Jackson Hole: More Focus on Monetary Policy Tools than on Interest Rates

| By Rocío Martínez | 0 Comentarios

Central banks are taking a break from their respective monetary policy meetings in August, but the markets are not entirely devoid of news related to the activities of these institutions. The Jackson Hole Central Bankers Symposium (Wyoming, United States) is the summer’s key event to observe potential decisions in the meetings scheduled for the remainder of the year.

From Thursday, August 22 through Saturday, August 24, senior central bank officials from around the world will share their views on the state of the economy. A significant part of the market is also waiting for clues about the next steps in interest rates.

The main event will take place on Friday, with the appearance of U.S. Federal Reserve Chairman Jerome Powell. All eyes are on him, considering that the U.S. monetary authority has yet to lower interest rates like other institutions.

Bank of America notes that Fed chairs “tend to keep a low profile at Jackson Hole” and that the easiest course for Powell “would be to repeat his July message.” The firm has reasons to believe this will be the case this time, as last week’s economic data delivered a “clear” message: inflation is low enough for the Fed to start cutting, but not so low as to focus solely on its employment mandate. “We remain convinced that the Fed will cut twice this year, in September and December,” the firm asserts, adding that a shift in language from July “would suggest that the committee is ‘very close’ or ‘close’ to the point where monetary policy easing is likely.”

Meanwhile, George Curtis, Portfolio Manager at Vontobel, points out that the data known so far “points to a slowing economy, but one that is still growing,” and expects Powell to highlight this on Friday. “We don’t believe he will rule out a 50 basis point cut, especially considering that another labor report will be released before the September meeting,” he says, but admits that his baseline scenario remains a 25 basis point cut.

There could also be market reactions, as Federal Reserve officials have not changed their tone since the weak non-farm payroll data that triggered mass selling. “There’s a possibility that equities could continue to retreat to mid-July levels.” The S&P 500 equity index has erased its losses for the month, and credit spreads have almost done the same. However, government bond yields remain near their monthly lows, so “either Powell validates this more bearish view, or government bonds will give back some of their recent gains,” Curtis asserts.

David Kohl, Chief Economist at Julius Baer, does not expect many clues at this meeting either. He anticipates that this year’s symposium will offer fewer insights into the path of interest rates and focus more on the appropriate tools for monetary policy. “The return to the trade-off between price stability and maximum employment makes the arguments for cutting rates much clearer, as long as inflation is falling and unemployment is rising,” argues Kohl, who notes that recent positive economic data supports a gradual reduction in interest rates.

The expert points to the event’s title – “Reevaluating the Effectiveness and Transmission of Monetary Policy” – to infer that there will be a debate on the appropriate tools for guiding monetary policy. “This includes the appropriate interest rate, the level or range of inflation, and the amount of liquidity the Federal Reserve wants to provide to financial markets,” he explains.

At the same time, Kohl does not expect much in terms of what is most interesting for financial markets: the trajectory of official interest rates in the coming months. “We expect the scope and pace of monetary easing to depend more on economic data than on the fundamental issue of monetary policy debated at the symposium,” says the expert, who, on the other hand, sees “much clearer” arguments in favor of cutting rates now that falling inflation is accompanied by rising unemployment. Kohl anticipates a 25 basis point cut at each of the upcoming FOMC meetings through the end of the year.

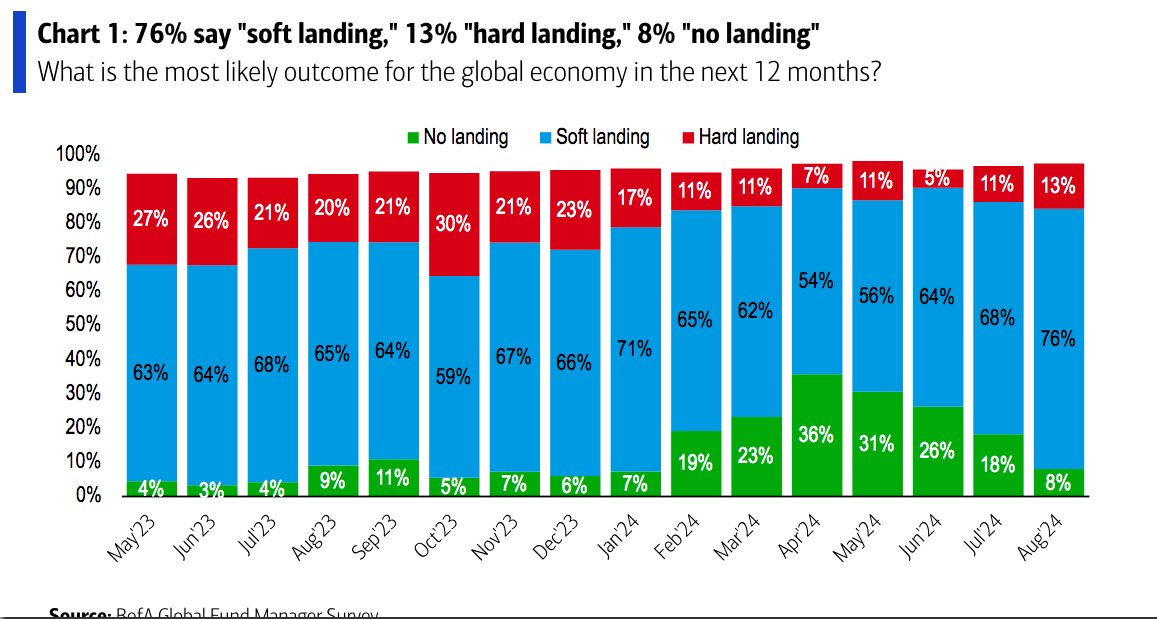

For James McCann, Deputy Chief Economist at abrdn, Powell’s speech at Jackson Hole could signal “that rate cuts are on the horizon, but the speed and extent of the easing remain uncertain.” Given the current moderation in inflation and the cracks appearing in the labor market, the Federal Reserve may prioritize attempting a soft landing by reducing the restrictive nature of monetary policy, according to McCann. He believes it is likely that Powell will indicate the start of an ongoing easing cycle, “setting the stage for rate cuts at each of this year’s remaining meetings.” And while he acknowledges that the good news for the Federal Reserve is that last week’s data from the U.S. confirms that the economy is not heading for an imminent recession, he also notes that U.S. monetary policymakers will have a better perspective on the recent health of the labor market when the Quarterly Census of Employment and Wages benchmark revisions are released this week.

Jean-Paul van Oudheusden, market analyst at eToro, is also aware that these speeches at Jackson Hole have “sometimes” hinted at significant changes in monetary policies. In this case, he expects Powell to highlight the success in controlling inflation and prepare markets for a potential rate cut in September in a speech where he will not take questions. “Although speculation about a 50 basis point cut has increased, July’s CPI data – which largely met expectations – does not currently support an adjustment of such magnitude,” the expert explains, adding that the actual magnitude of the rate cut “will likely depend on August’s labor market data, which will be released in two weeks.”

Guy Stear, Head of Developed Markets Strategy at Amundi Investment Institute, is convinced that the Fed will cut rates three times before the end of the year and could suggest as much at the Jackson Hole symposium. “We expect the Fed to cut rates by 75 basis points between now and the end of the year, with successive 25 basis point cuts at each Fed meeting, and we expect its chairman to continue signaling that the first rate cut is planned for September,” argues Stear.

However, the expert does not rule out the possibility that investors might be disappointed by comments referencing the stickiness of inflation. “If the U.S. two-year yield were to rise back to 4.2%, from its current 4.05%, it would be a good opportunity to increase long positions at the front of the U.S. curve,” he concludes.

ECB

Although Powell will be in the spotlight, ECB President Christine Lagarde will also command market attention. This is the view of Martin Wolburg, senior economist at Generali AM – part of the Generali Investments ecosystem – who expects a rate cut from the European monetary authority, in line with what the Federal Reserve might do.

“The ECB made no changes at its June meeting, as expected. However, the Governing Council considered that the inflation outlook was in line with its forecasts, and the rhetoric on wage growth seemed less concerning in June,” explains Wolburg, who also recalls that at that time, Lagarde herself stated that “what we do in September is totally open.” The expert is aware that July’s inflation data clearly provides some ammunition to the “hawks,” but he expects the “reduction” process to continue, with quarterly cuts in official interest rates of 25 basis points, “until the deposit rate reaches 2.5%.”