“Protectionism and the Fed Will Explain the Low U.S. Growth in 2026”

| By Amaya Uriarte | 0 Comentarios

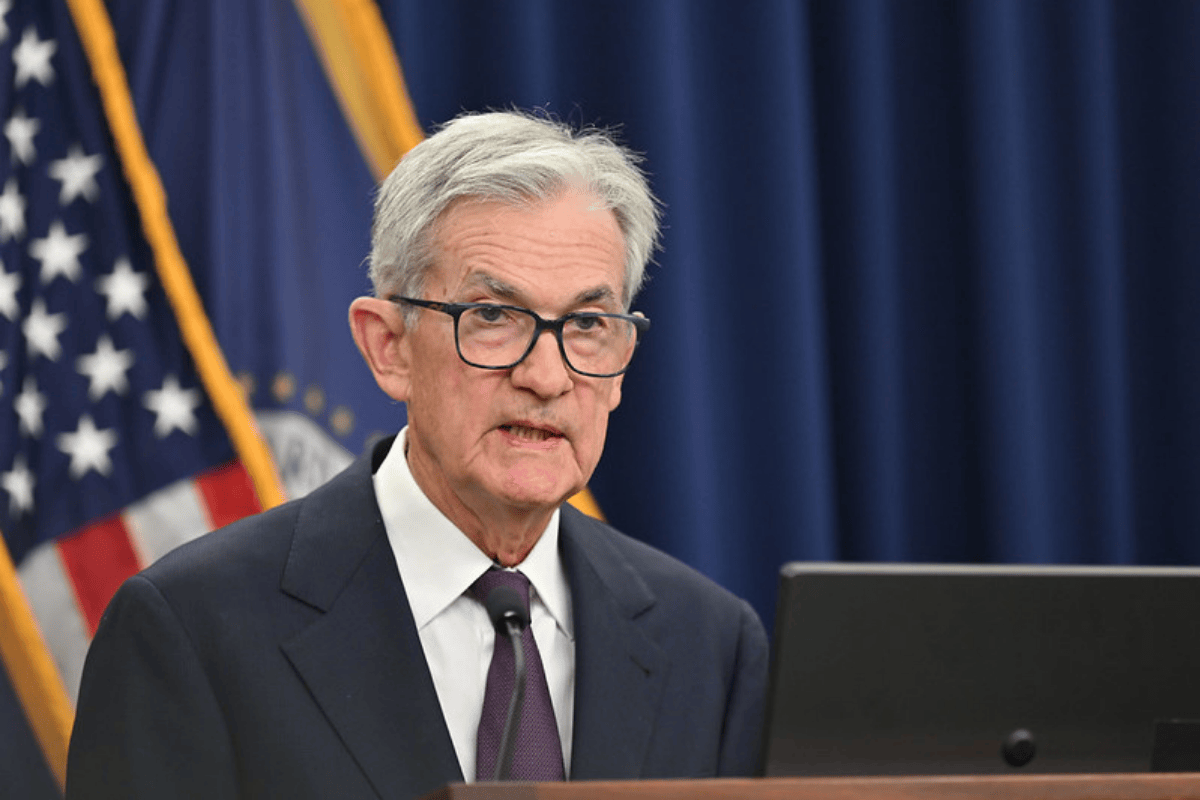

In a conversation with Funds Society, U.S. economist Daniel J. Mitchell, a leading expert on tax and public spending issues, analyzed the pillars of the new Donald Trump cycle in the White House, fiscal tensions, the role of trade, and the outlook for 2026.

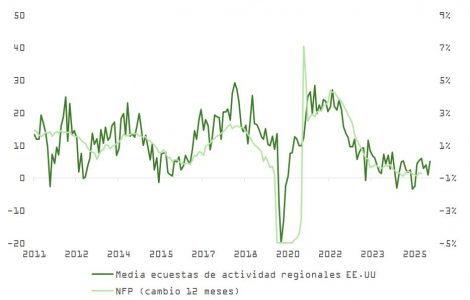

From his point of view, next year the growth of the world’s largest economy will be “modest” in terms of investment and employment due to the “suicidal protectionism” implemented by the “populist” leading the U.S. government, who acts like “Santa Claus,” thinks only in the short term, and neglects long-term growth.

The long-term damage to the economy will be greater, and fiscal risks will increase. The “spending spree will inevitably lead to future tax hikes,” and the risk of another government shutdown in 2026 is rising, he warned.

With a Ph.D. in Economics from George Mason University and a Master’s and Bachelor’s degree in Economics from the University of Georgia, Mitchell began his career in the United States Senate, where he worked as an advisor to Senator Bob Packwood (Oregon) and to the Senate Finance Committee. He also participated in the Bush/Quayle transition team in 1988.

In 1990, he joined The Heritage Foundation, where he developed an extensive career analyzing and promoting fiscal policy, advocating for income tax reform.

In 2007, he joined the Cato Institute as a senior fellow, a position he still holds, focusing on fiscal policy research, flat tax implementation, and the defense of international tax competition. He is also co-founder and president of the Center for Freedom and Prosperity, an organization dedicated to protecting and promoting global tax competition.

A More Protectionist and Interventionist Trump

Mitchell believes that the second term of the U.S. president retains traits of the first but with more pronounced emphasis, especially in trade. In his view, Trump continues to operate under an economic vision in which “the government plays Santa Claus” to gain political support, while his only deep conviction is his commitment to protectionism.

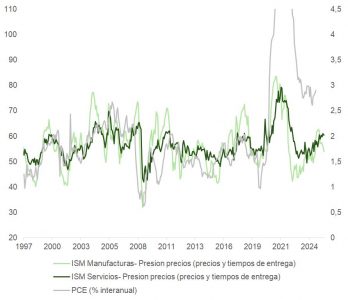

“Protectionism has worsened significantly,” he stated. The economist explained that Trump’s new tariffs imposed on the rest of the world are not based on revenue or geopolitical logic, but on a “lack of understanding” of how international trade works. The result, he warned, is greater economic inefficiency and costs for virtually all productive sectors.

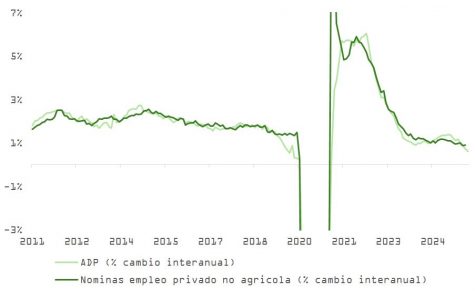

According to Mitchell, the two main economic pillars of the new Trump administration are protectionism as the core of the economic program and immigration restrictions, which he also considers part of the economic package due to their direct impact on the labor market.

His view is critical: deportations or stricter immigration barriers, he argued, will reduce total GDP, although they may raise per capita GDP if they primarily affect low-skilled workers. He pointed to sectors like hospitality, construction, landscaping, and low-skill services as the most exposed to these measures.

Tax Reform: Mixed Effects and Fiscal Tensions

The economist confirmed that the 2017 tax cuts have already been extended and that some pro-growth measures were added, although also “new and absurd loopholes” in the tax code. Mitchell expects a modestly positive impact on growth, investment, and employment, but overshadowed by the economic damage from protectionism.

Is there fiscal space to support a tax cut agenda? For Mitchell, the answer is clear: “100% of the U.S. fiscal problem is excessive spending.” He insisted it is not a revenue issue, and that if not corrected, uncontrolled spending will inevitably lead to future tax increases—something he considers a significant risk to the economy.

Mitchell also emphasized that the greatest risk of the trade agenda is not just inflation or supply chain disruptions but the widespread economic inefficiency that new tariffs will cause.

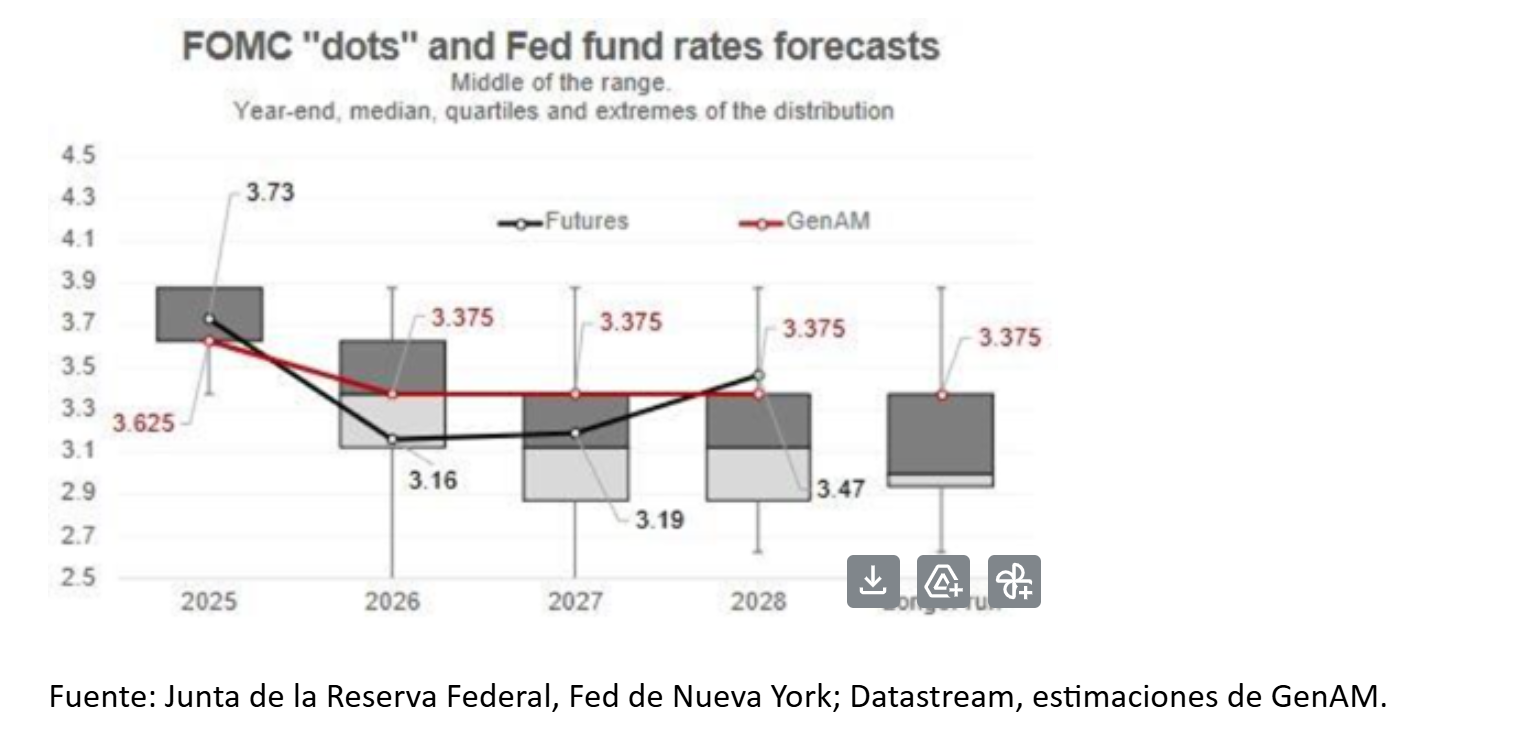

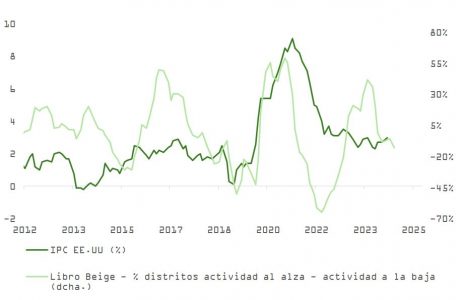

Regarding inflation, he predicted that 2026 will be a year of inflationary pressures—but not due to fiscal or trade policy, but rather the Fed’s monetary policy. He warned that, like “almost all populists,” Trump favors easy money, which could undermine the independence of the central bank.

Looking Toward 2026: Three Scenarios

Mitchell outlined three possible scenarios for 2026:

Optimistic: Trump abandons his “trade war,” providing a boost to growth.

Base case: he maintains the current course, resulting in mediocre growth.

Stressed: protectionism and loose monetary policy deepen, increasing the likelihood of significant deterioration.

When asked about the coherence between pro-dollar policies and the encouragement of the crypto ecosystem, and on the other hand, restrictive immigration policies alongside a strategy of greater engagement with Latin America, Mitchell noted that consistency is not a priority for Trump. “Like all populists, he cares about what pleases voters in the short term,” he concluded.