A Less Restrictive Fed: Ahead of a New Rate Cut and the End of QT

| By Amaya Uriarte | 0 Comentarios

The U.S. Federal Reserve (Fed) faces its monetary policy meeting with the latest headline CPI data for September still resonating, highlighting a further slowdown in underlying price pressures. The index rose 0.3% month-on-month—compared to the previous 0.4%—while core inflation slowed to 0.2%—down from the previous 0.3%.

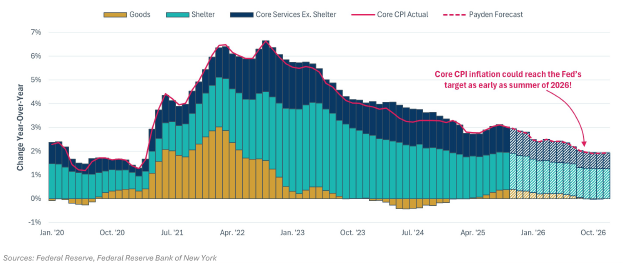

The report revealed that core CPI inflation increased by 0.2% in September, aligning with the Fed’s 2% inflation target. “Specifically, while tariffs pushed up goods prices, core services and housing prices continue to moderate. Owners’ equivalent rent—the most significant and sticky component of core CPI inflation—recorded its lowest monthly reading since January 2021. The moderation in core inflation, along with continued labor market weakness, supports the possibility of another rate cut by the Fed at this week’s FOMC meeting,” explains Payden & Rygel.

Looking ahead to 2026, in their view, as tariff-related price pressures fade over the next 12 months and service inflation continues to cool, we can anticipate a scenario in which core CPI inflation reaches the Fed’s 2% target by late summer 2026. And, as the Fed governor noted in his latest speech, inflation on track toward 2% will not pose “an obstacle to a more neutral monetary policy.”

“The Fed officials will not be going into the October FOMC meeting completely blind, though they will be navigating through an uncomfortable haze. Since the federal government shutdown began earlier this month, there has been a scarcity of U.S. macroeconomic data releases, particularly regarding the labor market, and we don’t yet know when this data drought will end. At least, the Fed received the September CPI data on Friday, for which a slight uptick is expected,” notes the latest report by Ebury, the global fintech specialized in international payments and currency exchange.

According to the experts, the Fed could rely on this data to restart the cycle of rate cuts. If this happens, it would be the second consecutive cut and would confirm that the Fed is now more concerned about the labor market slowdown than about potential inflation spikes.

A New Cut

Experts agree that the communication received from the Fed ahead of the October FOMC meeting suggests that the lack of available data will not prevent central banks from cutting rates by another 25 basis points. “Which seems odd, considering we are flying blind due to the absence of new official data caused by the government shutdown. However, it is reasonable to assume that labor market conditions have not changed significantly since last month,” says Christian Scherrmann, chief U.S. economist at DWS.

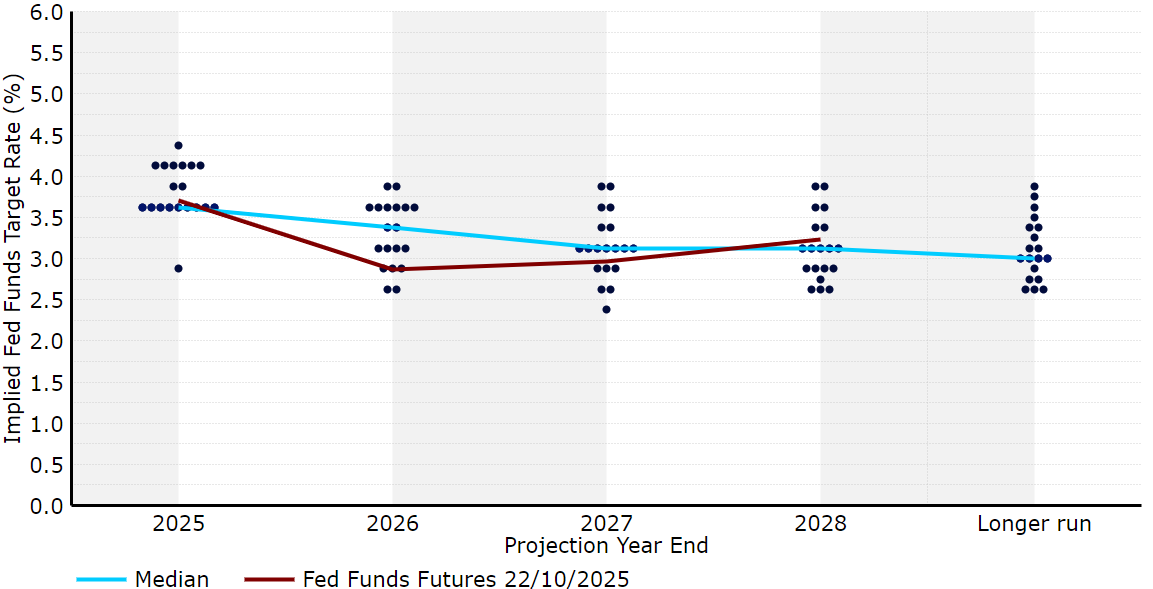

He adds that renewed concerns about the health of the financial system, stemming from weaknesses in certain credit sectors, could provide final support for a 25 basis point rate cut and the end of quantitative tightening. “So far, so good, and markets appear well-positioned in terms of expectations for the upcoming meeting. However, beyond the October meeting, it would be unwise to become complacent. While another cut in December is consistent with the current dot plot, the median of Fed members only marginally supports this outcome. Not everyone favors rapid cuts, and some have voiced concerns about potential inflationary pressures,” Scherrmann argues.

“Historically, precautionary cuts have rarely been one-off measures. A new round of easing would not only mirror last year’s sequence of three consecutive cuts—totaling 100 bps between September and December—but also align with previous ‘insurance cycles.’ In three out of four cases since 1980, the Fed cut rates again within 90 days of the first reduction. Given the limited visibility in the current economic, political, and trade environment, as well as the ‘curious balance’ observed in the labor market—where both labor supply and demand have significantly moderated over the year—monetary policy decisions remain highly data-dependent. Although it would take considerable positive surprises in growth and inflation to avoid a new cut, upcoming price and employment data (with the September jobs report still unpublished due to the shutdown) could decisively influence the FOMC’s decision,” says Michael Krautzberger, global CIO for fixed income at Allianz Global Investors.

In the opinion of Guy Stear, head of developed market strategy at the Amundi Investment Institute, the Fed is expected to cut rates not only in October but also in December and two more times in the second quarter of 2026. “The market expects this as well, and the more interesting question is whether the Fed’s press conference will support the very aggressive cuts already priced into the curve through early 2027. Equally important will be understanding how the Fed plans to address shrinking liquidity at the short end, given the large volume of Treasury issuance in recent months. We could see a slight increase in two-year yields in the U.S. if the Fed disappoints the market’s aggressive expectations for rate cuts, but yields could also be supported if the Fed starts increasing system liquidity,” Stear explains.

What We Know

Experts have been trying to find clues about the Fed’s upcoming narrative from Chair Powell’s speech on monetary policy outlook at the National Association for Business Economics last Tuesday in Philadelphia. Specifically, Powell confirmed to markets that the October rate cut, which the Fed had already hinted at in its previous meeting, remains on the table. In the same speech, he expressed concern over lower hiring levels, which could pose a real risk to the U.S. economy. He also explicitly stated that, based on the available data, the labor market outlook had not changed since the September meeting, when the Fed’s dot plot outlined two additional cuts for 2025.

“Powell focused on the Fed’s balance sheet and stated that the reduction could be concluded in the coming months. The speech did not introduce any new elements, and the Fed appears on track to reduce rates by 25 basis points at its upcoming meeting on October 28 and 29. The odds of easing at each of the next two meetings have risen above 100%, so the momentum for a 50-basis-point easing cycle is starting, though it remains unlikely in our view,” says Karen Manna, fixed income client portfolio manager at Federated Hermes.

This month’s meeting will not include updated macroeconomic projections or a new dot plot. Therefore, in Ebury’s opinion, markets will scrutinize the tone of the bank’s statement and Powell’s press conference. “Given the absence of new economic releases, we believe the bank’s statement will be practically the same as in September. The Fed will likely once again highlight downside risks to employment, possibly noting that they have increased, and that the federal shutdown has made the decision-making process more difficult. However, the upside risks to inflation remain a headache for the Fed and should warrant a cautious response, despite the belief that the inflationary impact of tariffs will be transitory,” the fintech argues in its report.

More Accommodative Liquidity Conditions?

Cristina Gavín Moreno, head of fixed income at Ibercaja Gestión, agrees with this view and adds what she sees as the most relevant aspect of the meeting: “The end of the quantitative tightening (QT) process and the optimal size of the Fed’s balance sheet are additional points of discussion that are on the table, and this meeting could shed more light on them.”

Florian Späete, senior bond strategist at Generali AM, part of Generali Investments, notes that although the language is vague, Powell’s remarks suggest that quantitative tightening (QT) could end as early as this year. “This measure had previously been expected in the first quarter of 2026. It would represent a shift toward more accommodative liquidity conditions, easing pressure on funding markets. Improved liquidity and downward pressure on the term premium would offset the increasingly pronounced steepening trend in yield curves. However, overall, we assume that global yield curves still have room to steepen, given the higher inflation environment and rising public debt levels,” he states.

According to his analysis, since QT was already expected to end in early 2026, the impact on risk assets and the U.S. dollar is likely to be limited. “The easing of financial conditions, further interest rate cuts by the Fed, and relatively modest investor positioning are also favorable factors. The depreciation of the U.S. dollar, which we had already anticipated, should also be supported by the end of QT. The possible end of QT by the Fed is consistent with the idea of a less restrictive monetary policy in the United States,” he concludes.