Janus Henderson Investors has published the results of its Investor Survey 2024: Insights for a Brighter Future, which reveals that uncertainty surrounding the upcoming presidential elections, the economic situation, and the interest rate environment has led some investors to reduce the risk in their portfolios.

In particular, only 42% of surveyed investors feel very satisfied with their current financial situation, down from 48% a year ago, and two out of three (67%) believe that the cost of living is rising faster than their income. “In times like these, all investors should bear in mind that changes to a portfolio designed to avoid short-term volatility can often jeopardize long-term goals. The news cycle moves at an incredible pace, and headlines can be disconcerting, but U.S. equities have remained remarkably resilient despite high levels of uncertainty,” says Matt Sommer, head of Specialist Consulting Group at Janus Henderson Investors.

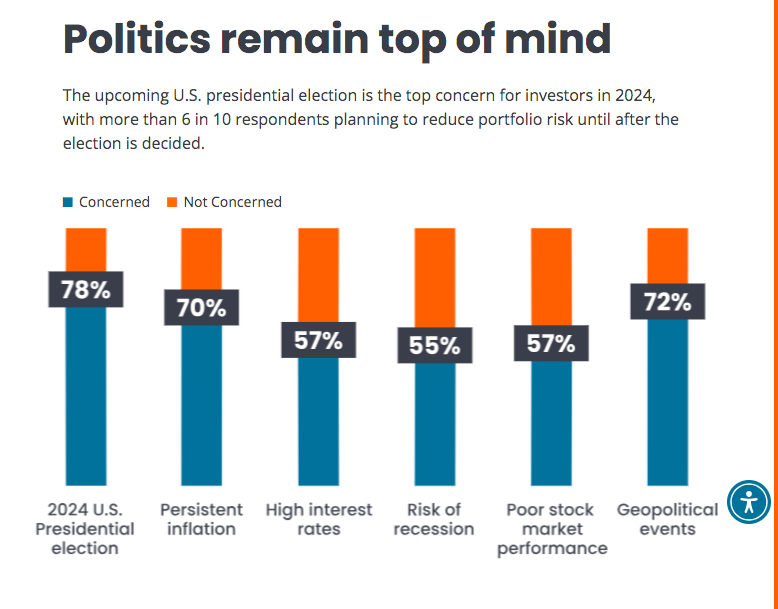

According to the report, the presidential elections are a bigger concern than inflation and interest rates. In an election year marked by turmoil, it clearly weighs heavily on the minds of current investors, with 78% of respondents concerned about how the upcoming presidential elections might affect their financial situation in the next 12 months. In fact, more respondents are worried about the elections than about persistent inflation (70%), high interest rates (57%), poor stock market performance (57%), or a potential recession (55%).

Over a longer period, namely the next 10 years, investors’ concerns are related to broader national and global systemic issues. Specifically, in order of relevance, they are worried about the long-term impact of increasing political discord in the U.S. (77%); the rising cost of healthcare (67%); national debt (66%); and U.S.-China relations (64%).

Less equity and more active management

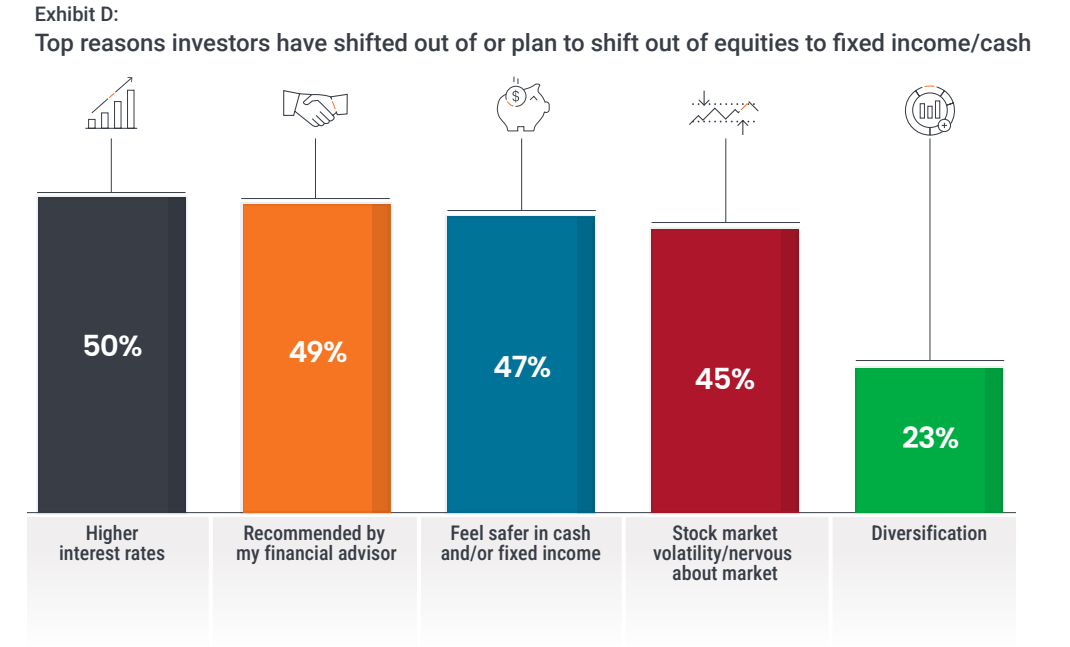

When evaluating the investment implications of this sentiment, the report notes that investors have reduced their exposure to equities. Over the last 12 months, 33% of respondents have moved assets from equities to cash or fixed-income investments, and almost the same number (32%) plan to move equity assets to cash or fixed income over the next 12 months.

“The main reasons for leaving equities or planning to do so include rising interest rates, following advice from their advisor, and feeling safer in cash or fixed income. Although nearly half of the respondents (54%) say they are preparing for a recession, this figure is lower than the 65% seen in 2023,” the asset manager explains.

On the other hand, a notable trend is that active management remains in demand. According to the report’s conclusions, amid high uncertainty, 43% of investors who hold mutual funds or ETFs prefer an even mix of active and passive funds in their portfolios, 26% favor active managers, 18% prefer passive ones, 10% have no preference, and 3% were unsure.

Additionally, the areas that investors consider to represent the best investment opportunities in the coming years are technology (73%), healthcare/biotechnology (62%), and real estate (38%).

The risk of AI

A striking finding is that investors view AI-related fraud as an established threat. Nearly three out of four investors (73%) believe that AI significantly increases the risk of financial exploitation, and 56% are very or somewhat concerned that they or a loved one might fall victim to financial exploitation. Millennials (66%) and Generation X members (63%) are more likely to be concerned about financial fraud than Baby Boomers (48%) or members of the Silent Generation (43%).

Across all generations, 45% of investors who use a financial advisor say their advisor has already provided them with resources to help avoid financial fraud, 29% would like their advisor to provide such resources, and the remaining 26% are not interested in these resources.

However, the sentiment around AI is not entirely negative. Among those who use a financial advisor or are considering hiring one in the next two years, most feel good or neutral about their advisor using AI technology for educational content (85%) or administrative tasks (83%). However, the report points out that 36% would oppose their advisor using AI to make investment recommendations, and 44% would be upset if they knew their advisor used AI to respond to their text or email messages.

Greater satisfaction with financial advisors

Finally, the survey highlights that among investors who work with a financial advisor, 67% are very satisfied and 31% somewhat satisfied with their relationship. Notably, when advisors address emotional needs, client satisfaction improves, as factors associated with higher levels of satisfaction include:

– The advisor gives me peace of mind that I am on the right track to achieve my goals (cited by 79% of “very satisfied” clients)

– They care about me as a person, beyond my financial situation (72%)

– They provide financial education (65%)

It is worth noting that 42% of advised investors say their advisor is 50 years or older, and within this group, 42% said their advisor had addressed succession planning, 25% were unaware of their advisor’s plans but were interested in learning more, and the remaining 32% did not see the need to address this issue.

“Growth-oriented financial advisors should view the challenges investors face in this era of high uncertainty as an opportunity to strengthen their value proposition. It is clear that client satisfaction rates are very high among advised investors. However, with many advisors nearing retirement, those able to build trust and differentiate themselves by offering better experiences to their clients will be rewarded,” says Sommer.