BlackRock Bets on Japan, AI, Quality Companies, Emerging Markets, and Europe

| By Amaya Uriarte | 0 Comentarios

BlackRock has focused on the real economy in its investment strategy for the second half of 2024. This was acknowledged by Javier García Díaz, Head of Sales for Iberia at BlackRock, during the firm’s presentation of its outlook for the second half of the year.

“We are in interesting times with challenges and opportunities for investors,” said García Díaz, who admitted that the firm shows a preference for risk “but with control” and that one must be alert to the opportunities that will emerge in this new economic regime. “Resources are currently being invested in major economic forces, such as artificial intelligence or deglobalization, which generate winners and losers,” he said.

The bet on the real economy is reflected in the opportunities the firm sees in data centers for artificial intelligence, “which will grow between 60% and 100% in the coming years”; also in the energy transition, with needs amounting to $3.5 trillion, and the reconfiguration of supply chains. “The real economy is gaining ground over the financial economy, benefiting infrastructure and industry,” the expert noted.

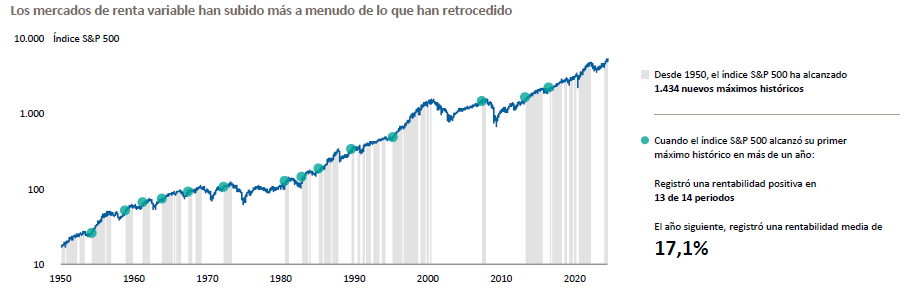

Risk, according to García Díaz, should be “tactical,” and it’s a good time to invest, characterized by below-trend growth, above-average inflation data, high debt, and elevated interest rates.

The equity positioning – an asset that has been performing well this year due to technology and good corporate earnings – focuses on Japan, artificial intelligence, quality companies, emerging markets – albeit selectively – and, tentatively, Europe.

1. Japan: The country is favored, according to the BlackRock expert, by a more favorable monetary policy, an economic recovery, healthy inflation, and structural reforms for shareholders and investors. “We advise allocating 10% of the total portfolio to Japan,” said García Díaz.

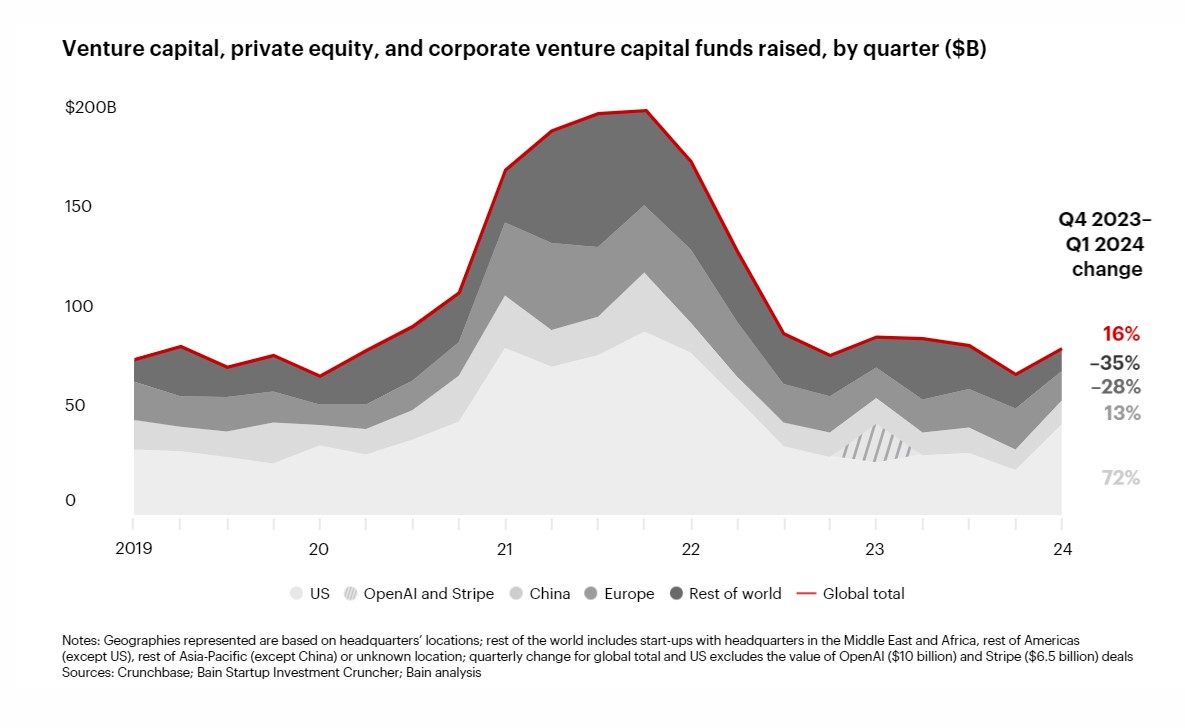

2. Artificial Intelligence: “We continue to overweight this sector and increase our conviction,” said the expert, who relies on the strong profits of these companies. “We believe we are still in a very early stage of AI; tech companies are investing heavily, and in future phases, telecommunications, healthcare, and finance will incorporate AI into their development, eventually permeating the real economy,” he assured. García Díaz revealed that AI will add 1.5 percentage points per year to the US GDP in the future.

Opportunities in this sector, according to the expert, are in data protection and cybersecurity; infrastructure such as data centers, semiconductors, and cooling; and finally, energy, due to the high consumption of this technology.

However, he also disclosed risks such as the capacity of the electrical grid to meet energy demand; regulation, or potential bottlenecks in the supply and production of metals necessary for artificial intelligence, like copper.

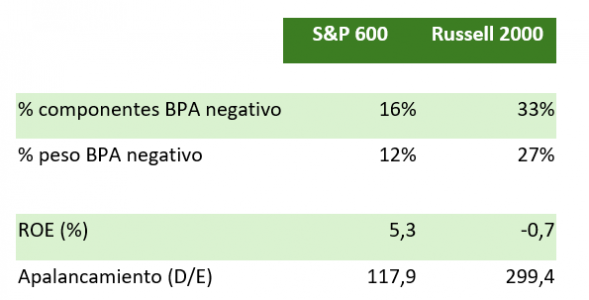

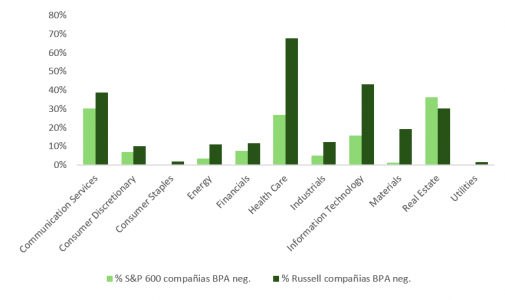

3. Quality Companies: Companies with healthy balance sheets and investment capacity are BlackRock’s main targets. These are abundant, according to the firm, in technology and the luxury sector.

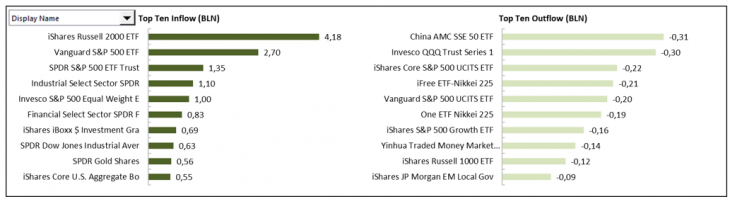

4. Emerging Markets: The position García Díaz advises in emerging markets is “selective,” with India as the main protagonist, following the recent elections won by President Narendra Modi. “There has been volatility in the Indian market, but we value its young population; there is strong investment in supply chains, and there is a flow of equity ETFs into the country,” he said. His bet on India includes not only the stock market but also the country’s fixed income.

5. Europe: The firm’s positioning in Europe is still “tentative.” In this region, there are notable aspects, according to García Díaz, such as a better situation in the banking sector; the automotive industry weighs less in the indexes than in the past, and international companies are now better. “We are cautiously optimistic: we prefer banks, healthcare, and luxury in Europe,” the expert affirmed.

In fixed income, the firm overweights US short-term bonds and is increasing duration in European fixed income, considering that the ECB has already lowered interest rates and that inflation in the US remains elevated. The positioning is neutral in credit – both investment grade and high yield – while being selective with emerging markets, again favoring India as the preferred market.

Alternative markets are another of BlackRock’s bets due to the strong expected growth: in the coming years, assets will double. This growth, according to the expert, would come from easier access to such assets through products like Eltifs, technological improvements, and the progressive reduction of listed companies – since 2009, there are 20% fewer companies on global stock exchanges. “It’s a clear bet, as demonstrated by BlackRock’s last two corporate acquisitions: the GIP investment fund and the private markets data provider Preqin.”

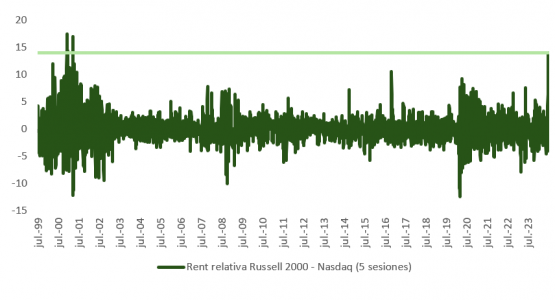

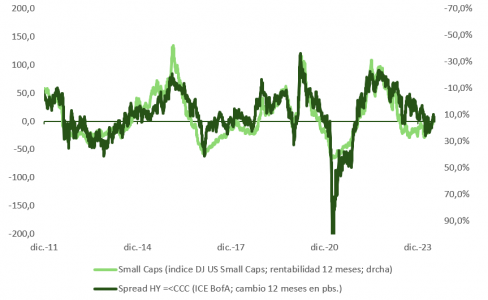

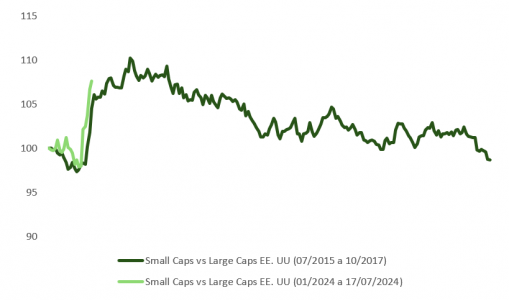

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.

drive up inflation and benefit domestic demand (small caps), but it will eventually be a deflationary measure.