On May 21, the draft law amending the provisions for alternative (structured) investments by AFOREs, among other changes, was published on the website of the National Commission for Regulatory Improvement (CONAMER).

Its publication in CONAMER is part of Mexico’s regulatory improvement process, which requires draft regulations to be made transparent and submitted for public consultation before being published in the Official Gazette of the Federation (DOF).

The estimated period between publication in CONAMER and its eventual entry into force (via the DOF) is between 2 to 3 months, provided that no substantive adjustments are made to the text. Regarding alternative (structured) investments, these are the key points of the new framework, should it be published without changes in the DOF:

Predominant Investments in National Territory

Two levels are established to determine compliance:

– General Limit (Annex S of CUF): Applies to all structured instruments. Requires that at least 10% of the capital effectively invested be allocated to projects in Mexico.

– New Additional 10% (Annex S bis): Applies only to instruments issued starting in 2025.

Requirements:

– 80% of committed capital must be allocated to projects in Mexico.

– 50% of effectively invested capital must remain in national territory by year five.Minimum National Committed Percentage

To access the additional 10%, at least 80% of the committed investment must be allocated to national projects.Specialized Subcommittee in Structured Instruments

Mandatory. Must include at least one lawyer (not independent) and one independent expert in structured instruments.Concentration Limits

Caps are established per project, issuance, and manager. If exceeded, the possibility of new investments is suspended until the situation is regularized.Prior Evaluation of Structured Instruments

All investments must undergo technical evaluation in accordance with Annex B and be approved by committees, including a favorable vote from the majority of independent directors.Maximum Fees

– Up to 200 basis points if the fund is in its initial stage.

– Up to 150 basis points if considered mature.

Any excess must be returned to the investment fund.Monitoring and Control

Requires a technical justification, clear exit strategy, and continuous monitoring (through reports, independent valuation, or participation in technical committees).Capital Call Computation

The invested value plus up to 35% of the notional value of pending capital calls will be computed.Mandatory Certification

All personnel involved in structured investment decisions must hold a valid, specific certification.Five-Year Verification

It will be verified that at least 50% of effectively invested capital remains in national territory.Regulatory Benefit

Instruments that meet the requirements of Annex S bis will not be counted toward the global structured investment limit.Exclusions from National Computation

Investments placed in other structured instruments and liquidity positions within the vehicle will not be considered national investments.

Final Thoughts:

– Corporate governance is reinforced with the obligation to establish a specialized subcommittee in structured instruments.

– A clear distinction is made between prior structured investments and those related to the new additional 10%.

– It is expected that AFOREs will be equally or even more stringent in using the additional 10%, predominantly within national territory.

– From our perspective, allocation of resources from the new additional 10% will be used selectively and gradually.

– The maturity of CKDs and asset growth will enable AFOREs to free up resources for the use of the 20%, allowing them to invest up to 90% globally and 10% locally.

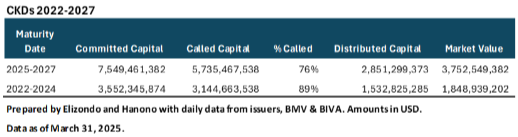

– CKDs maturing between 2025 and 2027 have a market value of $3.8B (1.1% of AFOREs’ AUM as of March 2025), and those maturing between 2022 and 2024 total $1.8B (0.5% of AUM). The total market value of all CKDs is $16.6B.