How to Use Securitization As a Key Tool for Distribution?

| By Romina López | 0 Comentarios

Asset securitization has had a significant impact on portfolio management and distribution, providing asset managers with an additional tool to diversify, optimize performance, and manage risk more effectively. This article by the fund manager FlexFunds explores how portfolio managers can use asset securitization to enhance the distribution of investment strategies, examining its benefits, challenges, and impact on capital markets:

Asset securitization

Asset securitization is nothing more than the process of transforming any type of financial asset into a listed security. Through this financial technique, exchange-traded products (ETPs) are created, acting as investment vehicles aimed at giving the underlying assets greater liquidity, flexibility, and reach.

FlexFunds, a leading company in the set up and issuance of investment vehicles (ETPs), defines asset securitization as a tool used by asset managers as a bridge to facilitate access to investors and foster capital raising for various investment strategies.

Among the main benefits that securitization offers to portfolio managers are:

1.- Increased liquidity: The securitization process of any asset results in a product listed on the stock exchange with an individual identifier (ISIN) that can be bought and sold through Euroclear and Clearstream, making it possible to hold it in an existing brokerage account.

2.- Risk diversification: By distributing the risks associated with the underlying assets among multiple investors, securitization helps reduce exposure to risk for any individual investor. This is especially important during times of market volatility.

3.- Access to international capital: Securitization facilitates access to international capital markets, allowing companies to attract investment from a global investor base.

4.- Centralized account management: Securitization can offer the advantages of centralized account management. It avoids the administrative redundancies of separately managed accounts and allows investors to access higher-ticket projects that they would not have been able to access otherwise.

5.- Protection of assets under the structure: Because the issuance is executed through a special purpose vehicle (SPV), the underlying asset is isolated from the credit risk that may affect the manager, and thus, the investor.

In general terms, asset securitization is a process that allows multiple classes of assets, liquid or illiquid, to be converted into listed securities. Additionally, it offers the inherent capacity of exchange-traded products (ETPs) to transform assets into “bankable assets,” understood as assets that acquire the capacity to be distributable on various private banking platforms, according to the specialized opinion of FlexFunds.

How can asset securitization help distribute your investment strategy?

Asset securitization plays a crucial role in the distribution of investment strategies internationally. Here are some ways this process can enhance these strategies:

- Flexibility in strategy management: Securitization allows asset managers to access a broader range of assets that they might not otherwise have access to. This includes assets from emerging markets or specialized sectors that may offer higher returns but carry higher risks.

- Facilitates complex investment structures: Through securitization, asset managers can structure more complex investment products, such as collateralized debt obligations (CDOs) or mortgage-backed securities (MBS), which attract different types of investors with different risk profiles.

- Efficiency in distribution: Securitization facilitates the distribution of investment products in different jurisdictions, leveraging the infrastructure of international capital markets. This allows asset managers to reach a broader and more diverse investor audience.

- Transparency and international standards: Securitization requires compliance with international regulatory and transparency standards, increasing investor confidence and facilitating the distribution of products in multiple markets.

Challenges of securitization

Despite its numerous benefits, asset securitization also presents several challenges that must be managed carefully:

- Opacity risk: While securitization can disperse risk, it can also introduce complexities that make the products less transparent.

- Regulation and compliance: The regulatory requirements for securitization can be complex and vary between different jurisdictions. Managers must ensure compliance with all applicable regulations, which can increase the costs and time needed to structure and issue securitized products.

- Market risk: Although securitization disperses risk, the underlying assets are still subject to market risks. A deterioration in the quality of the underlying assets can negatively affect the performance of securitized securities.

The future of securitization in international capital markets

As capital markets continue to evolve, asset securitization will remain a vital tool for distributing investment strategies.

Regulations will keep changing: the securitization market has been subject to increased regulatory scrutiny in recent years, and this trend is expected to persist. As regulators gain a better understanding of the risks associated with securitization, they are likely to introduce new rules and guidelines to ensure the market remains stable and transparent.

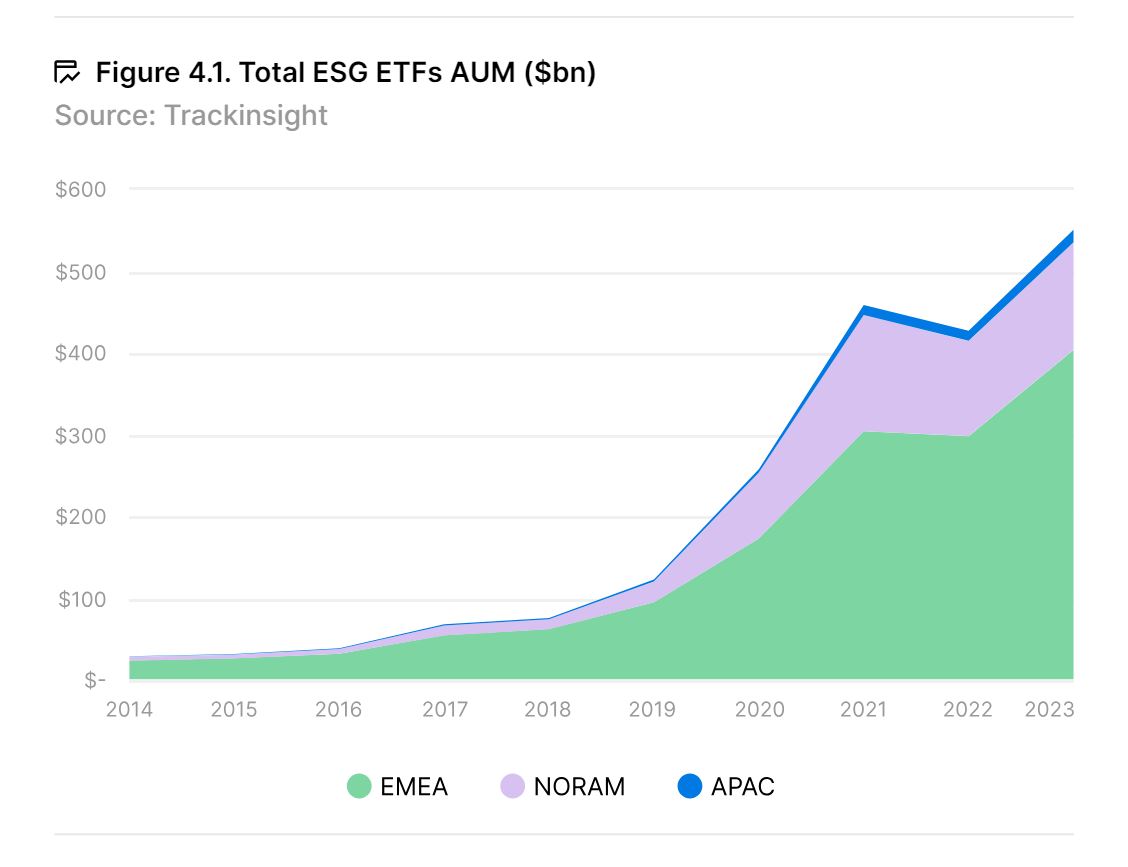

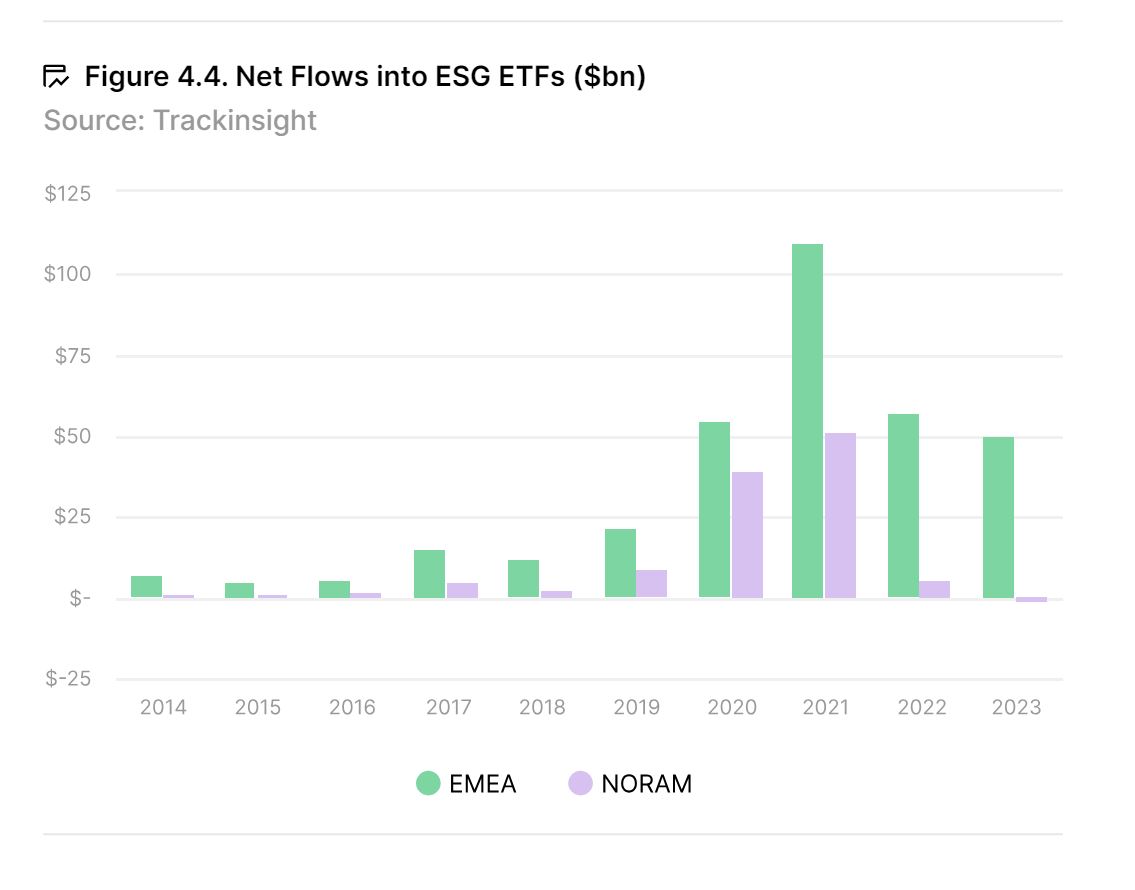

Moreover, the growing demand for sustainable investments is driving the development of securitized products that incorporate environmental, social, and governance (ESG) criteria. Asset managers are exploring the securitization of green assets, such as renewable energy projects, to attract investors seeking to generate a positive impact along with financial returns.

In summary, asset securitization is a powerful tool that can enhance the distribution of investment strategies in international capital markets. By transforming any type of asset into listed securities, securitization improves liquidity, diversifies risk, and facilitates access to global capital. However, it is crucial to carefully manage the associated challenges, including transparency, regulation, and costs.

If you want to know how asset securitization can enhance your investment strategy and facilitate capital raising in international markets, contact the specialists at FlexFunds at contact@flexfunds.com