The Dollar One Year After Trump’s Victory: Story of a Depreciation

| By Amaya Uriarte | 0 Comentarios

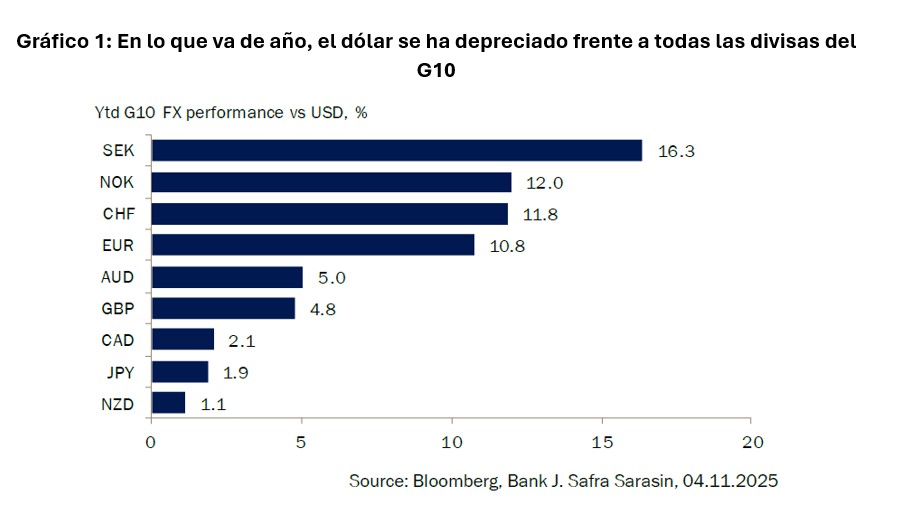

This week—specifically on November 5—marked one year since Donald Trump won the 2024 U.S. presidential elections. Since then, market consensus has shifted from betting on a strong dollar—due to Trump’s promise to impose tariffs on imports of foreign goods—to witnessing a depreciation against all G10 currencies.

“Following the sell-off at the beginning of the year, the dollar has stabilized in recent months. However, it is easy to imagine a scenario in which the depreciation continues,” explains George Brown, Global Economics Economist at Schroders.

According to his view, it is undeniable that the strength of the dollar has had wide-ranging repercussions on global growth, inflation, capital flows, and asset prices. However, “this year, the dollar is on track to record its biggest value drop since at least the year 2000. In this context, it makes sense for all investors to assess what such a decline could mean, as we believe there could be clear winners and losers,” states Brown.

“Investors Feared That the Trump Administration’s Policies Would Harm the Overall U.S. Economy. Moreover, a Series of Unorthodox Proposals Caused Concern: in Addition to Tariffs, the Government Considered Taxing Income From Treasury Bonds Held by Foreigners and Requiring Its Allies to Purchase Low-Yield ‘Century’ Bonds in Exchange for Security Guarantees. In Addition, Attacks on the Federal Reserve’s Independence Also Weighed on the Currency,” explains Claudio Wewel, currency strategist at J. Safra Sarasin Sustainable AM, regarding the uncertainty that has affected the U.S. dollar.

Outlook for the Dollar

In the view of the Schroders economist, the fundamentals of the dollar—such as the large twin deficits (budget and current account) and an exchange rate well above its long-term average—could lay the groundwork for a further 20%–30% depreciation. “The market reaction in recent months to U.S. policy announcements suggests that concerns about the Trump Administration have been the catalyst for these weak fundamentals to start materializing,” warns Brown.

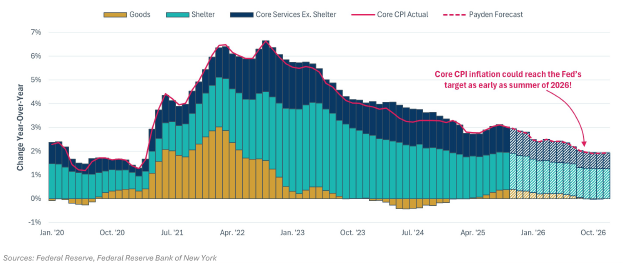

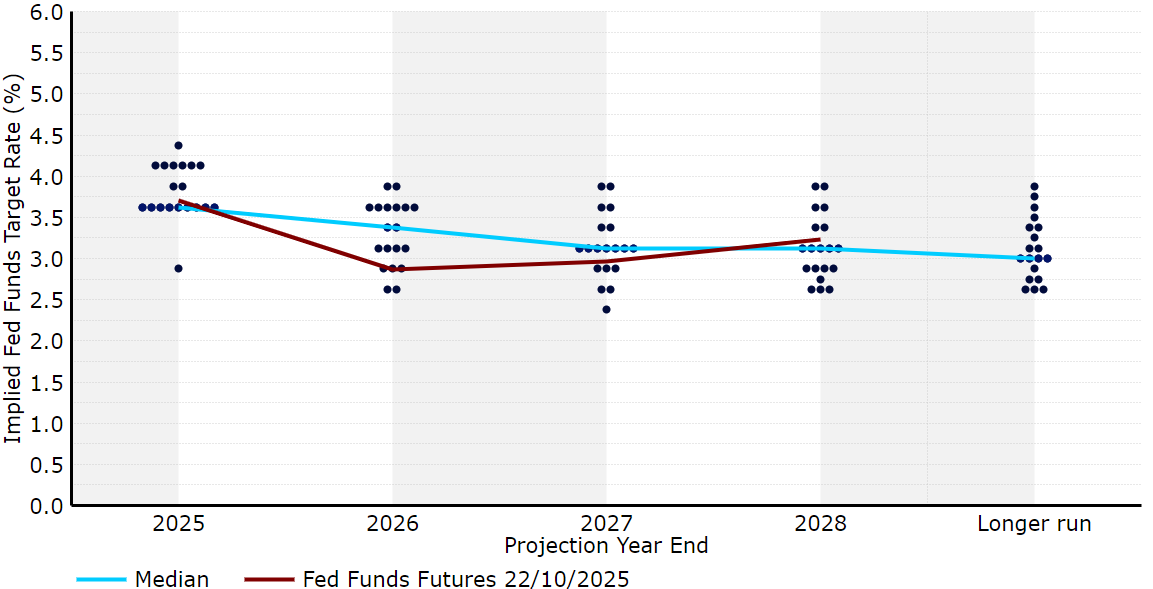

For his part, Wewel sees little chance of this depreciation trend reversing and expects the dollar to continue weakening in 2026. “It’s true that investment in artificial intelligence is driving U.S. GDP growth, and investment in information processing technology will remain an important tailwind in 2026. However, support from the monetary front should begin to fade. Following the government shutdown, the Fed will be making decisions based on limited information. Although a rate cut in December is not guaranteed, we anticipate more easing in 2026, as the institution will maintain its ‘risk management’ approach. With Powell’s term ending in May 2026, the independence of the Fed will return to the center of the debate. We believe this will lead the market to anticipate a more accommodative monetary policy than the current one, even if inflation remains high. Furthermore, we do not expect the volatility leading up to the U.S. midterm elections to boost the dollar. In our view, a significant rebound in the currency would require a clear surge in U.S. macroeconomic momentum, something that is not part of our base scenario,” argues Wewel.

Regarding the recovery the dollar experienced on November 4—when it reached its highest level since May—David A. Meier, economist at Julius Baer, believes that the return of U.S. economic data will eventually break the current consolidation phase of the U.S. dollar, paving the way for further weakness.

“The dollar’s consolidation continues, with a new upward push last week that brought the euro/dollar pair to the 1.15 level. As confidence in U.S. assets has somewhat returned, the dollar is benefiting from the lack of economic data, showing very low volatility. Nevertheless, we maintain our view that, once economic data returns, the slowdown driven by U.S. tariff policy will become more evident, ultimately ending the consolidation and pushing the dollar lower. Although it is hard to justify given its recent resilience, we maintain our euro/dollar forecasts at 1.20 in three months and 1.25 in twelve months, which remains in line with the average depreciation of the dollar over those periods,” notes Maier.

Implications for Investment

For Pierre-Alexis Dumont, Chief Investment Officer at Sycomore AM (part of Generali Investments), one of the key lessons for investors in this first year is that both the dollar and U.S. Treasury bonds have seen their status as reserve currency and safe haven questioned, respectively. “As a result, investors have sought diversification and alternative safe investments. Trump’s disruptive agenda has also created new market leadership, especially for European exporting companies. We will have to get used to an environment of lower visibility, greater dispersion, and different stock market leadership,” explains Dumont.

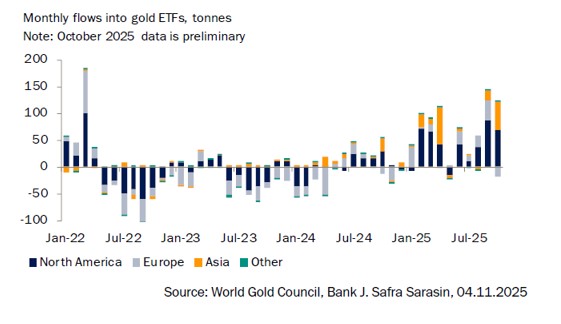

According to the currency strategist at J. Safra Sarasin Sustainable AM, the weakening of the dollar reflects investor concern, as they have sought ways to protect themselves against a decline in the dollar. In this regard, one of the big winners has been gold, which has posted its best performance since 1979, with an increase of over 50% so far this year.

“Flows into gold-backed ETFs have risen significantly, while central bank purchases have moderated. Despite its recent correction, we remain convinced that the environment remains favorable for the precious metal in both the medium and long term. We expect it to continue expanding its role as a global safe-haven asset,” notes Wewel.

Finally, Brown highlights the impact that the weakening of the dollar will have on emerging markets and their investment opportunities. The Schroders economist notes that a weaker dollar would be a deflationary boost for the rest of the world, an effect that tends to be stronger in emerging markets.

“A 20% depreciation of the dollar could reduce the average food inflation rate in emerging markets by around 1.2% and lower energy inflation by another 1.4%. Altogether, just the effects on food and energy could bring down the average headline inflation rate in emerging markets by about 0.5%, which stood at 3.2% in May 2025. Lower inflation due to currency appreciation would open the door for emerging market central banks to further ease their monetary policy, improving growth prospects,” concludes Brown.