In periods of heightened market stress, volatility often dominates investor conversations. While traditional risk management techniques remain critical, the search for more stable return sources has led many investors to reconsider the role of private markets within diversified portfolios. Following the broad market selloff in 2022—when equities and bonds both delivered negative returns—attention has increasingly turned toward alternatives like private credit, which offer the potential for lower correlation to public markets and more consistent performance through cycles.

Understanding the Appeal of Private Credit

Private credit strategies generally involve lending to private companies through negotiated, illiquid transactions. Unlike public market instruments, these assets are not subject to daily price fluctuations driven by market sentiment. Instead, their valuations are typically informed by third-party pricing agencies using fundamental analysis to assess credit quality, cash flows, and comparable deal metrics. This methodology helps reduce the impact of short-term volatility and market noise. Even when broader credit spreads widen, private credit valuations tend to adjust more gradually due to the use of smoothing mechanisms over multi-month periods.

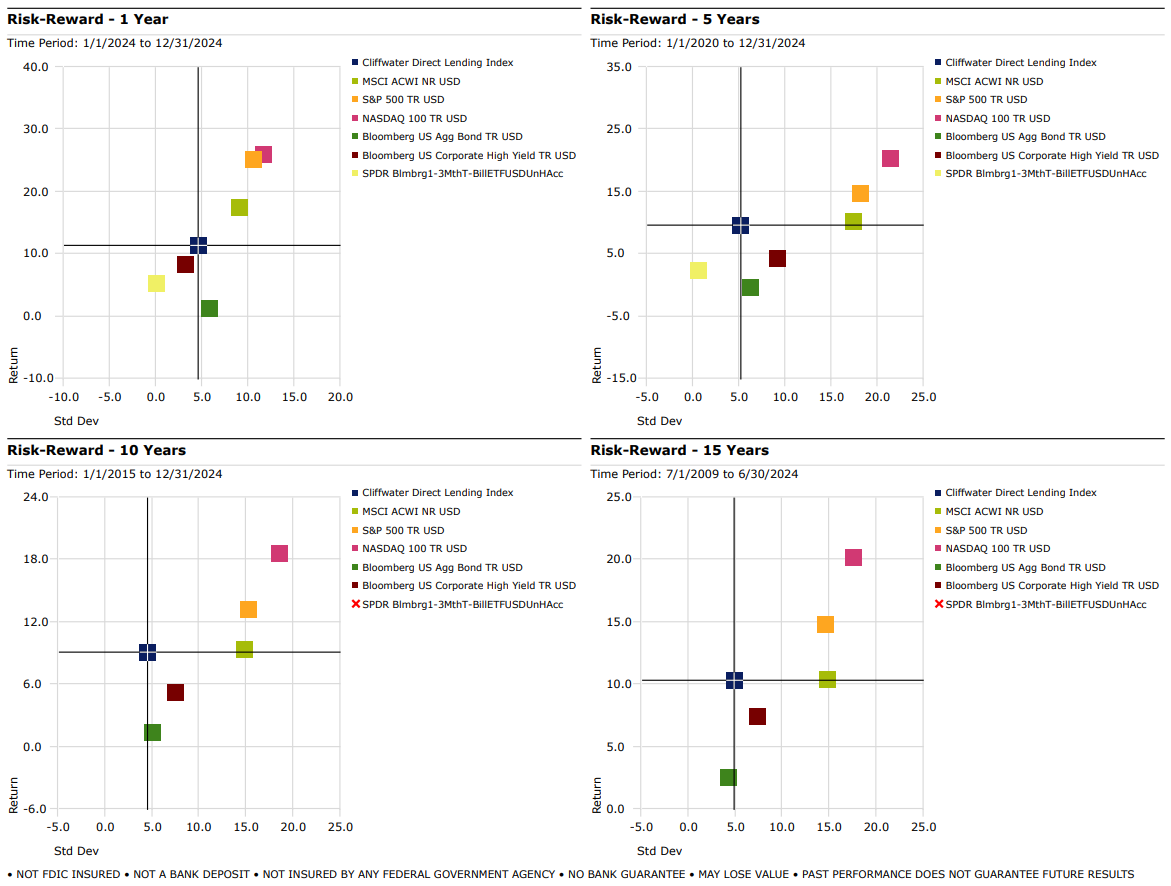

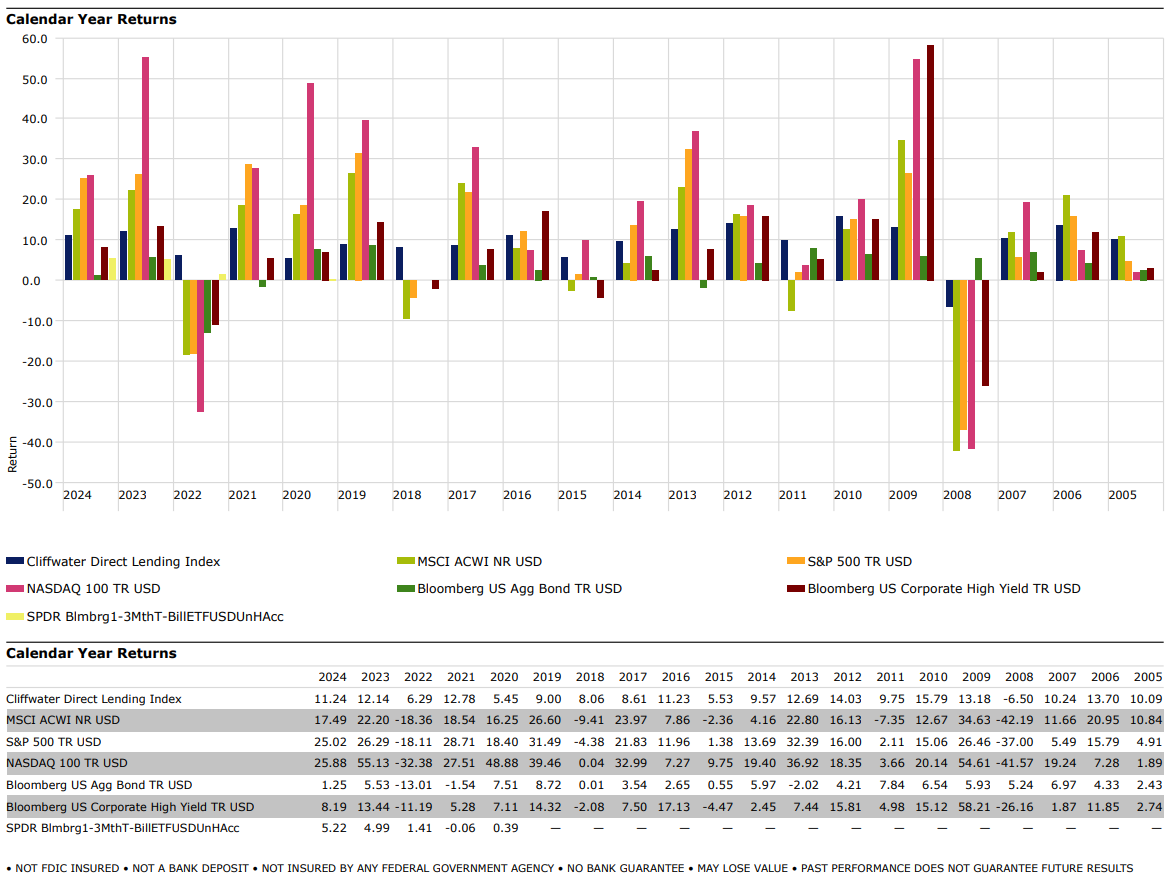

As a result, private credit has historically delivered more stable returns than many public asset classes. The Cliffwater Direct Lending Index (CDLI), a widely followed benchmark for private credit, reflects this trend—showing lower volatility and more consistent returns over the past decade compared to public equities and high yield bonds.

Performance Through Cycles

The resilience of private credit has been evident across a range of market environments. From the pandemic recovery period through the recent rate hiking cycle, the CDLI has continued to post positive performance, highlighting the asset class’s defensive qualities. In fact, even in years when public credit markets saw sharp drawdowns, private credit remained notably more stable.

Charts comparing CDLI performance with public market benchmarks further underscore private credit’s potential role as a stabilizing force in diversified portfolios. By offering downside mitigation and reduced mark-to.

Opinion by Frederick Bates, managing partner; y Juan Fagotti y Lucas Martins, partners Becon IM

If you wish to have a deeper dive into the Private Credit asset class, please feel free to reach out to info@beconim.com.

Authors of the article:

object(WP_Post)#22340 (24) {

["ID"]=>

int(271828)

["post_author"]=>

string(2) "59"

["post_date"]=>

string(19) "2025-04-30 17:06:19"

["post_date_gmt"]=>

string(19) "2025-04-30 15:06:19"

["post_content"]=>

string(219) "

Frederick Bates is a Managing Partner at BECON IM. He previously worked at MFS Investment Management and Fidelity International in various roles. He is based in Miami.

"

["post_title"]=>

string(15) "Frederick Bates"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(15) "frederick-bates"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2025-04-30 17:06:20"

["post_modified_gmt"]=>

string(19) "2025-04-30 15:06:20"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=271828"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

Frederick Bates is a Managing Partner at BECON IM. He previously worked at MFS Investment Management and Fidelity International in various roles. He is based in Miami.

object(WP_Post)#22336 (24) {

["ID"]=>

int(271845)

["post_author"]=>

string(2) "59"

["post_date"]=>

string(19) "2025-04-30 17:12:24"

["post_date_gmt"]=>

string(19) "2025-04-30 15:12:24"

["post_content"]=>

string(227) "

He is a partner at BECON Investment Management, a firm he joined in 2018. He holds a degree in Administration and Systems from the Buenos Aires Institute of Technology (ITBA).

"

["post_title"]=>

string(13) "Lucas Martins"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(13) "lucas-martins"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2025-04-30 17:12:25"

["post_modified_gmt"]=>

string(19) "2025-04-30 15:12:25"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=271845"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

He is a partner at BECON Investment Management, a firm he joined in 2018. He holds a degree in Administration and Systems from the Buenos Aires Institute of Technology (ITBA).

object(WP_Post)#22334 (24) {

["ID"]=>

int(271843)

["post_author"]=>

string(2) "59"

["post_date"]=>

string(19) "2025-04-30 17:08:37"

["post_date_gmt"]=>

string(19) "2025-04-30 15:08:37"

["post_content"]=>

string(196) "

He is a partner at BECON Investment Management, a firm he joined in 2018. He is a Certified Public Accountant (Universidad Católica Argentina).

"

["post_title"]=>

string(12) "Juan Fagotti"

["post_excerpt"]=>

string(0) ""

["post_status"]=>

string(7) "publish"

["comment_status"]=>

string(6) "closed"

["ping_status"]=>

string(6) "closed"

["post_password"]=>

string(0) ""

["post_name"]=>

string(12) "juan-fagotti"

["to_ping"]=>

string(0) ""

["pinged"]=>

string(0) ""

["post_modified"]=>

string(19) "2025-04-30 17:08:37"

["post_modified_gmt"]=>

string(19) "2025-04-30 15:08:37"

["post_content_filtered"]=>

string(0) ""

["post_parent"]=>

int(0)

["guid"]=>

string(61) "https://www.fundssociety.com/?post_type=profile&p=271843"

["menu_order"]=>

int(0)

["post_type"]=>

string(7) "profile"

["post_mime_type"]=>

string(0) ""

["comment_count"]=>

string(1) "0"

["filter"]=>

string(3) "raw"

}

![]()

He is a partner at BECON Investment Management, a firm he joined in 2018. He is a Certified Public Accountant (Universidad Católica Argentina).