The U.S. Federal Reserve (Fed) met the expectations set by its chairman, Jerome Powell, at the Jackson Hole meeting and announced on September 18 a rate cut of 50 basis points, the first since 2020. The cut was widely expected and discounted by the markets, but the debate centered on whether the Fed would opt for a 25 or 50 basis point cut. In the end, its stance was more aggressive, opting for the latter, which came as a slight surprise. Why?

“It was a closely contested meeting, with markets divided over whether to start the rate cut cycle with 25 or 50 basis points. In the end, the Fed made a bold move with a 50 basis point cut. Certainly, the labor market has cooled in recent months, and inflation has continued to fall. The cut appears to be preventive, and both the accompanying dot plot and comments from the press conference highlight greater caution regarding the pace and extent of future easing. All in all, it’s a somewhat aggressive cut. However, one thing is clear: the ‘doves’ are in control, and any further weakness in the labor market would lead to faster and deeper cuts. And now the markets know this. We maintain our view that a soft landing remains the most likely outcome for this year,” adds Salman Ahmed, Global Head of Macro and Strategic Asset Allocation at Fidelity International.

On the other hand, for Guy Stear, Head of Developed Market Strategy at Amundi Investment Institute, the big news isn’t the 50 basis point cut itself, but rather the downgrade in growth forecasts and the sharp revision of the dot plot. “The Fed seems confident that it has won the battle against inflation and acknowledges that monetary policy is now too restrictive, especially in light of the threats to growth,” Stear emphasizes.

According to Tiffany Wilding and Allison Boxer, economists at PIMCO, “The Fed’s actions suggest that it saw a shift in the balance of risks surrounding inflation and employment, justifying a quicker adjustment toward neutrality than many Fed members had previously thought.” They also note that historically, when examining Fed cycles since the mid-20th century, an initial 50 basis point rate cut often precedes or signals a recessionary easing cycle, meaning a series of deeper, more abrupt, or prolonged cuts aimed at stimulating a struggling economy.

The Labor Market Issue

Several analysts point out that this aggressive cut is due to the labor market. “The reasoning is as follows: the economy is still doing well, but there’s a warning in the labor market. By responding firmly to this change in the labor market, the Fed limits the risk of contagion to the rest of the economy and reduces the probability of a recession in the coming months. The 50 basis point cut carries these qualities,” explains Philippe Waechter, Chief Economist at Ostrum AM (Natixis IM).

In this regard, Christian Scherrmann, U.S. Economist at DWS, adds: “We view yesterday’s policy decision as an insurance policy to protect labor markets from further deterioration, which would be incompatible with achieving a soft landing. During the press conference, the Fed Chairman somewhat confirmed this view, referring to the decision as an ‘appropriate recalibration’ in light of the cooling labor market conditions. However, he reiterated that they are not on a preset course, meaning they could slow or accelerate their efforts. Ultimately, this means that the Fed remains data-dependent, and the dot plot ‘is not a policy plan,’ with 50 basis points not being the new pace.”

Avoiding a Recession

For Donald Ellenberger, Senior Vice President and Portfolio Manager at Federated Hermes, by cutting 50 basis points instead of 25, the Fed signaled its confidence that inflation will continue on a sustainable path toward 2%. “FOMC members reduced their core inflation forecast from 2.2% to 2.3%. But the most important measure seems to show their determination to achieve a soft landing, avoiding the slowing labor market from dragging the economy into a recession,” he clarifies.

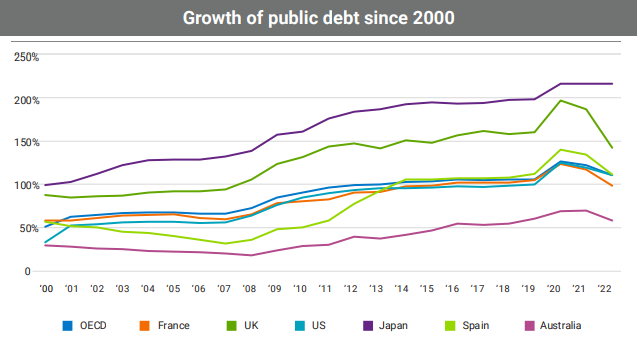

Franco Macchiavelli, an independent market analyst, points out that one of the few reasons behind the Fed’s surprising decision may be the U.S. government’s growing debt, which not only rises exponentially but already exceeds military defense spending. “Nonetheless, the Fed has been irresponsible, allowing such a stark narrative between 25 and 50 basis points to remain so prominent in the market, instead of setting a clearer roadmap that would have allowed the market to price in the September move and avoid sharp spikes in volatility, as seen in the options market,” he explains.

The analyst believes that the markets have gone too far in pricing in a recession, primarily driven by labor market weakness, and because they believe the Fed has fallen behind other central banks that have already begun cutting rates. “However, what stands out is the disparity between optimism and pessimism, mainly based on the narrative that the U.S. economy is very weak and on the verge of recession. But… is the U.S. economy really as weak as it is perceived to be?” Macchiavelli reflects.

“We don’t believe the U.S. economy is currently in a recession. Consumer spending remains resilient, and investment growth appears to be accelerating. However, as inflationary pressures ease, the Fed seems focused on ensuring that U.S. growth and labor markets remain strong by aligning monetary policy with the current economy, which now seems much more normal since the series of pandemic-related shocks that drove high inflation has largely subsided,” PIMCO economists add.

The Road Ahead

Experts now focus on when the next rate cut will be and, again, whether it will be 25 or 50 basis points. “The key for the Fed will now be to carefully calibrate the pace of easing as inflation continues to approach the target and the economy slows down. In fact, while Chairman Powell may signal that 50 basis points will be the exception rather than the rule during this easing cycle, the Fed should be prepared to move with these larger steps if it sees new signs of weakness,” notes James McCann, Deputy Chief Economist at abrdn.

PIMCO economists believe the Fed is on track to ease monetary policy with 25 basis point moves at each of its upcoming meetings. “However, the Fed remains data-dependent. If the labor market deteriorates faster than expected, we expect the Fed to make more aggressive cuts,” they clarify.

In the opinion of Ostrum AM (Natixis IM)’s Chief Economist, “The Fed will continue, but the magnitude of future cuts will depend on the pace of the labor market, while inflation will slow with the sharp drop in oil prices. The issue remains with the ECB, whose cut last week already seems ridiculous.”

From DWS’s perspective, starting the rate cut cycle with a larger step is not without risks. “On the one hand, it implies increased confidence by central bankers in the inflation outlook, although the main factor behind the decision was likely uncertainties about labor market prospects. This carries the risk that the Fed will need to recalibrate its reaction function to incoming data, as we have seen in recent times,” explains Scherrmann.

The Broader Picture

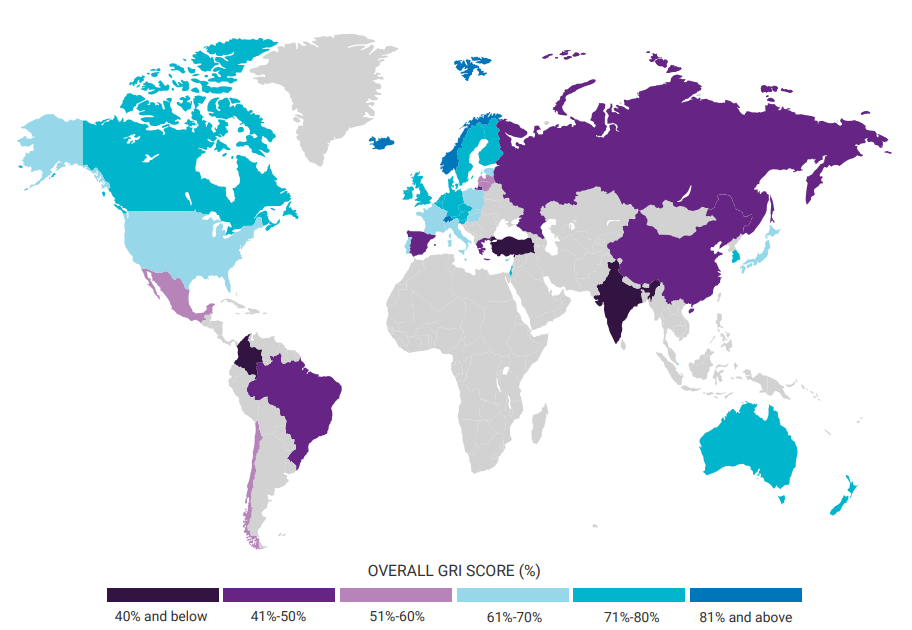

With this rate cut, the Fed is following the same path as most developed market central banks, and consequently, global financial conditions will continue to ease in the coming months. “This will allow several emerging market central banks to resume or continue the easing cycles they had initiated before the Fed. The decline in risk-free rates in developed markets will also lower the external borrowing costs for emerging market issuers, reducing refinancing risks and improving debt sustainability. The easing cycle will incentivize asset allocators to increase their exposure to emerging markets, as the appeal of money market instruments and rates in core developed markets will gradually diminish,” observes Carlos de Sousa, Portfolio Manager of Emerging Markets Debt at Vontobel.

Regarding market reactions, Carlos del Campo from Diaphanum’s investment team notes that the stock market response was not overly dramatic since a 50 basis point cut was a very real possibility. However, “In fixed income, we can see a consolidation of the historical yield curve inversion of recent years coming to an end.”