The Second Day of the Miami Fund Selector Summit, Focused on Credit and European and Quality Equity Strategies, and also Supported by Big Data

| By Alicia Miguel | 0 Comentarios

Opportunities in equities, from a quality perspective (advocated by Investec), focused on Europe (an attractive option for Carmignac) or with an alternative management perspective and using big data as support (BlackRock), were the focus of much of the second and last day of the third edition of the Fund Selector Summit organized by Funds Society and Open Door Media on the 18th and 19th of May in Miami. But in this forum there was also room to talk about credit opportunities, championed by Schroders -which focused on high yield opportunities- and NN IP -in US investment grade credit.

Still Life Left in Credit

Thus, Julie Mandell, Fixed Income Investments Director at Schroders, said that there is still life left in this credit cycle and focused on high-yield opportunities. “The financial crisis forced central banks to create solutions: first cut rates to zero, but then came the non-traditional measures like QE, and the purchase of bonds,” she points out, describing the environment of liquidity and low rates, which were even negative after those measures. In this yield-seeking environment, risk assets have performed very well, including those with higher yields in fixed income, such as the high yield.

“Currently, global high yield is the most attractive segment within fixed income, with a yield of around 5%” and a strong rally so far this year, points out the asset manager, compared to the 4% yield of emerging market debt. The expert still sees opportunities in the US despite being in the last stages of the cycle, and she even believes that the cycle may extend over time. In an environment such as the current one, she says that companies tend to be more conservative, which also benefits investors in that asset.

Although, of course, if growth continues, the Fed will continue to raise rates, twice more this year and the question is what will it mean for fixed income: “Since 2001 there have been 15 periods in which Treasury rates have risen by more than 50 basis points, but in those periods the US and global high yield have offered positive returns of around 5% against slight declines in global credit,” she explains. The reasons: high yield has lower durations than other fixed income segments, and therefore is less sensitive to changes in rates. In addition, when looking at total return, even if price falls, being a higher yield, this asset provides greater hedging and cushion than investment-grade credit. And finally, the high yield benefits from an environment of economic improvements and falls in the default ratios: “It is currently a good asset class, a good place to be invested in general, and not where to worry about rate rises,” explains the expert.

In short, fundamentals are very good, technical factors are moderate and, in price, high-yield bonds are fairly valued,” he says. But there is a catch: she believes that the risks derived from the timing of Trump’s agenda, which is clearly pro-growth, haven’t been priced in. “The markets are not pricing in this uncertainty or compensating for it, so, to enter, we are waiting for increases in spreads of about 50 basis points. At those levels, it would be a good point of entry,” she says.

Thus, the asset manager is more defensively positioned, expecting a better entry point, with high liquidity positions (10%, twice the general levels) and some investment grade debt positions – at around 8% Because they are not sacrificing returns by these positions; they also provide uncorrelated high-yield and hedging returns; and because they can use the IG as a second line of defense and liquidity if necessary. Positions in BB-quality names account for 35% of the Schroder ISF Global High Yield portfolio, B account for 30% and CCC for slightly more than 15%. In sectors, they’re overweight on banks (especially in the United States, because they believe that they are overcapitalized and over-regulated and yields are attractive, even though they are underweight on European banks). The largest underweight is in capital goods. By countries, they’re overweight on US against their underweight in Europe.

At NN IP, they also opt for credit, but with higher credit rating: Anil Katarya, Co-Head of Investment Grade Credit at NN Investment Partners, talked about the advantages of investing in US investment-grade credit. “Investment grade credit continues to be an attractive asset class,” he said, emphasizing its safe asset characteristics, the returns generated in recent decades and its low relationships with equities and other fixed income assets, as well as the benefits of diversification by investing in a portfolio dedicated to US investment grade credit. “IG credit has grown three times after the financial crisis, and there are great management opportunities, we continue to see opportunities with active management,” he says.

He explains that current yields and valuations are attractive (despite a strong rebound in credit spreads since the US election, valuations remain attractive, as spreads are above their historical average, Katarya explains), as the growth prospects for the US support the compression of spreads, and demand for yields also supports growth globally, in a low yield environment: “We continue to see inflows from investors in Europe, Asia and Latin America,” says the asset manager. “In general, the market is positioned to offer risk-adjusted returns this year, given the improvement in the macro outlook, valuations, and strong demand for yield,” he summarizes. However, at some point he expects corrections, in the real estate market, or in equities… but, at this moment, he does not see any excesses that justify exaggerated falls.

In regard interest rates expectations, he indicates that given that the high growth expectations in the US will not happen, and that rates will gradually rise, it will still be a good time for this asset. In addition, when the hikes do occur, it will not be bad for the asset because it will finally offer higher yields: the asset manager also points out that the total return on the asset class has been historically positive and has offered adequate downside hedging in periods of rising interest rates.

In this environment, the asset manager believes that US investment grade credit can offer a total return this year of around 3.5% -4%. “The investment case for the IG is not about buying today or tomorrow, but to have a core allocation over a long period of time,” adds the asset manager.

In its NN (L) US Credit fund, its position is to not take positions in duration (covered with US Treasury futures), and to be guided purely by the selection of securities and companies, in order to form a portfolio with high conviction and an active management style to take advantage of strategic and tactical opportunities. Currently, the overweight in BBB-rated names (with an 18% overweight as compared to the index) is noteworthy, with attractive valuations and with the conviction that the credit cycle is not yet over. By sectors, energy and technology are some of their overweight bets. The fund can invest up to 10% in names below investment grade.

Equities, but With Quality

In equities, Abrie Pretorius, Portfolio Manager at Investec Asset Management, explained the attractiveness of global equities from a quality point of view, through the Investec Global Quality Equity Income strategy – a strategy focused on high dividends, but also on names that reinvest; and also of Global Franchise, a strategy of high conviction in global equities.

On the meaning of quality, he explains that a good company is one that can offer a high return for every dollar spent and invested, pointing out that there are few businesses that can sustain a profile of offering high returns. And that’s what the asset management company looks for in their portfolios. “Very few companies have the capacity to generate and maintain high levels of profitability over time. Companies that do this have often created lasting competitive advantages,” says the asset manager, who explained how his firm invests in companies that combine this high quality with attractive growth and performance characteristics to build portfolios with strong long-term returns and with risk below market levels.

The asset manager showed how these powerful factors can be used both in growth-seeking portfolios and in long-term income portfolios and that current valuations could be sending signals of an attractive entry point. Regarding Investec GSF Global Franchise, it’s a highly concentrated fund of high conviction (between 20 and 40 securities, so that for one security entered, others must be displaced), focused on investment-grade firms and understanding the risks of companies in order to reduce uncertainty in an uncertain world and reduce risks. It also has a low correlation with traditional indexes and comparable funds, and combines quality, growth, and yield perspectives to select the firms in which it invests. “For a firm to be included, it has to improve its quality, growth, or yield,” he explains. At the moment it has 35% in basic consumption but has tended to reduce that part to increase its exposure to technology (it now represents 28% of the fund). 17% are in health care. By geographies, North America accounts for 60% of the portfolio, but the exposure by income is only 40%, and the same happens when investing in European or US firms with exposure outside their borders: hence the significant difference between absolute exposure and exposure by income. Names such as Johnson & Johnson, Visa, Microsoft or Nestlé hold more than 5% weight in the portfolio, which is an attractive mix of value and growth.

Regarding the income strategy, Investec Global Quality Equity Income Fund, he explains that it is also of high conviction (between 30 and 50 high-quality names), and speaks of three options when looking for income: investing in cyclical businesses, such as Anglo-American, businesses with higher dividends but higher risk, such as American Electric Power, or, finally, invest in a quality component, even if the input yield is lower – but above the market – but with a high free cash flow yield, which is the option preferred by the asset manager. Among the main securities are Imperial Bands, Microsoft or GSK, with weights close to or above 5% and by geography, the fund is more exposed to Europe, followed by North America. By sectors, basic consumption and healthcare stand out and the fund has more exposure to industrial firms as compared to the previous product.

And, in Europe…

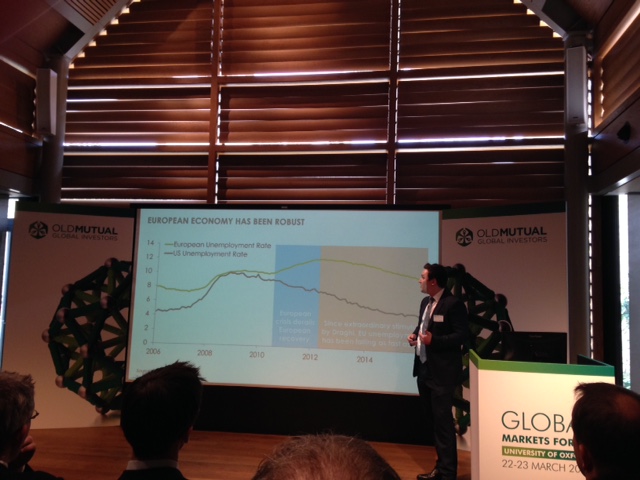

Carmignac’s Risk Managers see opportunities in European equities. Mark Denham, Portfolio Manager at the French asset management company, explained the attractiveness of the asset at a time when the context of European shares is increasingly favorable, with an improvement of the economy throughout the region that encourages profit growth expectations in 2017, and that they can take advantage of through the entity’s three strategies (a long only fund of large and mid caps, another focused on small and mid caps, and a third long-short of European equities).

“The economic background in Europe is currently favorable and indicates expansion and economic growth, which supports the market and in turn translates to profit forecasts,” explains the expert. And these forecasts are not reflected in the current valuations, so the asset presents attractive investment opportunities.

As for bottom-up investment philosophy centering on fundamentals, its focus is on businesses that have better long-term prospects, focusing on two main features: high sustainable profitability combined with reinvestment capacity and initiatives. In fact, the firms in which they invest usually have strong and unique brands, strong market positions and cost advantages, as well as powerful know how. His vision is long-term, active, and of high conviction (active share is around 80% and 90%) and gives a strong importance to risk management (inherent to the investment process).

As examples, he mentioned investments in firms such as Reckitt Benckiser or their positions in the pharmaceutical sector, where the asset manager sees opportunities for growth. Not forgetting the European banking sector, partly in Spain where he sees quality names (like Bankinter) and thanks to the improvement in its economy, something that cannot be extrapolated to Italy, where they have no exposure.

In an environment of polarization between ETFs and alternative products and hedge funds, and in which vehicles either have no daily liquidity, or no transparency, Carmignac wants to provide products that can de-correlate from markets and obtain returns independently of their behavior, while at the same time providing daily liquidity and transparency, explains its sales team.

Big Data to Provide Alpha in Alternative Vehicles

Chris DiPrimio, Vice President and Product Strategist at BlackRock, spoke about the role of Big Data in investment and about the BSF Americas Diversified Equity Absolute Return (ADEAR), a neutral market equity fund that leverages this tool to provide diversified and uncorrelated alpha. That’s why he began his lecture on the important and growing role in the portfolios of liquid alternative vehicles: “There are three benefits that can come from the alternatives: absolute returns, hedging against falling prices, and diversification”, so that these strategies allow asset managers to maintain clients invested even during difficult times.

The expert pointed out the great race that these vehicles have carried out in recent years, with assets tripled since 2009: “It means that we have to find sustainable and scalable portfolios.”There is great demand and we can invest in a wide range of liquid alternatives, but the challenge for all is how to differentiate ourselves in the market,” he said.

At BlackRock, they try to differentiate themselves from the rest of the competitors with the Scientific Active Equity platform, one of the pioneers in quantitative investment, with more than 90 professionals globally managing $ 86 billion in assets. “Usually we are seen as architects of quantitative investment,” says DiPrimio. On the role of Big Data in this context, he speaks of a world full of possibilities and of using it for investments, always keeping in mind to use an appropriate container as the key, while big data is the ingredient, with the aim of obtaining diversified alpha. “Big Data does not replace investments but is an increasingly important tool for investors who want to gain a competitive advantage in the markets.”

And that container, where these techniques are used to obtain differentiated and uncorrelated alpha, is ADEAR, a pan American fund that seeks to generate returns irrespective of the direction of the markets, with five underlying sub-portfolios (US large caps, US small caps, Investments in Latin America, another portfolio of Canada and a last US mid-horizon), destined to capture different opportunities, with a track record of five years and with emphasis on innovation, data, and technology. “We live in a world full of information and the ability to extrapolate it and put it into the process is a great competitive advantage,” he says. It is a neutral market vehicle that tries to provide diversified alpha based on big data. “It does not matter what happens in the long term, but what happens in real time,” says the expert. BlackRock also has a European and Asian strategy similar to the American one and with a global long-short fund that covers the developed markets.

SAE evaluates 15,000 stocks every day automatically: it blends investment vision with technology and big data in order to analyze a broader universe from three points of view: fundamentals (for example, Internet traffic to verify a company’s increase or decrease in sales for Identifying future growth), sentiment (such as conference calls, scanning lots of data to evidence changes in market sentiment) and macro issues (such as online job listings to evaluate growth prospects in industries by analyzing companies’ intention to engage in hiring). A strategy, for example, helps to exploit the differences in regional exposure across the US. and to find opportunities and red flags in the midst of all the avalanche of information that companies have to report. In Latin America, it combines first and new generation techniques.

Without Reflation… Due to Technology, Amongst Other Things

The importance of technology and big data connected with Daniel Lacalle’s presentation. Lacalle, a fund manager considered to be one of the 20 most influential economists in the world in 2016, according to Richtopia, opened the event on its second day as guest speaker. The expert denied the “reflation trade” agreed on by the markets for the next few years, and warned of the risks of denying the current problem of overcapacity and deflationary risk. Although, precisely because central banks are unable to get out of the liquidity trap in which they are immersed, he rules out a major financial crisis. Lacalle emphasized the role of technology as a disruptive force to invalidate the inflationary estimates that are seen in the market, and as an important source of opportunities from the investment point of view, and improvement in standards of living of citizens around the world.

In his presentation, he also advised as to the short-term importance of avoiding conformist or market consensus biases, such as the denial of Brexit or Trump, and as is now the consensus on the arrival of inflation, the return of profit growth to levels of the beginning of the century, the return of Capex, or the restrictive policies of central banks at a global level, which he considers to be impossible, and not occurring.