In 2025, 196 self-made billionaires drove global wealth to a record high of $15.8 trillion, a 13% increase over 12 months and the second-largest annual gain after 2021. According to the latest UBS report, titled Billionaire Ambitions Report 2025, we are witnessing a new wave of billionaires, fueled by business innovation and a rise in inheritances.

The report highlights that these new billionaires include both entrepreneurs successfully building businesses in today’s uncertain environment and heirs participating in a multi-year, accelerated wealth transfer. In 2025, the second-highest number of self-made individuals in the history of the report became billionaires.

“Our report shows how the rise of a new generation of wealth creators and heirs is transforming the global landscape. As families become more international and the great wealth transfer accelerates, the focus is shifting from simply preserving wealth to empowering the next generation to succeed independently and responsibly. This is influencing not only succession planning, but also philanthropic priorities and long-term investment decisions,” notes Benjamin Cavalli, Head of Strategic Clients and Global Family and Institutional Wealth Connectivity at UBS Global Wealth Management and Co-Head of EMEA One UBS.

In Cavalli’s view, we are seeing a billionaire community that is more diverse, mobile, and forward-looking than ever before. “The combination of entrepreneurial drive and the largest intergenerational wealth transfer in history is creating new opportunities and challenges for both families and wealth managers,” he adds.

Regarding investment priorities, despite market volatility in 2025, North America remains the top investment destination (63%), followed by Western Europe (40%) and Greater China (34%). Some 42% of billionaires plan to increase their exposure to emerging market equities, while more than four in ten (43%) are considering increasing their exposure in developed markets.

Self-Made Billionaires

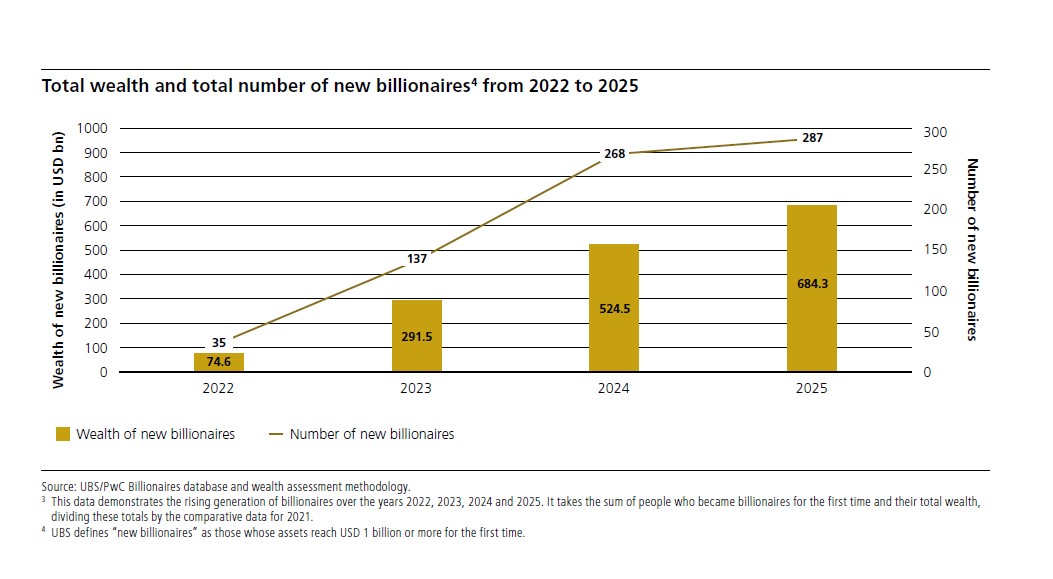

According to the report’s data, in 2025, these 196 self-made billionaires added $386.5 billion to global wealth, pushing total wealth to a record $15.8 trillion. This marks the second-largest annual increase recorded in the history of the report. As a result, the number of billionaires rose by 8.8%, from 2,682 to nearly 3,000.

The report explains that, unlike the boom driven by asset revaluation after the pandemic in 2021, “this growth was marked by strong business dynamics and intense company creation.” From marketing software and genetics to liquefied natural gas and infrastructure, these innovators are reshaping large-scale demand, with billionaires from the United States and Asia-Pacific leading the way.

While billionaires investing in the tech sector saw their wealth grow by 23.8%, consumer and retail slowed to 5.3%, as the European luxury industry lost momentum to Chinese brands. Despite this, the consumer and retail sector remains the largest, totaling $3.1 trillion.

Industrial wealth experienced the fastest growth, rising 27.1% to reach $1.7 trillion, with more than a quarter coming from new billionaires. Meanwhile, wealth originating from the financial services sector increased by 17% to $2.3 trillion, driven by strong markets and a rebound in cryptocurrencies. Self-made billionaires now represent 80% of total wealth.

Billionaires by Inheritance

When it comes to wealth transfer, it is clear that the pace is accelerating. Looking ahead, billionaires are expected to transfer around $6.9 trillion globally by 2040, with at least $5.9 trillion going to their children.

Regarding this year’s developments, the report reveals that 91 individuals (64 men and 27 women) became billionaires through inheritance, receiving a combined $297.8 billion—more than one-third above the $218.9 billion in 2024. Additionally, according to calculations, at least $5.9 trillion will be inherited by the children of billionaires over the next 15 years.

Globally, inheritances have contributed to a rise in the number of multigenerational billionaires, now totaling nearly 860 and managing a combined $4.7 trillion in wealth, compared to 805 who controlled $4.2 trillion in 2024. Notably, the average wealth of women continued to rise in 2025, increasing by 8.4% to $5.2 billion—more than double the growth rate of men, which was 3.2%, reaching $5.4 billion.

“Although the transfer of wealth will likely be concentrated in a limited number of markets, high levels of migration could shift this landscape. Most wealth transfers will take place in the U.S. and in certain markets, but 36% of surveyed billionaires report having moved at least once, while another 9% are considering it,” the report notes.

Moreover, billionaires expect their children to succeed independently despite the influence of inheritance: 82% of surveyed billionaires with children want them to follow their own path and say they aspire to instill the skills and values necessary to thrive on their own, rather than relying solely on inherited wealth.

“In an era in which entrepreneurs often appoint professional managers or sell their businesses instead of passing them down to the next generation, 43% still hope their children will continue and grow the family business, brand, or assets,” the report adds.