The assets managed by the AFOREs grew by 26% in dollars in the year to September, reaching 423 billion dollars. This growth is partly due to the gradual increase in mandatory contributions that began in 2023 and will conclude in 2030, rising from 6.5% to 15% of the base salary, in accordance with the pension system reform.

Additionally, the drop in interest rates and the rise in stock markets favored the revaluation of portfolios. The 10-year Mexican bond alone went from 10.45% to 8.60% on October 9.

According to the estimate by J.P. Morgan Asset Management from February 2024, the reforms could bring AFORE assets to 659 billion dollars by 2030. Meanwhile, Santander Corporate & Investment Banking—in its February 2023 estimate—projects a balance of 983 billion by 2035.

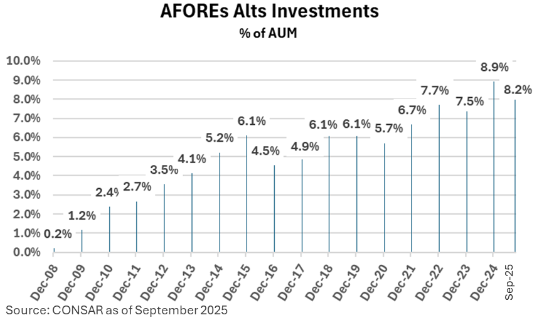

Although investments in alternatives by Mexican AFOREs continue to grow in amount, their weight within portfolios has decreased. J.P. Morgan Asset Management and Santander Corporate & Investment Banking estimate that the assets will continue to increase.

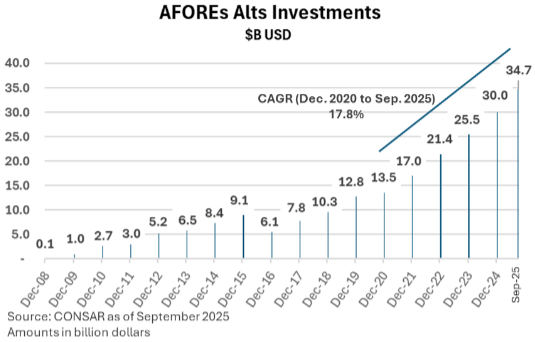

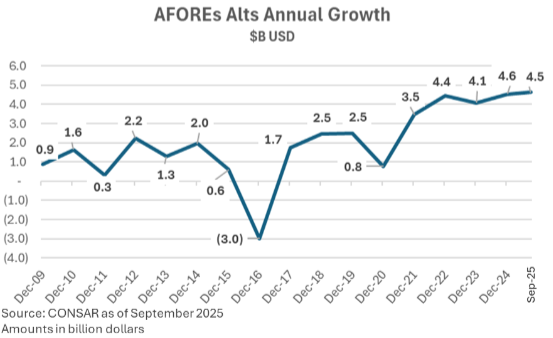

AFOREs’ investments in alternatives (locally known as structured instruments) rose from 30 billion dollars in 2024 to 34.7 billion as of September 2025, implying a Compound Annual Growth Rate (CAGR) of 17.8% in dollars between December 2020 and September 2025.