheap to expensive and back again, and the cyclical behaviour of assets may change in response to these valuations changes. Assets, for example, like government bonds, may have lost some of their defensive characteristics as they have become more expensive, making them less useful in negative economic periods.

Build exposure from the bottom up

Building portfolios from the bottom-up seeks to ensure that positions are consistent with the desired outcome, rather than just exhibiting broad market characteristics. The market will

contain many securities which may not help towards meeting your objectives. It will contain expensive assets, as well as ones that don’t provide much income. It will also contain assets with signi cant quality or capital risks. As a result, it is important to tailor the underlying portfolio to re ect the desired outcome and, again, to allow this mix to evolve over time.

Think holistically

Building from the bottom-up also allows a holistic approach across asset classes and capital structures. For example, given the many challenges faced by the banking sector, we have felt

that it is generally better to lend to banks as a senior bond holder than to own their equity. Regulatory change is designed to make harder for banks to make money for their equity holders, but conversely regulation is designed to make banks safer for their bond holders.

Similarly, earlier this year when oil prices collapsed, a lot of energy-related assets ended up at relatively cheap levels across their capital structures. We looked to see whether there were interesting opportunities that could do well, even if oil prices remained low, and which would benefit from any recovery in the oil price. Reviewing the opportunity set, we found that some of the best opportunities were within US high yield energy sector bonds, but selectivity would be key, because of the risk of default.

Hope for the best, but prepare for the worst

Financial markets are always hostage to events. One way to guard against this is to think about which events are worth worrying about, and then analyse their potential consequences

for markets, and the implications for your portfolio. This can be looked at alongside how probable the event appears to be, to decide whether to hedge exposed areas within the portfolio. This kind of approach worked particularly well in advance of the UK’s EU referendum, a discrete risk event with an uncertain binary outcome.

Rather than taking a view on how the vote would go, we believed that a more prudent course was to seek to reduce risk to limit the possible downside, in return for perhaps foregoing some of the upside. It can be very useful to manage exposure around future referenda or elections in a similar way.

Open-ended event-based risks offer a different challenge, such as the risk of a ‘hard landing’ in China, the risk of an oil price spike, or the risk of a bond yield spike. With these, it is worth examining exposure levels to see whether it makes sense to hedge certain risks while still maintaining core strategic positions.

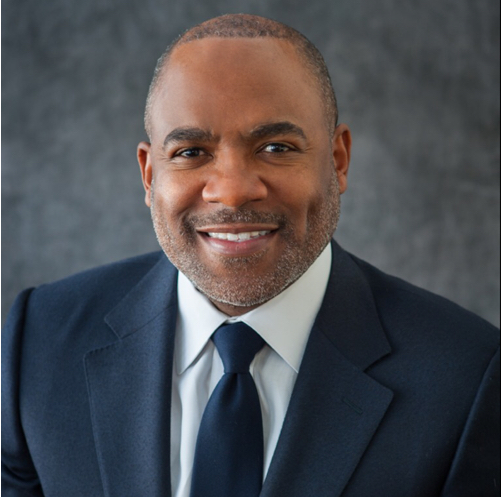

John Stopford is Co-Head of Multi-Asset at Investec.