Outlook for Latin America: Electoral Processes, the Dollar, Trade Tensions, and Inflation

| By Amaya Uriarte | 0 Comentarios

According to the latest report by Solunion, a credit insurance company offering services related to commercial risk management, the region is experiencing a combination of consumption dependence, low investment, and the challenge of balancing external competitiveness with internal purchasing power, all within a context of persistent inflation, political tensions, and increased exposure to trade and security risks.

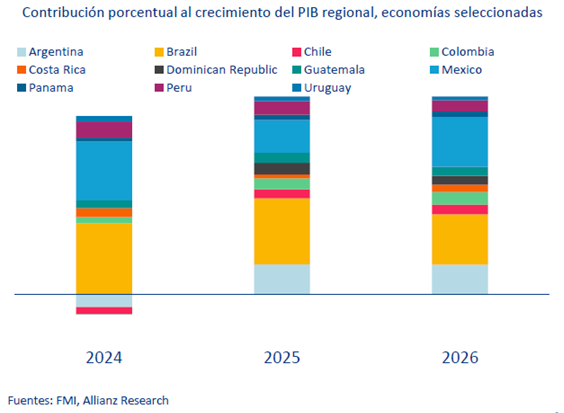

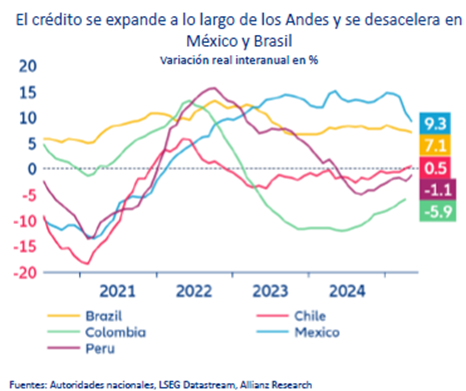

Among its findings, the report notes that Latin America’s growth in recent years has been driven by the boom in commodities, increased agricultural volumes, and strong domestic consumption—factors that led to upward revisions in economic forecasts between 2022 and 2024. However, this expansion period appears to be giving way in 2025 to a phase of stalled growth.

Key Findings

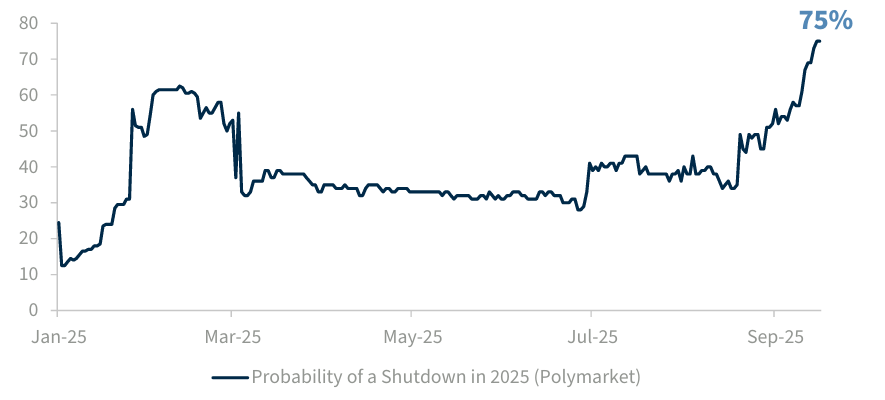

“Systemic uncertainty—stemming from trade tensions, geopolitical conflicts, and financial volatility—is combining with the appreciation of regional currencies against the dollar. This movement, while improving internal purchasing power, reduces export competitiveness and encourages an increase in imports, displacing local production,” notes Luca Moneta, Senior Economist for Emerging Markets & Country Risk at Allianz Trade, one of Solunion‘s shareholders.

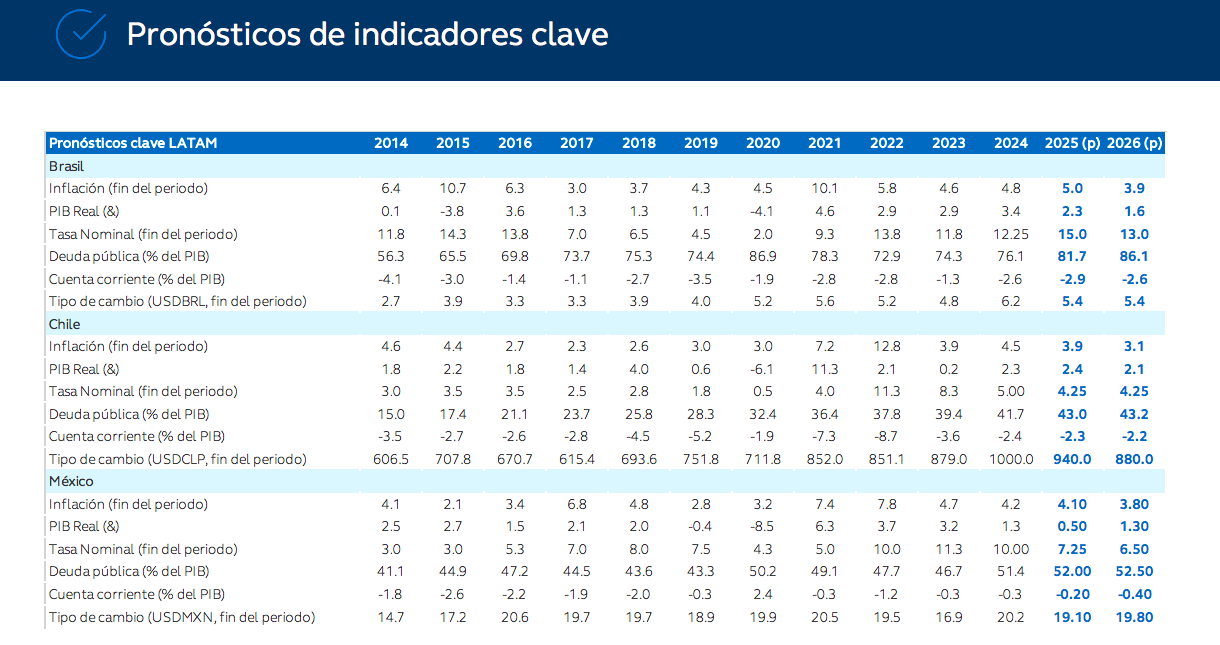

According to the report, in some cases, this effect has been amplified by the acceleration of trade operations to avoid tariffs, adding volatility to trade flows. For 2025, stagnant growth is expected in many economies, as well as additional risks in 2026 for key markets like Mexico and Brazil, where factors such as slowing consumption, declining remittances, and falling commodity prices could negatively impact economic activity.

“This is a scenario in which Argentina gains prominence and partially offsets the lower contribution of these two economies to regional growth,” the report adds.

According to the report, inflation remains one of the region’s main challenges, with persistent pressures in several markets despite restrictive monetary policies. In various countries, benchmark interest rates appear to have reached their peak and, based on central bank communications, could begin to decline. The average real interest rate in the region remains approximately two percentage points above that of the United States, which has contributed to the strength of local currencies.

“If interest rates were to fall prematurely and the Fed did not resume an expansionary cycle, local currencies could weaken and inflation could rise. In more dollarized economies such as Mexico and Chile, the additional boost to growth would be almost entirely offset by this price effect,” the report explains.

A Tightly Packed Electoral Calendar

A key point in the report is that the 2025–2026 electoral cycle in Latin America is unfolding in a context of growing polarization and a lack of clear majorities—a widespread phenomenon that adds uncertainty to the economic outlook.

“Insecurity is another factor impacting investment, especially in consumer-oriented sectors. Added to this is a rise in international litigation, including cases initiated between countries and investors within the region itself, with particular impact on strategic sectors such as mining and energy resources,” it states.

For its part, Argentina is beginning to emerge from recession thanks to economic stabilization measures, although inflation is expected to remain high (24% by the end of 2025).

In Chile, consumption is rebounding due to the revaluation of copper and macroeconomic stability, but investment is constrained by the volatility of the peso.

Colombia maintains growth driven by consumption (77% of GDP), but suffers from low fixed investment, elevated fiscal risk, and political uncertainty.

Lastly, Peru maintains macroeconomic stability, with inflation below 2% and low unemployment, although domestic consumption remains weak and mining output is declining.

Ecuador, meanwhile, is showing signs of recovery, with cocoa emerging as a new key sector in primary production.