Nearly Half of Investors Believe the 2024 Election Will Have a Bigger Impact on Portfolios Than Market Performance

| By Marcelo Soba | 0 Comentarios

As the political noise leading up to national elections in 2024 begins its long crescendo, many American investors are nervously considering implications for their investment portfolios.

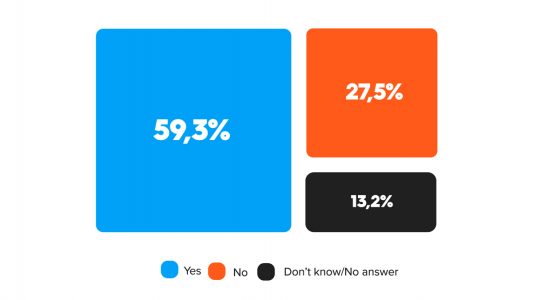

Regardless of political affiliation, nearly half (45%) of investors believe the results of the 2024 U.S. federal elections will have a bigger impact on their retirement plans and portfolios than market performance, according to Nationwide’s ninth annual Advisor Authority survey, powered by the Nationwide Retirement Institute.

In addition to general pessimism regarding the election’s impact on retirement prospects, investors fear the impact of new policy and opposing party rule on the U.S. economy. Nearly one in three (32%) investors believe the economy will plunge into a recession within 12 months if the political party with which they least align gains more power in the 2024 federal elections.

Roughly the same percentage (31%) believe the party they least align with gaining more power in office will negatively impact their future finances, and 31% believe their taxes will increase within 12 months.

“As we get closer to the 2024 election, we’re going to see more messaging and campaign ads that portray worst case scenarios, creating anxiety in investors that can lead to short-sighted, emotional decisions,” said Eric Henderson, President of Nationwide Annuity. “It’s important for investors to not get caught up in the ‘what ifs,’ and instead focus on what they can control. A proactive step would be having a conversation with their advisor or financial professional and establishing a long-term plan – or revisiting the plan they already have in place – to ensure it remains aligned with their goals regardless of which party takes control in Washington.”

Recession fears are strong across party lines

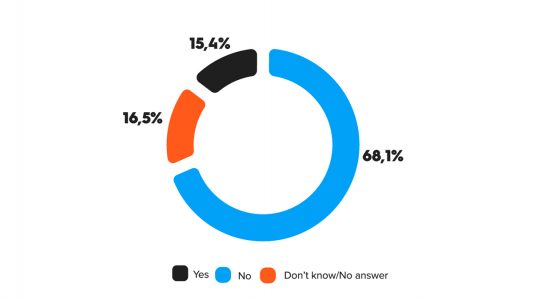

Some issues are viewed differently across party lines. More than half (57%) of investors who identify as Democrats say market performance will have a bigger impact on their retirement plans and portfolios than the results of the 2024 election, compared to 47% of investors who identify as Republicans.

However, Republicans tend to brace for election results more than their Democrat counterparts. More than two thirds (68%) of Republican investors believe the outcome of a presidential election will have a direct, immediate and lasting impact on the performance of the stock market, compared to 57% of Democratic investors. Independent investors are the least concerned with election results; fewer than half (40%) feel the results of next year’s election will have a bigger impact on their retirement plans and portfolios than market volatility – the lowest of the three primary political demographic groups.

“While it’s natural to feel the party you support will deliver the best economic outcome, history tells us that these instincts can be blown out of proportion,” said Mark Hackett, Chief of Investment Research for Nationwide. “Remember that election results in either party’s favor have historically had little impact on future investment returns. That’s why it’s important to apply a strong filter to election news coverage to maintain an objective understanding of the events shaping our world. It’s best to stay focused on the fundamental drivers of investment performance (e.g., company earnings, revenue growth, profit margins, etc.) and leading indicators of economic conditions.”

Older investors are more fearful

The general fear of a recession is magnified for those closest to retirement ahead of next year’s election, as any wrong decision could have a lasting impact on how they live through retirement. Pre-retiree investors (defined as non-retired investors aged 55-65) are more concerned about an impending economic recession (50%) than investors overall (41%). Pre-retirees and those already in retirement are more concerned about inflation than investors overall (66%, 66% vs. 61%, respectively).

As a result, pre-retirees are planning to be more conservative with their assets than other investors – perhaps because they don’t have the time to recoup losses. One third (33%) of pre-retiree investors are managing their investments more conservatively in anticipation of next year’s election, compared to just 31% of all non-retired investors. In addition, just 12% of pre-retirees and 4% of retired investors plan to invest more aggressively in anticipation of next year’s election.

Economic fears spur changes to spending

As campaigning and political punditry ramp up, economic factors are still top of mind for those saving for retirement.

Overall, investors who are not retired see inflation (47%), an increased cost of living (42%), and a potential recession (31%) as the greatest long-term challenges to their retirement portfolios. To compensate, they are changing their spending and investing habits, including making adjustments to cut spending and ensure a timely retirement.

To save more for retirement in the current environment, one third (33%) of investors are avoiding unnecessary expenses, such as vacations, jewelry, and shopping sprees over the next 12 months. A quarter (25%) of non-retired investors also say they will need to work longer to save money for retirement in case Social Security runs out of money, a hard reality that is projected in 10 years, according to the most recent Social Security Trustees Report.

Despite pulling back spending and adjusting investments as political pressures and economic turbulence collide, investors are entering election season on a cautiously optimistic note. Recession fears remain elevated but are down slightly from last year – four in five (80%) investors are now concerned about a U.S. recession in the next 12 months, compared to 85% in 2022. Four in ten (40%) of all investors and 32% of pre-retirees describe their financial outlook for the next 12 months as “optimistic.”

Advisors empathize with investor concerns

Financial advisors understand the fears that can stem from changes in Washington and can help investors navigate through it. Like investors, financial advisors view inflation (46%) as the most immediate challenge to their clients’ retirement portfolios. However, they are not immune to a partisan bias; 38% believe the stock market will be volatile for the 12 months following the election if the party they least align with gains more power after next year’s federal elections.

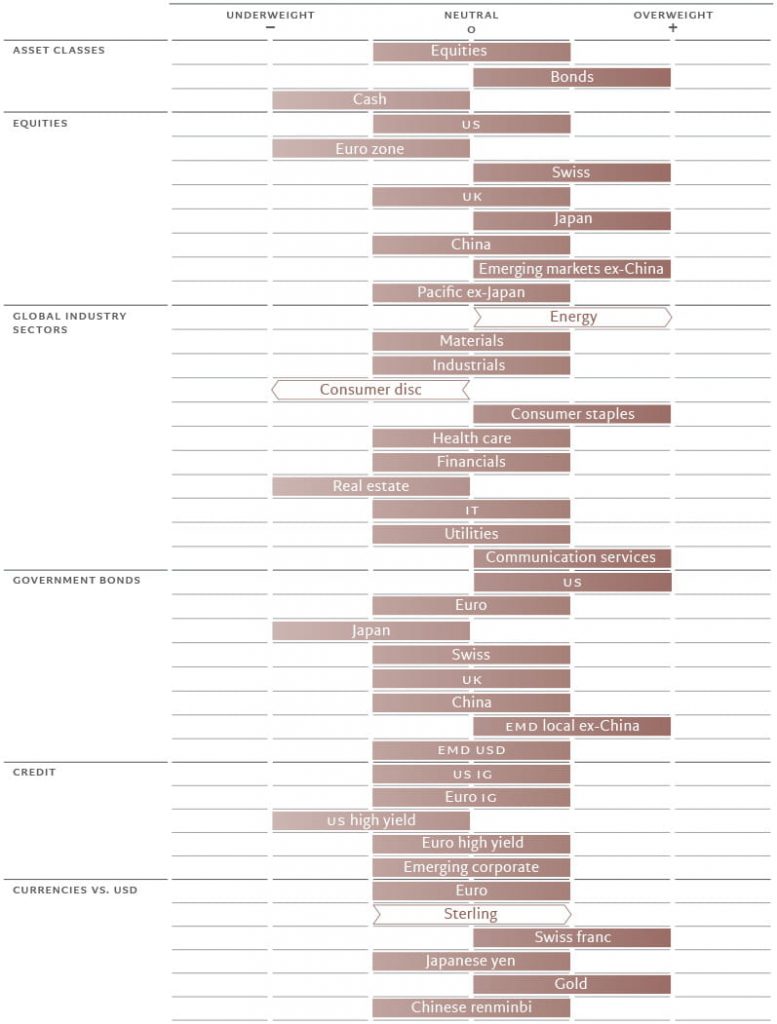

In the face of volatility spurred on by partisan noise and a potential exchange of power in Washington, advisors still maintain a more balanced, nuanced view of the election than their clients, in part because many have designed long-term strategies to protect them against volatility. Despite election jitters, most advisors (56%) believe staying the course – i.e., not changing their clients’ investment strategies – is the best course of action in an election year.

With this approach in mind, advisors are recommending and implementing their strategies accordingly. Almost all (96%) currently have a strategy in place to help their clients protect their assets against market risk, an increase from 92% in the last 12 months.

Annuities (80% vs. 78%), diversification and noncorrelated assets (72% vs. 57%), and liquid alternatives such as mutual funds or ETFs (54% vs. 31%) all saw at least a slight increase as solutions used by advisors to help their clients protect their assets against market risk in the last year.

“While elections are important, and it’s good to be engaged in our democratic process, making emotional decisions based on what you think will happen runs the risk of derailing your retirement goals,” said Henderson. “Advisors and financial professionals should seize the opportunity to engage with their clients to reinforce the importance of sticking to their long-term plan. Another way to address client anxiety is to help them understand the value of protection solutions, like annuities, that guarantee income in retirement and guard against market volatility – regardless of who ends up winning the election.”