BlackRock has announced the launch of the BGF Euro High Yield Fixed Maturity Bond Fund 2027, a fixed maturity bond fund. According to the asset manager, the fund is designed to take advantage of currently elevated yield levels, offering investors a combination of income distribution and capital appreciation. “In the current macroeconomic environment, fixed maturity bond funds can be an option for investors seeking some level of cash flow predictability or looking to stagger their interest rate exposure,” they explain.

The BGF Euro High Yield Fixed Maturity Bond Fund 2027 offers a carefully selected portfolio aimed at providing income and preserving capital until the strategy’s maturity date, which is three years from now. It primarily invests in two types of bonds: high-yield bonds, which the investment team believes will generate income, and high-quality government bonds for risk management. The fund aims to provide income through the European high-yield market, avoiding credit risks over a three-year investment horizon. Its strategy seeks to deliver income and preserve capital for investors holding their units until the Fund’s maturity date.

The asset manager explains that the investment process follows a barbell structure, incorporating high-quality government bonds and carefully selected high-yield bonds (at least 50%). The investment team believes this approach offers the best risk/reward trade-offs within the European sub-investment-grade bond universe. The bond mix is built to optimize yield while minimizing defaults, leveraging the team’s fundamental high-yield research. This investment process seeks to maintain an aggregate BB+ rating and optimize the tax efficiency of any coupon or capital gain, while aiming to sustain a high level of income for investors.

The fund, managed by José Aguilar, Head of European High Yield and Long Short Credit Strategies, is part of BlackRock’s active fixed income platform, which includes $1.1 trillion in assets under management. “As yields remain elevated, the opportunity cost of staying in cash is increasing. In this scenario, fixed maturity bond funds not only offer some visibility in income distribution but also provide investors with the chance to lock in attractive current yields. Moreover, the rise in dispersion in the high-yield bond market may create more opportunities for investors to generate alpha,” noted James Turner, Co-Head of European Fundamental Fixed Income at BlackRock.

Banco Santander has internally announced the appointment of Adela Martín as the new Head of Business Globalization for Wealth Management & Insurance (WM&I) at Grupo Santander, as confirmed by *Funds Society*. Martín will work closely with country teams and report directly to Javier García Carranza, Head of Asset Management, Private Banking, and Insurance.

Previously, Martín led Private Banking in Spain and was most recently in charge of the Wealth division in Spain. Her extensive knowledge of the three business areas will enable her to drive the global division by leveraging her deep understanding of how the business operates at a local level. The group’s new model aims to further globalize and coordinate its businesses, according to sources from the bank.

In light of this change, the bank has also confirmed the appointment of Víctor Allende as the new Head of Santander Private Banking Spain. Allende will report to Alfonso Castillo, Global Head of Santander Private Banking, and to the CEO of Santander Spain. His role will take effect at the end of September, and he will play a key role in transforming Spain into a leading private banking hub in Europe.

With nearly 25 years of experience in private banking, Allende brings extensive knowledge of the Spanish market. He spent the last 12 years at Caixabank, where he led a major transformation of the business, focusing on customer-centric strategies. Before that, he held various positions at Morgan Stanley and AB Asesores. Allende holds a degree in Economics and Business from the University of Navarra and an MBA from IESE.

Following these appointments, Nicolás Barquero and Francisco Bosch will report to their global business leaders and the CEO of Santander Spain. Additionally, the bank has made another key appointment: Monika Vivanco will take over as Head of People and Culture, replacing Patricia Álvarez de Ron, who is leaving the company.

Grupo Dunas Capital has announced the appointment of Natividad Sierra as Managing Director and Chief of Investor Relations for the firm’s alternative assets division. In her new role, she will be responsible for leading the fundraising processes for the firm’s alternative asset vehicles and managing investor relations. Additionally, she will join the Group’s Executive Committee.

With this appointment, Grupo Dunas Capital is once again focusing on the development and consolidation of its real assets business line. The firm advises several alternative asset vehicles that invest long-term in transport assets, as well as in impact projects, renewable energy, and energy efficiency. “It is an honor to join the team at Grupo Dunas Capital, a company built on strong values that has experienced exceptional growth since its creation, thanks to its unique business model, philosophy, products, and a highly professional team. In this new phase, I will continue to develop strategic, long-term relationships with investors, who will find in our product catalog a unique value offering in Spain,” said Natividad Sierra, the newly appointed Managing Director and Chief of Investor Relations (Alternatives).

Natividad Sierra brings 30 years of experience in the financial sector, primarily in private equity, as well as in mergers and acquisitions and corporate banking. Prior to joining Grupo Dunas Capital, she was Head of Investor Relations & ESG at Corpfin Capital, one of the leading private equity firms in Spain, where she successfully led the fundraising efforts for several funds and oversaw the ESG function. She was a partner at the firm, Director of Investments, and a member of the Board of Directors of several companies. She began her career in corporate banking in the Structured Finance division at BNP Paribas and later worked as an Associate at Apax Partners, executing mergers and acquisitions.

Regarding her education, she holds a degree in Business Administration from Universidad Pontificia de Comillas ICADE and a degree in Law from UNED. Her executive education includes the General Management Program at IESE and the Executive Program in Senior Management, Promociona, at ESADE. Additionally, she is co-President of Level 20 in Spain, a non-profit organization that promotes gender diversity in the European private equity sector.

Anta Asset Management, an independent firm belonging to Corporación Financiera Azuaga, has appointed Eduardo García-Oliveros as its new Director of Private Equity.

García-Oliveros brings over 10 years of experience in alternative markets, having worked at organizations such as Gala Capital, Nomura, and most recently, Alter Capital, where he served as Director of Investments and led the Madrid office.

Throughout his career, García-Oliveros has gained extensive expertise in alternative markets, with a particular focus on direct private equity investments and advising on mergers and acquisitions.

He holds a degree in Business Administration with International Honors Cum Laude from ICADE and Northeastern University (Boston).

Jacobo Anes, CEO of Anta Asset Management, emphasized the significance of this appointment. “Eduardo’s experience will help us strengthen our alternative investments line to tackle the upcoming projects. We aim to stand out in the industry as a manager offering unique and high-quality products,” he stated.

India has consistently been one of the most expensive countries in our emerging markets universe, boasting a larger number of high-quality companies with strong structural growth. However, over the past year, it has become even more expensive. In our view, India deserves to trade at a premium, but the high valuations and elevated expectations remind us to be particularly vigilant and disciplined regarding valuation levels.

The most overvalued areas are the small- and mid-cap segments of the Indian equity market, as well as companies in sectors more sensitive to government actions. However, it is still possible to find reasonably valued companies. Additionally, we see significant differences in valuation depending on the sector, and even among specific companies. In particular, we find relative value opportunities in the financial, technology services, and pharmaceutical sectors, all of which exhibit high-quality operations and management.

In Southeast Asia, Vietnam has faced challenges in recent years due to a deteriorating real estate market and a sudden liquidity shortage caused by anti-corruption measures and regulatory reforms in the corporate bond market. The market is volatile and has been revalued, requiring caution from foreign investors. However, from a valuation perspective, Vietnam is appealing. In the first half of 2024, Vietnam recorded a year-on-year GDP growth of 6.4%, demonstrating solid economic performance. The country serves as an important outsourcing hub for the Asian region, benefiting from recent supply chain shifts. Vietnam is becoming a new manufacturing center, attracting increasing foreign investment from international companies like Apple, Samsung, and Intel. The shift in supply chains from China to Vietnam is still focused on low-value-added production, such as final assembly, where Vietnam holds a competitive edge due to lower labor costs.

In our opinion, Indonesia also offers solid investment potential as one of the strongest and fastest-growing economies, not only in Southeast Asia but across the entire emerging markets region. It boasts a diversified economy and substantial wealth in natural resources such as coal, nickel, and copper. Both domestic consumption (53% of GDP) and exports of commodity-related products are contributing to a robust current account balance. At the same time, Indonesia is undergoing a political transition, raising some fiscal concerns, which has led to widespread sell-offs, making the market more attractive to value investors like us.

Finally, one of the markets that has lost favor with investors in recent years is South Africa. However, following surprising results in recent elections, which have led to the formation of a new national unity government, the country’s fundamentals are improving. Investor positioning is also low, which could present opportunities for value investors. As the country overcomes its energy problems and the quality of its companies improves, South Africa is becoming an interesting market once again.

As long-term equity investors, we understand the need to be selective and recognize that the world is constantly changing. Our analysis highlights that the quality of management can make a significant difference in company outcomes and their ability to navigate challenging market environments. Therefore, evaluating the management teams of the companies in our investment universe is a crucial part of our investment process, alongside our focus on companies with sustainable business practices that can generate long-term returns.

Opinion piece by Laurence Bensafi, portfolio manager and deputy head of the emerging markets equity team at RBC BlueBay Asset Management.

The European Fund and Asset Management Association (Efama) highlights in its document “The EU Must Adopt a New Deal to Mobilize EU Savings” that, according to the European Commission, more than €600 billion must be invested annually to achieve a successful green transition, as well as additional billions to support the digital transition. In light of this reality, Efama calls for the creation of the necessary investment conditions to address these challenges.

What exactly do these measures to create the “necessary investment conditions” entail? According to Bernard Delbecque, Senior Director at Efama, “a decisive shift in EU policies is needed, particularly in competition and industrial policies, to improve investment opportunities, boost the valuation of Europe-based companies in global stock indices, and increase investments from asset owners into EU companies. Once asset owners see more promising prospects in the EU, they will increase their investments in the region, thereby supporting the financing of the green and digital transitions.”

The report prepared by Efama states that to unlock private investment and finance the EU’s capital needs, it is crucial to leverage the potential of the Single Market and develop an effective Capital Markets Union (CMU) that offers more opportunities and better outcomes for European companies and savers. Additionally, it is imperative to redirect the European Commission’s Retail Investment Strategy to encourage EU citizens to invest more in capital market instruments and promote retirement savings, thereby increasing the pool of available savings to support the EU’s ambitions.

Impact on UCITS Funds

Efama sees addressing these challenges as urgent, as its report demonstrates that this situation is impacting the growing allocation of UCITS assets to U.S. equities, attributing this trend to the superior performance of U.S. stock markets. “By the end of 2023, 44.6% of UCITS equity portfolios were invested in U.S. assets, compared to 19.2% in 2012. The high exposure of European UCITS equity funds to foreign assets is specific to Europe, according to the study. In 2023, equity funds domiciled in the EU and the UK had 27% and 29% of their portfolios invested in local stocks, respectively, compared to 78% and 84% for equity funds in the U.S. and the Asia-Pacific region,” the report argues.

The document outlines several factors that may explain the lower domestic bias among European investors, such as the benefits of cross-border investments, the role of financial advisors, the development of fund platforms facilitating investments in funds tracking global indices, the relatively small size of EU stock markets, and the enthusiasm for leading U.S. tech companies.

“The strong performance of U.S. markets, which led to an increased allocation of equity assets to U.S. stocks, reflects a combination of factors and policies, including robust population growth, higher spending on research and development, substantial fiscal stimulus, and lower energy prices,” the report explains.

A Matter of Competitiveness

Efama’s main conclusion is that, to compete effectively on the global stage and foster the emergence of industrial leaders based in Europe, the EU must embark on a transformative path to boost economic growth, improve investment opportunities, generate higher investment returns, and increase the market capitalization of European companies. In their view, these are necessary conditions to attract more investment capital to the EU and ensure that European companies have access to financing throughout their development.

“This, in turn, could initiate a virtuous circle where higher economic growth strengthens asset owners’ confidence in the EU economy, thereby bolstering the ability of asset managers to provide a critical source of stable, long-term financing for European governments, companies, and infrastructure projects,” Efama concludes.

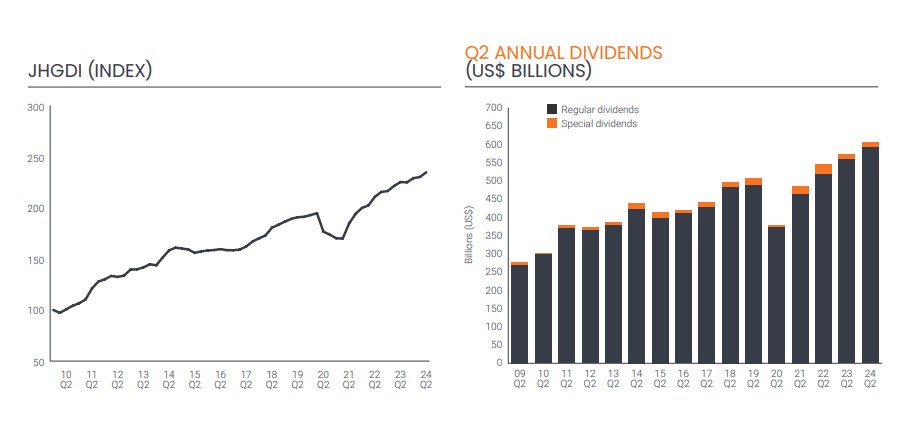

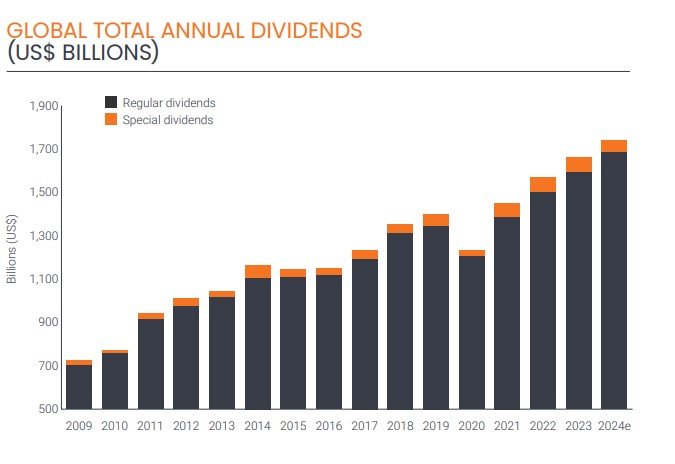

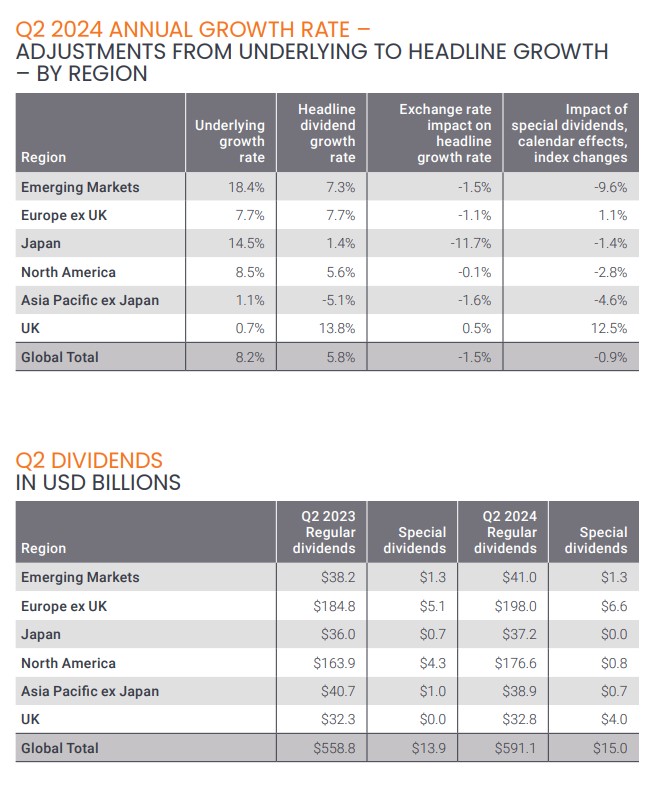

Global investors focused on income generation enjoyed a strong second quarter in 2024, according to the latest edition of the Janus Henderson Global Dividend Index. Dividends increased by 5.8% on a headline basis, reaching a record high of $606.1 billion. The underlying growth rate was even higher at 8.2%, after adjusting for currency effects, particularly the weakening of the Japanese yen.

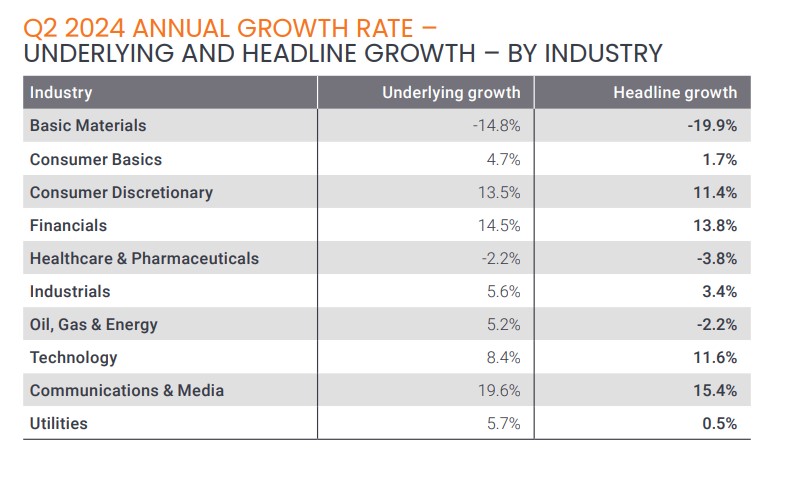

According to the asset manager, the initiation of dividend payments by major U.S. companies such as Meta and Alphabet boosted global growth in the second quarter by 1.1%. However, overall growth was widespread, with 92% of companies worldwide either raising or maintaining their dividends. Additionally, one-third of sectors posted double-digit underlying growth, while dividends declined in only three sectors.

Geographic Analysis

The second quarter is the peak season for dividend payments in Europe. Payouts rose 7.7% year-on-year, reaching a record $204.6 billion for the region. France, Italy, Switzerland, and Spain all saw record dividend payouts. More than half of Europe’s dividend growth came from banks, which have benefited from higher interest rates. In contrast, Germany saw a 1.2% decline in payouts, mainly due to Bayer’s significant dividend cut. In the U.S., dividends increased by 8.6%, with 40% of that growth attributed to Meta and Alphabet paying dividends for the first time.

The second quarter is also seasonally significant in Japan, where dividends increased by around 14% on an underlying basis, setting a new record in yen. However, the weak exchange rate prevented record payouts in dollar terms. Toyota Motor, the largest dividend payer in Japan, made one of the largest increases after reporting record profits in its last fiscal year. Elsewhere in the Asia-Pacific region, dividends remained stable in Hong Kong but fell sharply in Australia due to a cut by Woodside Energy. Singapore, Taiwan, and South Korea all posted double-digit growth.

Sector Analysis

Once again, banks were the primary drivers of dividend growth, accounting for one-third of the underlying year-on-year increase. European banks contributed the most, although this trend was evident globally. Insurers, automakers (especially in Japan), and telecommunications companies also played a significant role in the second quarter’s growth.

Outlook and Trends

Following a strong second quarter, and given the substantial contribution that new dividend payers could make this year, Janus Henderson has raised its 2024 dividend forecast. The asset manager expects companies worldwide to distribute a record $1.74 trillion, marking a 6.4% underlying increase compared to 2023 (up from the 5.0% estimated in the first-quarter report) and a 4.7% headline increase (compared to the previous 3.9% estimate).

“We had optimistic expectations for the second quarter, and the outlook was even brighter than anticipated thanks to the strength in Europe, the U.S., Canada, and Japan. Economies around the world have generally weathered the impact of higher interest rates well. Inflation has slowed, and economic growth has been better than expected. Moreover, companies have proven resilient, with most sectors continuing to invest for future growth. This favorable environment has been especially positive for the banking sector, which enjoys solid margins and limited credit deterioration, boosting profits and generating ample cash for dividends,” said Jane Shoemake, Client Portfolio Manager in the Global Equity Income team at Janus Henderson.

In her view, the initiation of dividend payments by major U.S. media and technology companies such as Meta, Alphabet, and China’s Alibaba, among others, is a highly positive sign that will drive global dividend growth by 1.1 percentage points this year. “These companies are following a well-established path seen in growth sectors over the past two centuries, reaching a stage of maturity where dividends are a natural way to return excess cash to shareholders. By doing so, they have surprised skeptics who believed this group of companies was different. The stock market evolves over time as sectors rise and fall to meet society’s changing needs. Paying dividends will also increase their appeal to investors for whom dividends are a vital part of their investment strategy and could encourage more companies to follow their lead,” Shoemake added.

Schroders has announced the appointment of Richard Oldfield as Group CEO, succeeding Peter Harrison, effective November 8, 2024, subject to regulatory approval. According to the firm, this announcement follows an orderly and thorough succession process that began in April and included a global search, with both internal and external candidates. The process was led by the Chair of the Board, supported by a Board Subcommittee, our Senior Independent Director, and a leading search firm. Peter Harrison will remain Group CEO until November 8, 2024, after which he will step down from the Board and continue working with Richard until the end of the year.

Until now, Oldfield served as Chief Financial Officer at Schroders, bringing with him extensive experience. He spent 30 years at PwC, where he held senior roles, including Vice Chairman of the firm and Global Markets Leader. Reporting to the Global Chairman, he was responsible for increasing profitability across PwC’s business lines while advising global clients on their most complex matters. “Since joining Schroders, Richard’s contribution has been significant, bringing a fresh perspective on capital management, driving new initiatives such as the inaugural bond issuance earlier this year, and integrating commercial discipline across the Group,” the company noted.

Dame Elizabeth Corley, Chair of Schroders’ Board, stated: “Richard has demonstrated his natural ability to lead client- and people-focused businesses. He has a global outlook, a strategic growth mindset, and a proven track record of leadership. The Board unanimously determined that Richard was the most suitable candidate.”

Corley explained, “It was clear that his strong business vision would drive decisive transformation at an accelerated pace, and we are confident that he will advance our strategic priorities, enabling Schroders to continue growing and serving clients. His personal values are closely aligned with Schroders’ culture; he is authentic, sincere in his approach, passionate about clients, and committed to nurturing talent.”

Meanwhile, Peter has shown strong leadership and unwavering commitment, leading the business through a remarkable transformation over the past eight years. He has successfully expanded our capabilities in both private and public markets, overseeing sustained growth in our Wealth business and more than doubling assets under management to a record £773.7 billion. It has been a true pleasure working with Peter, and I would like to thank him, both personally and on behalf of the Board, for his exceptional service.”

For his part, Richard Oldfield said, “It is an honor to have been chosen as the next Group CEO of Schroders. Since joining, I have seen what a great company Schroders is. We are known for our long-term approach, meeting client needs, and delivering excellent investment returns. Despite the challenges facing the industry, I know we have the capabilities and the people to seize the right opportunities to grow our business and be one of the world’s leading wealth creators. I am eager to get started.”

“Schroders will always hold a central place in my life as I began my career here straight out of university. I am very proud of what we have achieved, and I feel a great affinity with the wonderful people working at the firm. When we hired Richard, I was impressed by his vast experience in managing and growing businesses, as well as his client-centric approach. He has brought fresh ideas during his first year, and I am confident he will continue to drive the business forward,” concluded Peter Harrison, the current CEO.

Consolidation remains a highly active trend across the financial industry. According to the latest report from Cerulli Associates on this sector, titled “Wealth Management Consolidation: Analyzing the Drivers Behind a M&A Deal Environment”, the pursuit of scale and the goal of capturing a larger share of the advisory value chain are fueling merger and acquisition (M&A) activity throughout the industry. The consulting firm believes this trend will create a more competitive environment for wealth managers.

The imperative to grow larger and more profitable has driven much of the intensified M&A activity that has been underway in the asset and wealth management industry for over a decade, resulting in an environment dominated by key players. According to Cerulli, the top five wealth management firms control 57% of the assets under management (AUM) of broker-dealers (B/D) and 32% of B/D advisors, while the top 25 B/D firms and their various affiliates control 92% of the AUM and 79% of the advisors.

Wealth managers are increasingly focused on providing truly comprehensive wealth management services, pursuing M&A to strengthen capabilities and capture more of the value chain. Although increasing share of the client’s portfolio has been an elusive goal in the industry for decades, Cerulli sees significant consolidation opportunities among wealthy investors. According to the research, 57% of advised households would prefer to consolidate their financial assets with a single institution; however, only 32% currently use the same provider for both cash management and investment services.

“Following a merger or acquisition, companies rarely emerge as well-oiled machines offering top-tier capabilities and services. The vertical integration of technology systems, client account migration, and changes in workplace culture are all potential pain points when an organization restructures. As wealth management firms enter new segments through acquisition, they must have a plan to transition clients to service models that meet their needs,” says Bing Waldert, Managing Director of Cerulli.

According to the firm, now more than ever, due diligence is a step that must be fully developed. “Deals that make sense on paper can turn into cautionary tales when acquirers miscalculate the impact of merging operations,” says Waldert. “In a wealth management environment where advisors and assets are more mobile than ever, there is an increased potential for a deal to have negative ramifications for advisor retention,” Waldert concludes.

M&G continues to make progress on the three strategic priorities it has set: financial strength, simplification, and growth. This was highlighted during the presentation of its first-half results, where it acknowledged “significant advances in M&G’s transformation, focusing on our strategic priorities” over the past 18 months.

“Despite a challenging market environment in the first half of the year, we have delivered another strong financial performance, with adjusted operating profit and capital generation almost matching last year’s excellent results. Our simplification agenda is advancing well, achieving cost savings of £121 million so far. We have made substantial progress across all our financial goals, and reflecting our strong track record and commitment to solid results for shareholders, we are now announcing upgrades to our capital generation and cost-saving targets,” said Andrea Rossi, Group CEO.

According to Rossi, the firm continues to drive its strategic priorities, “combining the Life and Wealth operations to accelerate our growth plan in the UK retail market. We also see growth opportunities in our international presence and in expanding our product offering,” he noted.

The Transformation of M&G

In its review of the first half of the year, the firm highlighted the good momentum in its Transformation program and noted that they are at the “midpoint” of this three-year initiative to “create a more agile and efficient organization.” To achieve this, “we continue to enhance our ability to respond to customers, reduce costs, and lead growth,” they affirmed.

According to their results, in the first half of 2024, they reduced costs by 4% compared to the same period in 2023, “more than offsetting inflationary pressures and freeing up resources to support investment in growth initiatives, thanks to the £121 million in cost savings since the program’s launch in early 2023,” they clarified.

Following a strategic review and in line with its commitment to operational discipline, they explained that they have decided to focus and streamline their Wealth strategy by combining Life and Wealth operations under the leadership of Clive Bolton. “With this change, we will be better focused on serving the UK retail market, complementing PruFund with life insurance solutions, reducing duplication, and improving efficiency,” they commented.

Regarding their cost reduction plan, they explained that they have raised their target from £200 million to £220 million by 2025, thanks to the progress made so far. “This target increase excludes any additional benefits arising from the streamlining of our operating model announced as part of the half-year results presentation.”

Growth and Outlook

The firm believes it is “successfully navigating a challenging macroeconomic environment.” “We have delivered strong performance while positioning the Group for sustainable long-term growth, focusing on capital-light business models in Asset Management and Life Insurance,” they emphasized.

They argue that the firm is well-positioned to face the current uncertain economic climate due to its diversified business model, international presence, attractive products and services, investment capabilities, and expertise. “The progress made in the first six months of the year supports our continued confidence in meeting our strategic priorities and financial goals, as we remain focused on transforming M&G to deliver excellent outcomes for our clients and shareholders,” they noted.

In this context, the firm reiterated that its priorities are clear: “Maintaining our financial strength, building on the progress already made in simplifying the business, and achieving profitable growth in the UK and internationally.”