In less than a decade, Investment Project Certificates (CERPIs) have evolved from being a vehicle reserved for institutional investors to becoming a gateway for private banking. The recent issuance by Promecap, with an international multi-manager approach, reflects this shift and presents new challenges for the Mexican market.

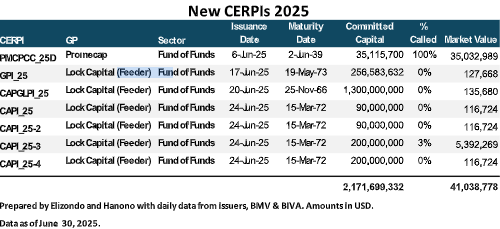

In the first six months of 2025, seven CERPIs were issued, highlighting the placement by Promecap (PMCPCC), which is entering the market with a fund of funds aimed at private banking investors. The issuance amounted to 35.1 million dollars, within a total program authorized for 650 million dollars. (Published July 1).

The effort to provide private banking investors in Mexico with access to international private equity funds through exchange-listed vehicles began in 2016 with StepStone, which has since launched several issuances with varying characteristics. Later, in 2023, Manhattan Venture Partners (MVP) carried out an issuance. These steps have gradually opened a market that, until just a few years ago, was practically reserved for institutional investors and large fortunes.

Promecap’s issuance stands out for its fund-of-funds structure with exposure to multiple international GPs, which enhances diversification and mitigates concentration risk. In contrast, MVP and StepStone issuances focus exclusively on one or several vehicles managed directly by their own platforms, limiting diversification across managers and strategies. Promecap’s approach aligns with international models aimed at offering private investors an experience closer to that of an institutional portfolio, leveraging the expertise of third-party specialists.

In addition to these issuers, global platforms, top-tier international managers, multi-family offices (MFOs), and independent wealth advisors have carried out private placements that allow their clients to participate in international private equity opportunities, either through a single fund or diversified portfolios. These types of private structures complement the public offerings on the stock exchange, expanding the alternatives available to private banking and their clients.

A few weeks ago, Funds Society commented on the study by Sandy Kaul of Franklin Templeton (CAIA Crossing the Threshold, 2024), which analyzes how, in less than two decades, alternative investments have shifted from being a niche reserved for institutional investors and large fortunes to becoming a growing component of individual investors’ portfolios. Between 2005 and 2023, assets under management in alternatives quintupled, rising from $4 trillion to $22 trillion, reaching 15% of global assets.

In the specific case of Latin America, the democratization of alternatives has been more gradual, influenced by regulatory frameworks, investor sophistication levels, and the availability of vehicles adapted to the local market. Mexico, with its CERPI structure, has become an interesting laboratory that combines securities market regulation with the possibility of investing in global strategies, while also allowing the participation of private banking investors who meet certain wealth and knowledge requirements.

However, international experience shows that democratizing alternative investments comes with challenges. These include the need to control total fees (management and performance fees) and to maintain attractive net returns compared to liquid asset classes such as equities or high-yield fixed income. If these factors are not well-balanced, access may become “expensive” in relative terms—especially considering the lower liquidity and longer investment horizons that characterize private strategies.

Promecap’s case can be interpreted as a relevant experiment for the Mexican market. Its combination of multi-manager diversification, stock exchange listing, and private banking focus allows it to stand out and potentially set a precedent for other issuers. If it succeeds in maintaining competitive costs, adequate levels of secondary liquidity, and performance aligned with investor expectations, it could open the door to a new wave of such issuances by both local and international managers.

In a global environment where alternatives are becoming an increasingly important component of portfolios and where competition for sophisticated investor capital is intensifying, the evolution of CERPIs aimed at private banking in Mexico will be a topic to watch closely in the coming years.